Paying for goods and services is a staple of life, as immutable as the blockchain itself.

Electricity, gas, insurance, or a loaf of bread down at the shop, everything you need has to be paid for. Payment methods are diverse, ranging from cold hard cash to credit cards, cheques, and everything in between.

Single or simple transactions are easy to process. More complex ones with large scale transactional data require a scalable and robust payment system.

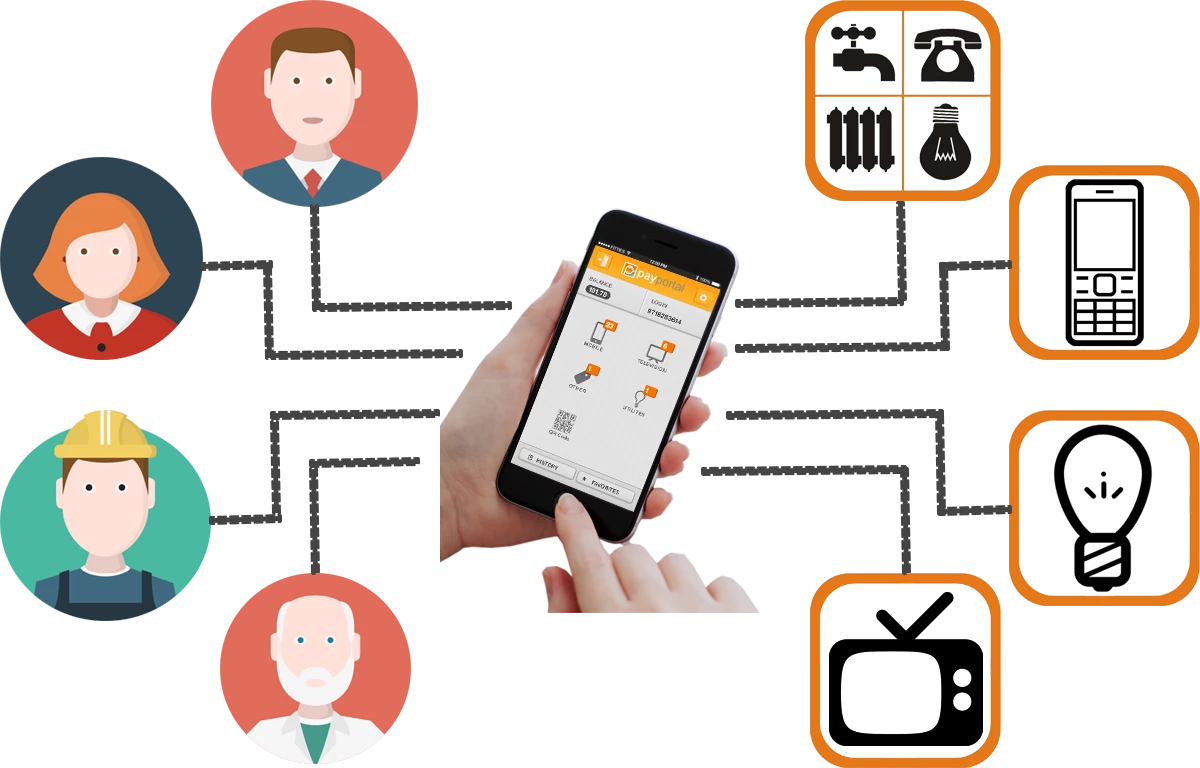

Payportal is a new ICO that offers a blockchain-based payment platform that connects service providers with the general public, to enable easy payment of bills and services.

Payportal: pay it forward on the blockchain

Payportal’s parent company was established in India back in 2011 and has since

processed payments worth 500m rupees, according to the website. The company is now launching an ICO to fund a new foray into blockchain technology.

Payportal intends to launch a wallet linked to a customer’s mobile number. Customers can use that wallet to pay for goods and services using the Payportal platform.

The wallet will enable:

- Online recharges

- Bill payments

- Domestic money transfers

Consult the Payportal whitepaper for more information about these services.

Payportal in figures & quick facts

- Token name – PPTL

- Total amount of tokens issued – 20m

- Total amount of tokens available for sale – 14,500,000

- Token price – 1 PPTL = 0,002 ETH

- Private sale start date – April 16th 2018

- Private sale end date – May 6th 2018

- ICO Start Date – tbd

- Soft cap – 3,000 ETH

- Hard cap – 24,000 ETH

Tokens that remain unsold after the end of the ICO will be burned.

The PPTL token

The Payportal token (PPTL), based on the Ethereum ERC-20 Standard, is described in the whitepaper: “the token aims to provide the development of the Payportal platform. It does not represent equity.”

Once created, the tokens will be distributed as follows:

- Sales – 70%

- Reserve – 10%

- Bounty – 5%

- Team & Advisors – 15%

The team

Second day photo report of #Payportal team from Indian Retail & eRetail Congress & Awards 2018. pic.twitter.com/1JAAuOBnmh

— PayPortal Services Pvt Ltd (@PayPortal_India) April 17, 2018

Learn more about the Payportal team here.

Social media presence and digital footprint

Some additional links https://t.co/D3BXtBI1sK

— PayPortal Services Pvt Ltd (@PayPortal_India) April 13, 2018

- Twitter – 3,100 followers

- Facebook – 13k followers

- Telegram – 1,536 followers

Correct at time of writing.

Competition

In addition to TW You can join Payportal Telegram chat using the following link https://t.co/E2oSetKie8 pic.twitter.com/DJ1ae6gmi4

— PayPortal Services Pvt Ltd (@PayPortal_India) April 12, 2018

Blockchain-based payment platforms are quite commonplace, with Paytomat, CloudMoolah, VISO, to name a few, but there are many others.

Payportal may hold an edge insofar as it is an already-established company, with a

good reputation and a sizeable client portfolio. Besides, Payportal appears to be

geographically limited to India, which may ensure its survival in the long run.

Additional information

See Payportal review on ICOBench.

Consult the Payportal Whitepaper for more information about the platform, additional features and services, etc.

Conclusion

Please find cool video version about #Payportal plans and achievements at:https://t.co/SsBt996avg

More information on https://t.co/7kPuMDrjEU

Join us: https://t.co/jxnnofh8sX

Follow us also on: @Irish_TechNews, @SimonCocking— PayPortal Services Pvt Ltd (@PayPortal_India) April 9, 2018

Payportal could cater for the needs of Indian customers. The fact that it’s a company indigenous to the country may entice and convince local investors to support it, since Payportal has been operating in one form or another for a good few years.