Aave is one of the oldest and most liquid DeFi lending protocols out there. According to DeFiPulse, it is currently the second-largest DeFi protocol with a TVL of over 3.3 billion USD. Here is how you can use Aave in order to get a loan or to earn a passive income.

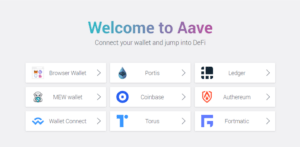

Like with any DeFi protocol, you first need to connect your wallet. For this purpose, Aave offers a variety of choices, including of course MetaMask. If you are using a Ledger hardware wallet, you can directly connect it to Aave without needing to take any further steps.

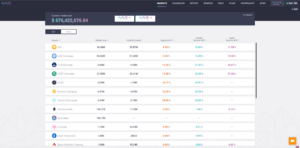

After connecting your wallet, the first thing you will see is an overview of all crypto assets supported by the Aave lending economy. On top, there are tabs that you can click in order to access the features of Aave.

In this overview, you can see how many of the asset users have deposited on the platform and how much users have borrowed. Using these two parameters, Aave determines a yearly rate for deposits and loans. The higher the proportion of the deposits that have been borrowed by other users, the higher the rates.

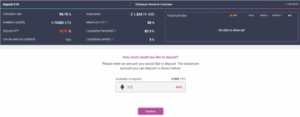

Since loans on Aave need to be overcollateralized, the first thing you need in order to do anything on the platform is to make a deposit. For this, you switch to the Deposit tab and select the asset that you want to deposit, in this case, Ether.

Note that each transaction on the Ethereum blockchain that hosts Aave requires gas, which can lead to unexpectedly high transaction fees. For example, MetaMask currently estimates a transaction fee of up to $20 for a single deposit transaction. If you want to try out Aave and familiarize yourself with the platform, it is, therefore, best to use the testnet client which runs on the Kovan testnet (hence the odd deposit rate in the picture above).

After selecting an asset, you can see all details for the deposit including the current APY, loan-to-value rate, and liquidation threshold. After entering the amount you want to deposit, you need to confirm the transaction and of course, send the transaction in your wallet.

After depositing, your funds instantly start earning the deposit APY (annual percentage yield) and you can now start taking out loans in the Borrow tab. After selecting the asset you want to borrow, you can see the APR (annual percentage rate) that accrues over time until you pay the loan back. In that sense, the APY and APR are akin to the interest rate you either receive or pay for bank deposits and loans.

You can also see a “health factor” that reflects the risk of a liquidation. Don’t let your health factor drop below 1.00, or your deposit will start to be liquidated in order to pay the loan back, which additionally incurs a liquidation penalty.

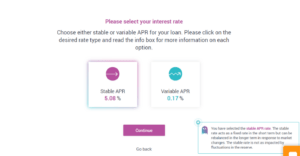

As mentioned earlier, the borrowing rate will fluctuate over time depending on the total value of all deposits and loans for each asset. For some assets, Aave additionally offers a stable rate, which is however higher than the flexible rate.

For this test, I have taken out two loans: a USDT loan for a stable rate (APR) of 5.08% and an AAVE loan for a flexible rate of 0.00%. Under the Dashboard tab, you can see an overview of all your deposits and loans. This is also where you can select to repay the loans or withdraw your deposits.

Be careful though when you withdraw funds while you still have open loans, as this will decrease your health factor. Once more, the health factor is an important risk management tool that Aave offers for you to judge how high the risk of liquidation is. The closer it is to 1, the higher the risk. If it drops below that threshold, you will lose up to 50% of your deposits, which will then be sold to automatically repay your loan, after the liquidation penalty is deducted.

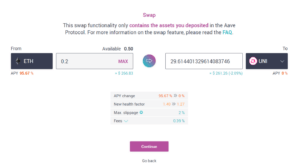

Under the Swap tab, you can instantly swap your deposits without needing to withdraw them to an external exchange. In this example, I have swapped some of my ETH deposits for UNI.

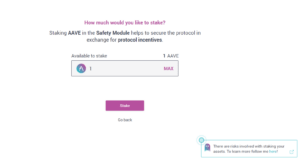

Under the Stake tab, you can stake the protocol’s native AAVE tokens. Since loans are automatically being liquidated when their collateralization rate (reflected by the health factor) drops below a certain threshold, lenders shouldn’t be concerned about not getting their deposits back under normal conditions.

However, in rare circumstances, the liquidation process might fail, leaving the Aave protocol short of money to repay deposits. This happened for example with a similar lending protocol (Maker) in March 2020. Due to the looming COVID-19 crisis, the market prices for crypto assets sharply dropped on that day, along with basically any volatile asset on the planet, including gold and stocks.

This triggered a cascade of liquidations on Maker, which then tried to auction the liquidated deposits in order to cover the outstanding debt. Since the Ethereum blockchain was highly congested at that time, most bidders in the auction did not have a chance to post their bid in time, which resulted in many deposits being sold for next to no counter value. Subsequently, the money raised in the auctions was not enough to repay all debts.

Another problem that can lead to such a shortfall event is the risk of critical smart contract bugs or hacks. By staking AAVE tokens, you insure the protocol against such shortfall events. If any shortfall event happens, stakers and other AAVE holders act as lenders of the last reserve.

First, stakers partially lose their stake, which should cover most or all of the outstanding debt. If everything else fails, the protocol will simply mint new AAVE tokens. This ensures that deposits can be paid back at any time. Since stakers take the risk of liability in shortfall events, they are rewarded with AAVE tokens from the protocol’s reserve.

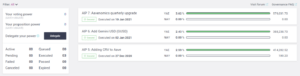

Finally, there is the Governance tab, under which AAVE holders and stakers can vote on improvement proposals. Instead of voting on their own, they can also delegate their voting power to another Ethereum address, which makes the voting process more efficient.

There are some additional features that round up Aave, for example, flash loans that do not require collateralization and the DeFi Saver DApp which can automatically prevent liquidations. Additionally, Aave prepares to move to second-layer solutions for Ethereum in order to decrease transaction fees.