Shiba Inu has become the next Jokecoin to pump with an unbelievable price increase of over 1600% over the last seven days.

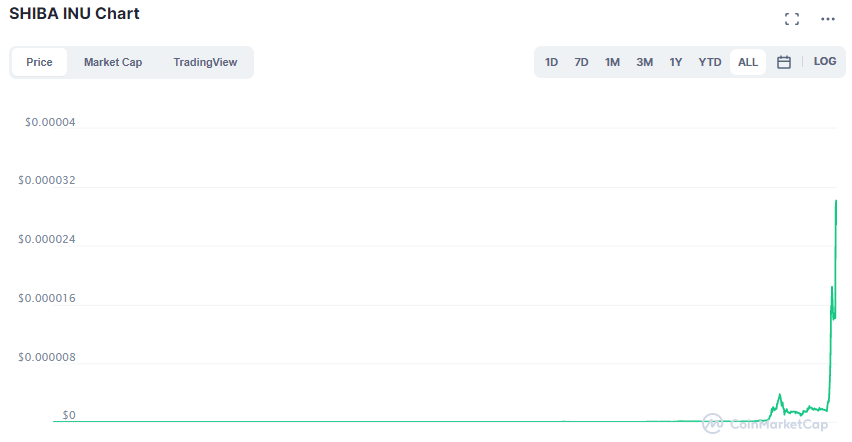

Beautiful#SHIB @CoinMarketCap pic.twitter.com/76T4QT6Jvb

— SHIB INFORMER (@ShibInformer) May 10, 2021

Vitalik Buterin owns 50% of all SHIB

Evidently, Shiba Inu (SHIB) is a copycat of Dogecoin (DOGE), using the same memetic dog breed as its heraldic animal. According to CoinMarketCap, the jokecoin was already launched in August 2020, but hardly sparked any interest, with a trading volume of $0 on many days.

In April 2021, there was a first pump, which coincided with a social media fueled Dogecoin pump. Since May 7, the price has gone parabolic. At the time of writing, CoinMarketCap reports a price increase of over 1600% over the course of the last week.

Another particularity surrounding crypto’s latest pumping jokecoin is its ties to Vitalik Buterin. Ethereum’s co-founder and figurehead owns half of the total token supply. As it seems, the anonymous founder of SHIB has gifted this share to Buterin’s Ethereum address.

How degenerate have we become?

At the current time, SHIB is on the 19th place of all cryptocurrencies compared by market cap, while DOGE is on 4th place. This means that these two crypto assets, which were conceived as an inside joke and never had been anything else now outshine hundreds of serious, but boring blockchain projects that either solve real-world problems already, or are working tirelessly on solving real economic problems.

For example, just recently, the UBI token launched that strives at nothing less than to enable a universal basic income for every human on earth, which is by far the hardest economic problem that crypto economists are actively trying to solve. Instead, crypto traders seem to favor meme coins like SHIB or DOGE that have a tendency for pump and dumps.

https://twitter.com/BENBALLER/status/1391481501632565249

What these soldiers of fortune seem to forget is that trading is always a zero-sum game. Anything one trader wins spells a loss for another trader. There is no value being generated by the pump and dumps and we can say that for sure since pump and dump schemes have accompanied the crypto economy since the emergence of the first altcoins.

Pump and Dump Gambling

There are numerous groups on social media that promote these schemes. Usually, the owners of these groups announce a date and time to rally up the masses to pump a specific low-value crypto token. Once the time comes around, the owners post the name of the token they want to pump and the followers do the rest. Usually, the price crashes down again in only a matter of minutes.

The only ones who win consistently from these schemes are the owners themselves since they know in advance which token is being pumped and can buy the token at a low price, in contrast to all of the participants who are not insiders. For everyone else, it’s just gambling with massively unfavorable odds. Saying that you can get rich through these schemes is akin to saying that you can get rich by betting your life savings on a Roulette wheel.

Memecoin pumps work in a similar fashion, just on a longer time scale. Sure, if you can predict when the price will come crashing down again, you can turn a profit. However, most people who buy one of these coins because they got a hot tip on Twitter are too inexperienced to even know the mechanics of pump and dumps, and those who actually think that they can predict the exact top are most likely delusional.

What is the most disturbing aspect of the recent meme-pumps is that people seem to have lost any sense of what a crypto asset is worth. The same tendency applies to 2020’s crypto hype (DeFi governance tokens) and the most current hype (NFTs). At some point in time, a correction is necessary and with the sheer amount of dumb money being put into the market right now, a crash that could shake up the whole crypto economy might be imminent.