Bitcoin’s market share among all cryptocurrencies listed on CoinMarketCap has fallen to its lowest mark since almost three years. This might mark an important turning point that decides the market sentiment for the upcoming months.

4/8 #BitcoinDominance has slowed but did not spike which is quite unusual during such a bid dump. This would indicate relative strength in the #alts and is an overall good sign for the market. pic.twitter.com/4pk078Oc2N

— Felix🛡 (@MakerOfGloves) May 18, 2021

BTC dominance on three-year Low

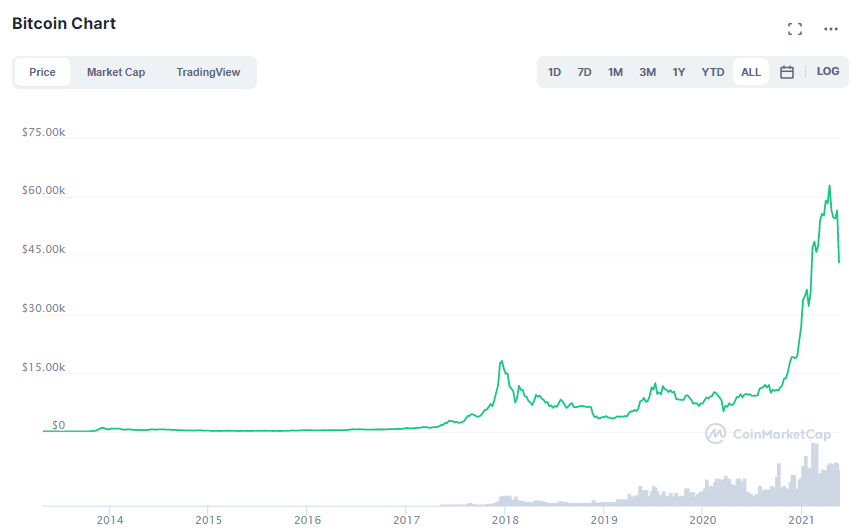

At the time of writing, CoinMarketCap quotes the Bitcoin dominance as 39.3%, to its lowest point since June 2018. Paired with this week’s sharp drop in crypto asset prices, this might be a sign that the bull run, which was started by last year’s halving event, might come to a stop.

During the last seven days, the leading cryptocurrency lost -23.5% of its trading value and now trades for 43,300 USD. In total, Bitcoin is down -33.0% from its all-time high, which was recorded on April 14 at 64,600 USD. This drop resembles the market crash of March 2020, when Bitcoin lost more than half of its value between the highest and lowest point.

The last time a comparable drop in BTC dominance happened marked the bursting of last mining epoch’s speculative bubble, which sent the cryptoeconomy into a year-long bear market.

The altcoin rally observed in late 2017 can be compared to a “maid boom”, which poses an exit signal to savvy stock traders. A maid boom is characterized by “dumb money” flowing into the market by inexperienced investors, such as domestic staff. Oftentimes, these inexperienced investors will sell their holdings on a smaller price drop, causing a full-blown market crash.

The recent price surge in memecoins such as Dogecoin (DOGE) and Shiba Inu (SHIB) could hint at dumb money entering the crypto markets, hinting that a maid boom might be occurring.

Market Crash or healthy Correction?

The meme coin rally necessitated a correction, but whether this will be the beginning of a bear market period is still an open question. At the very least, there are some indicators that point in the opposite direction.

For example, institutional investors such as Michael Saylor, CEO of MicroStrategy, are still going long on Bitcoin. Saylor announced that he bought the dip, acquiring more BTC for a sum of 10 million USD.

MicroStrategy has purchased an additional 229 bitcoins for $10.0 million in cash at an average price of ~$43,663 per #bitcoin. As of 5/18/2021, we #hodl ~92,079 bitcoins acquired for ~$2.251 billion at an average price of ~24,450 per bitcoin. $MSTRhttps://t.co/fU6LN4WbKI

— Michael Saylor⚡️ (@saylor) May 18, 2021

One investor who might tip the scales is Elon Musk. A recent petition addressed to the Tesla CEO called for Musk to sell all of his Bitcoin holdings. While the reasoning behind the petition is understandable, given Musk’s ironic support for Dogecoin, Tesla’s Bitcoin position worth 1.5 billion USD hitting the market might drive prices even lower.

Finally, the altcoin markets still seem somewhat healthy and reacting to recent positive developments. Both Polkadot and Kusama gained in trading value after the Web3 Foundation announced that both networks are in the final stretch of their development, with Kusama enabling parachains in the near future.

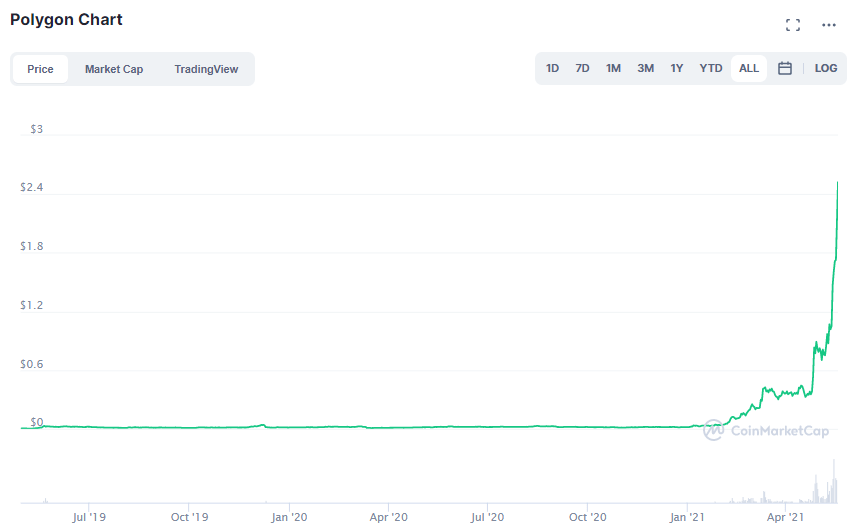

The best-performing altcoin in the last week was Polygon (MATIC), which achieved gains of 154.3% over the last seven days, catapulting MATIC to rank #14 on CoinMarketCap. While this parabolic rally might be exaggerated, a positive outlook on Polygon is justified, as the Ethereum layer 2 network attracted some valuable partners, positioning itself as as viable L2 solution to make the minting and trading of NFTs more affordable.