Ever since Bitcoin has been acknowledged as a tradeable asset on a par with traditional stocks and bonds, a whole suite of cryptocurrency trading platforms has emerged. The diversity of trading pairs and tools that are now offered to sophisticated traders can really defy imagination. However, this heaven for traders comes with its own fly in the ointment.

As the popularity of cryptocurrencies keeps growing, the news about this exchange or the other being hacked (Mt.Gox, Coincheck, Bitfinex, etc.) vigorously shake the market. This makes end-users question the security of their funds and look for safer alternatives with decentralized exchanges being one of them.

What’s wrong with centralized exchanges?

Although centralized trading platforms give users access to cryptocurrencies, they lack the advantages provided by the blockchain technology itself.

They have full control over users’ funds while storing them in a single central hub which is literally a honey pot for hackers of all sorts. Their opaque business models allow them to charge higher transaction fees and to manipulate the prices in their own favor. Also, users may lose access to their funds if an exchange gets blocked by local authorities. Finally, problems related to the performance of their central servers significantly increase the risks, especially for those who exchange large volumes.

The approach utilized by decentralized exchanges has the potential to resolve all these problems in a single blow.

Decentralized exchanges’ pros and cons

Unlike their centralized alternatives, decentralized exchanges (or shortly DEX’es) rely on the blockchain technology itself allowing users to exchange assets on a peer-to-peer basis while remaining in charge of their private keys. DEX’es have no access to end-users’ funds, neither do they employ any central entity for storing user’s personal data relying on a distributed registry instead.

With that said, decentralized exchanges provide their users with the following benefits:

-

Higher security and privacy. As DEX’es do not store users’ assets, they are not exposed to hackers. The lack of a single entry point providing access to the funds and personal data eliminates the risk of any breaches caused by external attacks.

-

Low risk of price manipulations. The transparent nature of decentralized exchanges and the lack of a central hub interested in manipulations for the sake of its profit reduces the risks of prices being falsified.

-

Independence from regulators. Decentralized exchanges do not suffer from the government’s pressure due to their distributed architecture. As they store no personal data, all these KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) procedures are simply useless.

-

Easy token listing. Blockchain startups that struggle to have their tokens listed on centralized exchanges may easily distribute them via DEX’es. Thus, they provide their supporters with minimum liquidity without having to pay enormous sums for listing.

Sounds like a perfect solution for cryptocurrency enthusiasts, doesn’t it? Lower your expectations, though, this coin has its dark side as well.

For one, the popularity of DEX’es is still much lower which significantly reduces liquidity for all the listed tokens. Their interfaces are typically much more complicated and, what’s worse, those that are based on the Ethereum blockchain suffer from the same scalability problems inherent to the underlying platform. Thus, if the network gets congested, transaction fees may become really high and the confirmation time will be way longer.

Some examples of decentralized exchanges

Although the number of DEX’es represented in the market has significantly grown over the past few years, not many of them can boast of high liquidity. If you are eager to give such platforms a try, here are some of the most popular solutions according to the statistics provided by Dappradar:

-

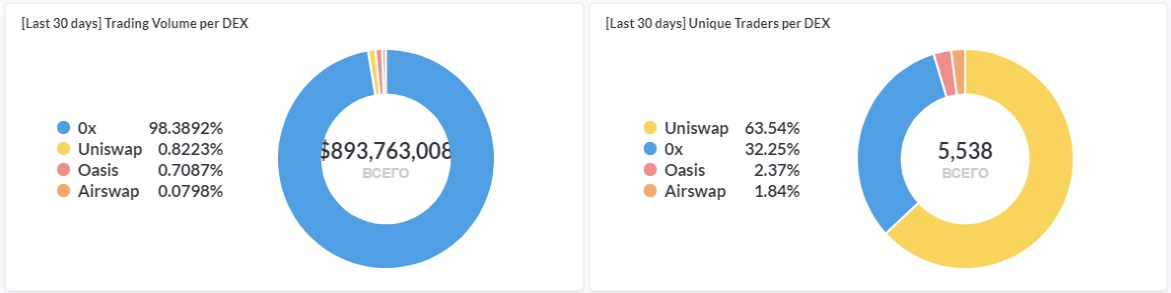

0x: this is an open protocol based on Ethereum. So far, it has managed to gain the highest daily trading volume.

-

Uniswap: another decentralized protocol based on Ethereum facilitating the process of changing ERC20 tokens between each other. It gained high popularity in summer 2020 due to the sudden surge of interest towards DeFi products.

-

Oasis: an online market for exchanging tokens in the Maker registry.

-

IDEX and Bancor are also worth mentioning as these are the eldest representatives of their kind. However, they have been overshadowed by new competitors, especially in the past couple of years.

Dappradar: 0x, Uniswap and Oasis have the highest trading volume and the biggest number of unique users as of November 23rd, 2020

Summing up

Despite the great advantages that decentralized exchanges offer to their users, they are still too far away from getting adopted by the market at scale. The ever-growing interest in blockchain technologies gives them a chance to get higher exposure in the upcoming years.