You’ll find boredom where there is an absence of a good idea, some say. Ideas usually go hand in hand with creativity, and while some creative projects require little more than an idea and a computer screen, others call for the investment of large amounts of cash.

Cost is to a good idea what the iceberg was to the Titanic. A huge obstacle standing in the way of history.

One cannot circumvent the issue of cost, so unless you were born with a silver creative spoon, you’d want to work hard on raising the money you need to make your own history.

One way to raise money for your project is crowdfunding, an activity which became popular towards the end of the first decade of the 2000s.

While – somewhat ironically- a good idea in itself, crowdfunding was always marred by controversy due to its very nature of raising funds for an often vague purpose. Initially envisioned to become a fundraising avenue for small projects and individuals, it soon fell prey to larger corporations with a lot of marketing clout, thus defeating its original vision. Crowdfunding became further tainted by fraudulent activity, excessive fees, and restrictive regulations, which meant that as much as 80-90% of crowdfunding efforts failed, in many cases leaving backers big time out of pocket.

The rise of cryptocurrencies has infused crowdfunding with a new lease of life, as the decentralization principle jettisons dependency on a single platform. The advent of blockchain heralds a new era in crowdfunding history, with KICKICO offering an interesting opportunity.

Crowdfunding, KICKICO style

Making history is never easy, is it? One must do something pretty big (for the good, or for the bad) to make one’s entry into the books.

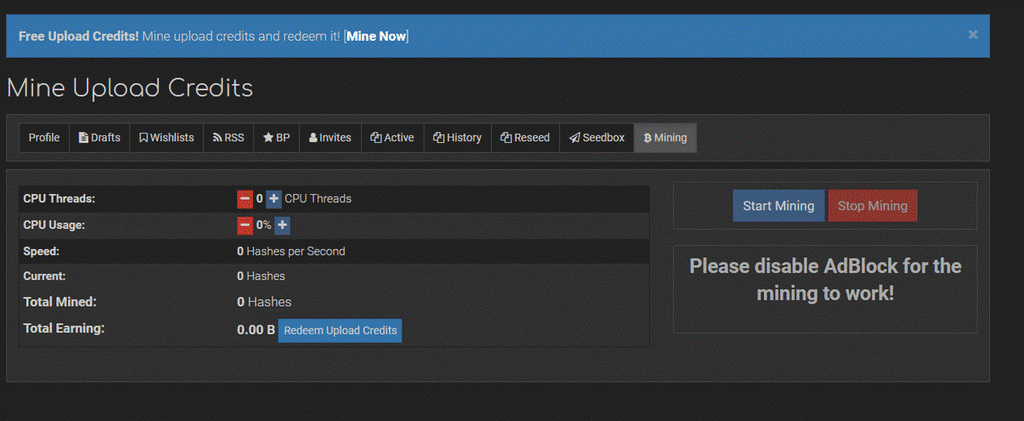

KICKICO is an online, blockchain technology-based crowdfunding platform that provides its users with online fundraising tools that operate through decentralized blockchain technology and Ethereum-based Smart Contracts, which removes the need for intermediaries (banks, payment systems, etc).

The company is etching its own future by becoming the first fully functional blockchain fundraising platform offering comprehensive solutions for three types of campaigns: ICOs, crowdfunding, and crowdinvesting.

KICKICO’s goal is to provide innovators, game developers, entrepreneurs, designers, and other future-thinking creators with a blockchain-based platform to turn their ideas into reality, regardless to their location, origin, or socio-economic status.

KICKICO’s 20-strong team provides fundraisers with:

- Technical Solutions, including Smart Contracts, marketing outreach, and advisory and management expertise

- A bonus, in addition to the tokens they receiveProtection from unrealistic projects, by carefully analysing a project’s viability

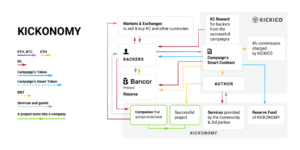

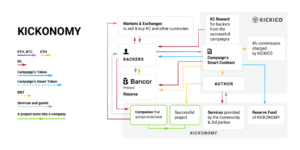

- KICKONOMY, s transparent ecosystem driven by the KickCoin fund, which is regulated by the community

KICKONOMY, and the four pillars supporting the blockchain fundraising monolith

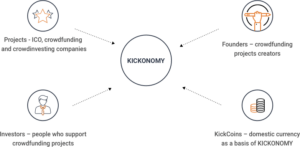

KICKONOMY is defined as the ecosystem of projects that accept KickCoins. Any project bearing the KICKICO banner will accept KickCoins as payment.

The idea behind KICKONOMY is to create a synergistic relationship between backers and the community, to enable a cohesive integration between all parties involved.

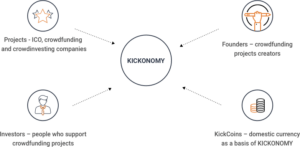

The KICKONOMY environment is supported by four pillars:

- Projects geared towards ICO, crowdfunding, and crowdinvesting

- Founders, the creators of crowdfunding projects

- Investors, the people supporting crowdfunding projects

- KickCoins, KICKONOMY’s fuel and lifeblood, the domestic currency that underpins the entire ecosystem

KickCoin, the vital fluid running through KICKICO’s framework

KickCoin is an Ethereum-based digital token that follows the ERC-20 standard. It is a virtual currency proprietary to the KICKONOMY environment.

KickCoin is a cryptocurrency awarded to backers who support preICO, ICO, or crowdfunding campaigns, and it’s designed for project authors to:

- Pay for the launch of crowdfunding projects

- Purchase services for crowdfunding projects

- Any other internal processes and payments pertaining to the infrastructure of KICKICO and KICKONOMY.

How KickCoins work

KickCoins are automatically generated by the Smart Contract when backers support campaigns launched through the KICKICO platform.

A total of 800 million KickCoins have been generated, including 30 million to conduct preICO, and 600 million to conduct ICO. 10% of the total KickCoins supply will be generated and shared between the founders of KICKICO. The rest have been generated for advisory, lottery, bounty, seed backers and PR pools. KickCoins will not be mined by users or any other companies.

The future of KICKICO and KICKONOMY

KICKICO’s a fully operational platform, launched this very month. The company has a roadmap to success, spanning to 2019 and beyond.

The KICKONOMY concept is sound and can attain success if it delivers on its premise of growth and development.

Every campaign launch will raise KICKICO’s profile higher, in turn attracting more attention and backers to it. The potential for exponential growth is there.

Have a look at KICKICO’s White Paper for more information.