- The latest research from CoinMetrics suggests that bitcoin is the least hoarded crypto of the major cap coins.

- The trend of equitable distribution across the space appears healthy except for some outliers like bitcoin cash.

- Crypto will likely not solve the wealth inequality debate, but it does provide some solutions.

According to the latest CoinMetrics report, bitcoin still leads the way in the distribution of wealth among all major cap cryptocurrencies for 2020.

The report analyzed wealth concentration on chains where wallets stored over 1/1000th of the total money supply:

How concentrated is crypto wealth? As of February 2020, large addresses storing over 1/1000th of the total money supply on a given network hold about:

95% of XLM

85% of XRP

46% of LTC

40% of ETH

29% of BCH

24% of BSV

11% of BTC

H/T @Coinometrics https://t.co/2fLR5I1T6A— Jameson Lopp (@lopp) February 18, 2020

The science isn’t bulletproof, of course, but the transparent nature of the blockchain made it easier to estimate that large addresses held a lowly 11% of BTC supply.

The percentage of BTC supply held by large addresses (with a balance of at least 1/1K of total supply) peaked at about 33% in February 2011. As of February 2020, those addresses hold about 11% of total supply. .

A Function of Time and Politics?

At first glance, it appears that the longer a blockchain has been around, the more evenly its wealth gets distributed.

There seems to be some truth to that notion as bitcoin moves into its 12th year of operation. The devil is in the detail, though, thanks to bitcoin programmers who continue to add privacy features to its blockchain.

Many modern wallets create new addresses for each new transaction in an effort to mask payment history. This makes it increasingly difficult to figure out who’s actually hoarding the digital currency:

However, supply distribution is not a perfect representation of wealth distribution. People often create multiple addresses, and it isn’t easy to figure out which addresses belong to a specific individual.

However, supply distribution is not a perfect representation of wealth distribution. People often create multiple addresses, and it is difficult to figure out which addresses belong to a specific individual.

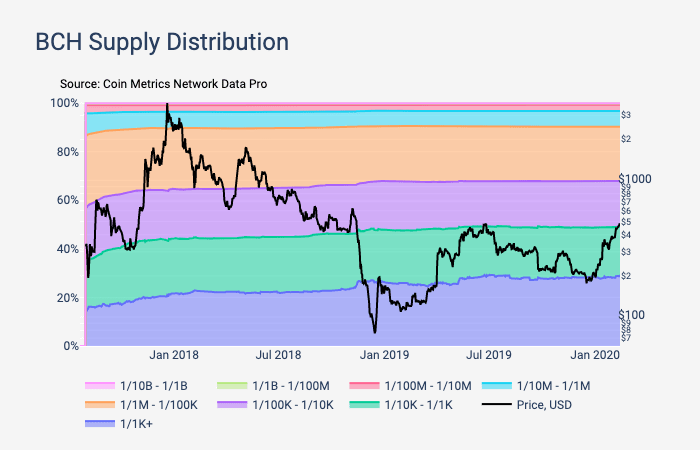

Overall the trend looks healthy, though, shown by a steady decline in the percentage of large addresses. There is one outlier though – bitcoin cash (BCH).

The bitcoin fork most closely tied with Chinese cryptocurrency miners actually doubled its concentration of wealth from 14% in 2017 to 29% currently:

The trend does not bode well for smallholders of BCH, particularly in light of the controversial 12.5% tax hike recently proposed by the miners mentioned above.

Wealth Inequality Remains a Global Social Problem

Bitcoin wealth centralization has always been a contentious issue, but the hotly-debated topic is not unique to crypto.

America’s humungous wealth gap remains a genuine problem in the fiat-based financial system. Even in a largely more equitable Europe, citizens are finding it increasingly difficult to buy assets:

Good morning from #Germany, where people have to work longer and longer to be able to afford shares. German workers must work an avg of 628 hours to afford 1 share of Dax, near record and almost 3 times as much as 10yrs ago. pic.twitter.com/ps4SXa3Qkc

— Holger Zschaepitz (@Schuldensuehner) February 17, 2020

Crypto on its own will likely not solve this problem; however, with a multitude of coins on the market, users may at least have some alternatives to their rapidly depreciating fiat currencies.