Gaining access to financial services for up to 2bn people worldwide is nothing short of a chimera, an unattainable dream as out of reach as the rings of Saturn. Such lack of accessibility to basic banking facilities prevents all those people from getting onto the property ladder, transfer funds to loved ones, obtaining credit, and many other functions that a more developed society takes for granted.

This effectively means that a person’s financial footprint is non-existent, and may remain so for their lifetime, particularly in underprivileged areas of the world. This stifles entrepeneurship, which in turn hinders development, which leads to societal stagnation. People’s potential is denied, and thus the evolution of a given community becomes slower, or stops altogether.

Many smaller, rural communities are full of small merchants selling their stuff in every corner. These small stores often become the focal point of such small localities, where people go to buy and stay for a while, socializing. The small merchant has access to the entire community, so it makes sense to turn these small stores into ‘small banks’, as it were.

The role of the small merchant within the locality cannot be underestimated. It is often the lynchpin that holds a street, or a little hamlet together.

It is against this background of small retailers and ‘unbanked’ people that BitMinutes enters the ICO market, intending to turn these corner shops into ‘corner bankers’, through the implementation of tokens that will enable the holder to access previously unreachable services such as money transfer, lending, and prepaid phone cards.

This piece is a full disclosure, a statement of facts without any intention of advice or endorsement about the BitMinutes value offer.

BitMinutes: Granting credit and airtime, all through the blockchain

Currently, access to credit facilities is tightly regulated and centralized within a few ‘traditional’ financial institutions. Banks, and similar entities have a stranglehold on the market. All these institutions require a full financial history, and a sound economic footprint, before they part with their tightly held cash. This status quo works in developed societies, where people are conditioned by money, and have access to it from birth.

Such may not the case elsewhere, as people living in emerging markets and other similarly disadvantaged areas may never get the chance to even own a bank account.

The power of decentralization comes in very useful in this situations, as BitMinutes uses the Ethereum blockchain to enable access to a number of services for people who may otherwise be denied them.

Currently, BitMinutes plans to offer access to micro-loans, money transfer, and airtime minutes, all through a network of small retailers, which they call ‘Trusted Agent Network’.

https://twitter.com/BitMinutes/status/931257365185343488

Retailers can make a profit by selling or lending BTM.

BitMinutes and Figures & Quick Facts

- ICO Start Date: January 1, 2018

- Token Name: BTM

- Token Volume Issued: 10 Billion

- Tokens Available for ICO: 3 Billion

- Token worth: 1 BTM = $.01 USD

The BitMinutes Token

As with any other ICO, the company will issue its own currency, the BitMinutes token (BTM). BTM is based on the ERC-20 standard, which utilizes the Ethereum blockchain.

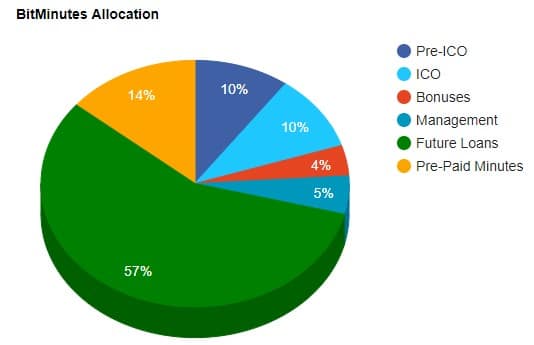

Once created, the tokens will be allocated as follows:

- 57% – Future loans

- 14% – Pre-paid minutes

- 10% – Pre-ICO

- 10% – ICO

- 4% – Bonuses

- 5% – Management

Investors can buy BTM using Bitcoin, Ether or USD/EUR by bank check.

The Team

Would a $5 loan help improve your life? It may not, but for billions of people around the world, it could be the right amount of cash to get them out of poverty. Meet @tomtmeredith Founder and CEO of BitMinutes https://t.co/aoWc2knXwF via @Totalprestige pic.twitter.com/ItONdSrjI7

— BitMinutes (@BitMinutes) November 29, 2017

BitMinutes’ site features an eleven-strong core team, plus four advisors.

The team includes the usual mix of technology- and finance-based roles that are required to make an enterprise such as this to be successful. Every member of the team features a link to their LinkedIn profile.

You can learn more about BitMinutes’ team here.

Social Media presence and digital footprint

A strong presence on Social Media is usually a good indicator of a company’s popularity, though it is not the only factor that determines success.

Here’s the numbers for BitMinutes, at the time of writing (December 2017)

- Facebook – 1,684 followers

- Twitter – 3,937 followers

- LinkedIn – 15 followers

Not great numbers for BitMinutes at this stage anyway, but this is often the case with relatively new ICOs. The company’s following may grow as time goes by.

BitMinutes’ roadmap can be viewed here.

Website quality & layout

Press Pickups on BitMinutes are Gratifying https://t.co/BB3E2Qzc7e #BitMinutes #News #PR #Fintech #ICO pic.twitter.com/j5KJfHsaKU

— BitMinutes (@BitMinutes) November 24, 2017

BitMinutes’ landing page features a dazzling, and certainly appealing graphic motif. A few graphics change periodically, making for a good graphic intro.

Every section that you’d expect to have for an ICO is there, along with a rather brief (and somewhat out of place) FAQ section at the bottom of the page.

Overall, the website does the job of presenting the information, and does it well.

Whitepaper

A well laid out, informative, comprehensive Whitepaper is a must for any ICO, if they are to be taken seriously. Documentation is sometimes treated as an afterthought, leaving many companies open to some criticism.

In BitMinutes’ case, the paper is quite extensive and long, presenting first the backdrop to the company’s proposition, and then providing the usual information about its ICO, architecture, etc.

Overall, the Whitepaper is rather drab and unappealing, from a graphical standpoint anyway. The point of a Whitepaper is not to be a dazzling marvel, granted, but a bit of color would have added some viewing value.

Nevertheless, the paper is well written, with proper grammar, spelling, and punctuation.

Conclusion

Enable access to financial services for those living in disadvantaged areas is a commendable enterprise, as lack of access to credit and other financial facilities means that, for many people, their entire lives are lived in poverty, or at a serious disadvantage at the very least. Children may not get access to education, which in turn denies them the chance of prosperity. This then continues on to the next generation, and so on, in a never-ending cycle.

The problem lies herein: The very nature of widespread poverty may curtail BitMinutes’ proposition, due to the sheer scale of the problem. BitMinutes should perhaps focus on a few small communities first to test the concept out, and take it from there.