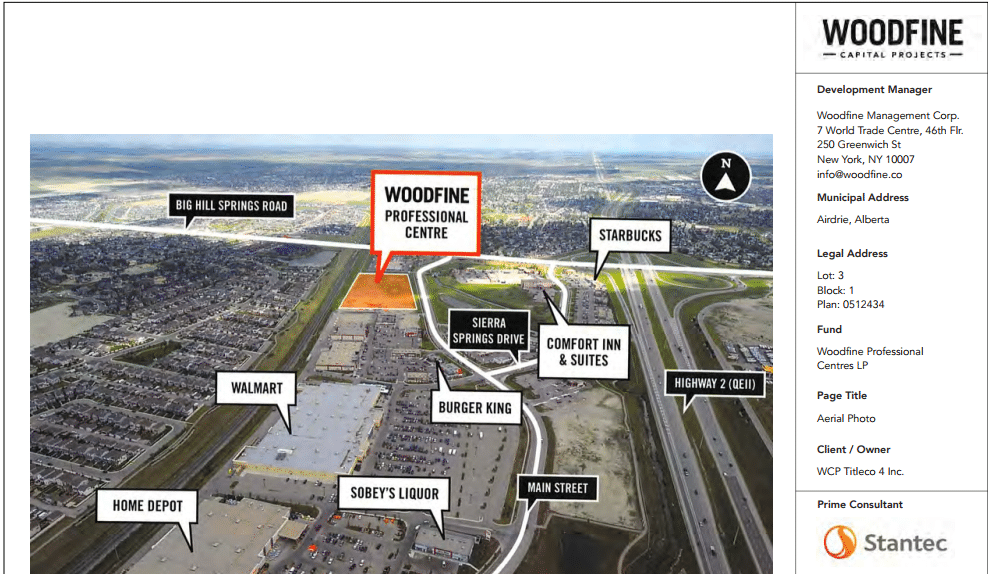

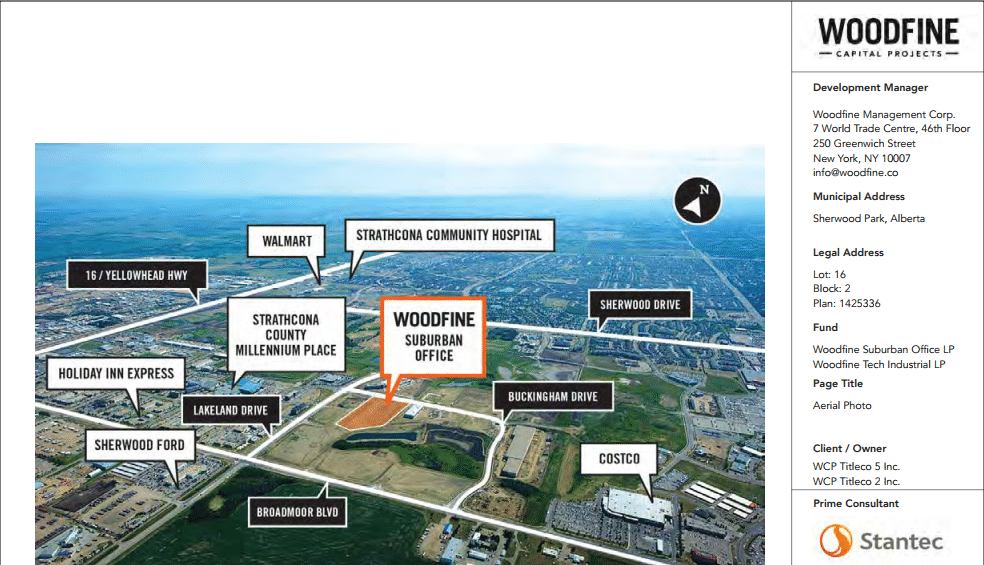

Earlier over the weekend on Bitcointalk, real estate development-focused cryptocurrency Relex announced that for the first time ever, a blockchain-based real estate asset will be listing on the New York Stock Exchange (NYSE), with Relex investors having a first opportunity to grab the common shares before the IPO listing. In addition to being the world’s first real estate development-focused cryptocurrency. Relex is a pioneer in the space of real estate cryptos by having one of its , Canadian real estate development firm and fund Woodfine Capital Projects (WCP), be the first real estate offering in the crypto universe to have its pre-IPO offering on blockchain en route to the NYSE. WCP is the latest iteration from Peter Woodfine, having 30+ years of experience in real estate development through Woodfine Development Corp, with an array of real estate projects in the Alberta region of Canada, and specializing in commercial real estate developments in the area of tech industrial, office, retail, and professional centers. CEO Peter Woodfine has development experience working with large corporates such as Walmart, Costco, and others.

Pooled Woodfine common shares and LP Units available for crowdfund investors are exclusively available via the Relex platform. Relex operates by first negotiating and then redistributing of broker commissions for the benefit of investors, disrupting the entire broker for commission fee paradigm. Relex negotiated a 10% commission from Woodfine Capital Projects, and redistributes the commissions in the form of investor discounts for Relex (RLX) holders. Therefore, common shares purchased on the Relex platform are available for just $18 CAD from the official announcement price below.

Investors can still sink into the Woodfine LP units on their own- at a hefty minimum price tag of $250,000 to gain access to the institutional benefits such as a 300% return in 8 years, fully transferrable units in which the investor can sell anytime they want, which is extremely rare in the fund world characteristic of investor lock-in periods and lack of liquidity in the market for selling fund LPs. Furthermore, Woodfine LPs are extremely rare in the sense that they are private wealth compliant. That means, when investors want to sell, they can stroll over to any financial institution that accept private wealth compliant products, instead of getting stuck with the LP unit as is common for the fund world. For investors that want to drop a little less cash, Relex is the only solution in which investors can on zero-commission basis access the groundbreaking Woodfine fund that breaks multiple paradigms in the fund world.

For the common shares, investors are free to pay full price and a minimum of $10,000 for 500 shares at $20 CAD a unit. If they want to invest at a lower amount, then Relex is the only authorized platform to access Woodfine common shares.

Relex announced because the Woodfine deal is “exclusively denominated in RLX for non-institutional investors, that they expect an appreciation of not only the Woodfine investment but also to create value for investors via the value of the token underlying the investment”. They said this would be a particular bonus for Relex holders. Relex also hinted to expect to wait no longer than January 1, 2018 for investors to be able to access this great yielding opportunity. Furthermore, Relex said they have confidence in Woodfine’s model very interestingly enough because it mirrors its site selection process to the same rigorous due diligence standards as Walmart. They said as the CEO, Peter Woodfine, possesses experience preparing development sites with Walmart in the past, that the due diligence process for each new Woodfine site is incredibly strict, with next-gen technology being applied to assess every potential site, but yet the system of that due diligence is deployable on a global scale, meaning Woodfine investors are looking at a Berkshire-Hathaway style investment vehicle that allows replicability and truly global scale. As Peter Woodfine has multiple developments under his belt with the Costco and Walmart name, Relex said it “may not be wise to dismiss a developer with such rich experience with key Fortune 500 companies”.

Woodfine’s model can be summarized in the following paragraph:

Woodfine differs from private equity in that they create perpetual equity and do not require traditional bank financing for their real estate debt. Their ability to issue debt with the purpose of reinvesting in more buildings is what distinguishes them from conventional real estate offerings. They provide investors with greater leverage, while adhering to borrowing restrictions that maintain investment-grade ratings. As public, non-listed funds, it’s all above board and completely transparent. At their core, what Woodfine believes is that it’s your money, and you deserve to know how it’s being spent.

- Model: Perpetual equity. The equity is invested by the limited partners, and the debt is self-issued by the funds, resulting in 3x capital appreciation with 20% annual distributions.

- Competitive edge: Infinitely replicable model allows repetition of the qualified investments at each of the development sites.

Relex further stated that they are pleased to be working with such an innovative real estate development fund such as Woodfine Capital Projects, which is a gamechanger in the real estate fund world from its public reporting issuer status, private wealth compliant LP units, fully transferable LP units, and a replicated model that is deployable beyond the US/Canada/Mexico universe. Regarding plans and expansion beyond North America, Relex said Peter Woodfine has stated that in addition to expansion plans into the European Union and Mexico, there are later-stage plans to consider expansion into fast growing markets such as India. As major institutional banks in the US have already certified Woodfine Capital Projects’ LP units as private wealth compliant, so we expect quite a breathtaking ride ahead as Relex and Woodfine make blockchain history onto the NYSE.

Relex, Using Crypto Solutions To Innovate Real Estate, John Bonar, Chief Investment Adviser

For official details behind the Woodfine offering, please see the announcement below:

Woodfine Capital Projects pre-IPO Placement

Woodfine Capital Projects is a real estate investment company that originates limited partnerships that develop commercial real estate. This model offers strong upside: seamless scaling, sustainable earnings, and organic growth, with expected AUM of over $4 billion in 6 to 8 years.

Blockchain-based Woodfine shareholders denominated in RLX will be party to a strict shareholders agreement:

- $20.00 (CAD) price per share

- Maximum 2,100,000 common shares issued to investors

- Featuring common shares acquisition by way of RLX

- Shareholders rights—no future dilution of share capital until after an exchange listing occurs

- Well-defined executive compensation—no stock options program; caps on salary and bonus

- Board of directors must include a majority of independents at arm’s length from the Woodfine Group

- Direct listing on a U.S. exchange in under 3 years

- Maximum subscription per person C$150,000.

This model offers seamless scaling, sustainable distributions, and organic growth, with expected AUM of over $4 billion in 6 to 8 years.

Please signal investor interest in the blockchain NYSE pre-IPO by registering for the Woodfine offering at www.relex.io .

For further information, please contact us directly at:

Relex Partners With Vietnamese Developer Nam Hai To Launch The Marine City Project On The Blockchain