This March marked the one-year anniversary of the COVID-19 pandemic. It was also when Brooklyn-based film director Alex Ramírez-Mallis put a coveted collection, “Year of Farts”, on the NFT market. One fartwork from the collection is currently listed at 50 ETH. That is, around $1,99,073.50.

“If people are selling digital art and GIFs, why not sell farts?” Alex asks.

And what better than a year’s worth of fart audio clips recorded during the quarantine to commemorate the pandemic.

If you still raise your eyebrows every time a friend drops updates from the NFT world, read on. Here, we will unravel the mystery behind these new ‘tech-art-thingies’ and why they are so ridiculously expensive.

What exactly are NFTs

(For noobs. If you are not one, skip. There is a lot of patronizing.)

NFTs stands short for Non-Fungible Tokens. They are unique and non-interchangeable units of data stored on a digital ledger. The data could be an image, audio, video, or even a tweet. Since they are built on blockchain technology, their ownership can be verified.

Wondering how they are different from cryptocurrencies; say bitcoin?

Let’s see.

Cryptocurrencies are fungible tokens. Like fiat currencies, they can be exchanged for one another. You borrowed one bitcoin from your friend yesterday and bought yourself a car. Today, you need not worry about returning the same exact bitcoin. You can borrow one from another friend of yours and pay her back. This is called fungibility. All bitcoins represent each other.

However, when it comes to NFTs, things are different. Each of them has a unique identity. They don’t stand in for each other.

Does that explain the NFT craze and the absurd price it comes with?

For part, yes. But there is more to it. Let’s take a look at each of the factors that make some NFTs worth a fortune.

1. Technology

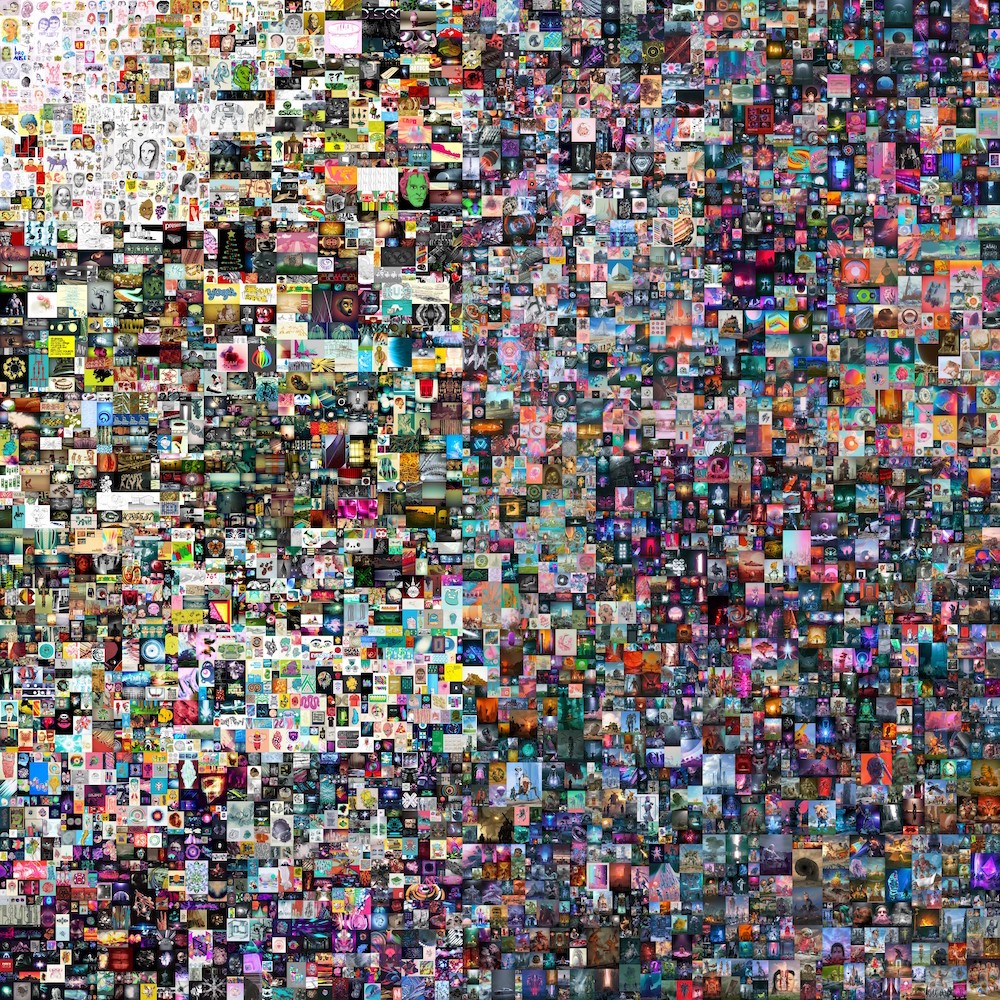

This is the most expensive NFT ever to have been sold: Everydays—The First 5000 Days, by Beeple. It racked up a whopping $69 million. Although it doesn’t make a lot of sense at first glance, it is a fruit of creativity and passion of 5000 days. Beeple, a popular digital artist, set out to make a new post every day in May 2007. They were compiled to create this unique work of art.

Still, why would anyone pay $69 million for it when you can just download a copy like we have?

Because its ownership is immutable. We can all get a copy of the art, store it on our computers, even frame and hang it on our walls. But that doesn’t change the fact that the ownership of the NFT remains with the holder, ingrained on the blockchain. And that means something for people in the collectible world. Similar to how we can all get a copy of the Mona Lisa, but it will remain the property of the French Republic.

Related: Most Expensive NFTs This Week: 16-22 October

Digital scarcity was deemed impossible for long. Blockchain changed this. You could create digital art, music, or movie putting in hours of labor, but once it goes live, so do the thousands of dupes. This brings down their value. With NFTs, things are beginning to take a turn for the best. Digital dupes have not been wiped out, of course. However, tokenization allows us to keep an accurate record of the transfer of ownership of the original file. This empowers the creator, seller, and reseller to claim a fair price on their digital assets.

In some cases, the creator can even charge royalty fees on every sale made. The applications of NFTs go far beyond the collectible and entertainment industries. The technology can be used in real estate, luxury asset sales, and supply chain and logistics, attaching real-life value to NFTs.

2. Speculation

Let’s face it. NFTs come from the same family as cryptocurrencies. And we know how volatile the crypto market is. The same applies to the NFT market. The fluctuations in the crypto market take a toll on the NFT market. On top of that, there is the speculative aspect built into all collectibles.

What else can explain why this tweet from Jack Dorsey was sold for $2,915,835.47.

just setting up my twttr

— jack (@jack) March 21, 2006

Or this scribble from FTX CEO Sam Bankman-Fried for $270,000.

1/1 "test" NFT by artist SBF currently has 23 hours left. https://t.co/R35DbNBEQa pic.twitter.com/R6jwvKndea

— FTX (@FTX_Official) September 6, 2021

They represent historical moments. As digital collectibles, their value is expected to appreciate over time.

Related: FTX Marketplace Debuts To Capitalize The Massive NFT Momentum

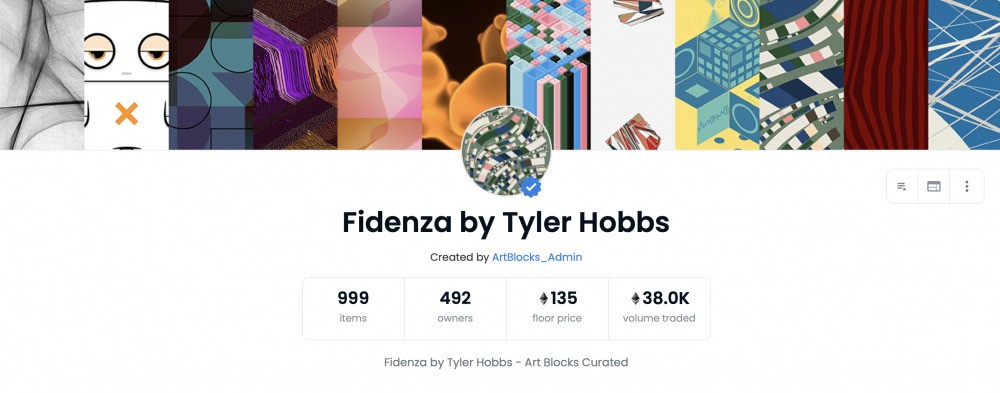

Just a few days back, Tyler Hobbs, the artist behind the prized NFT collection Fidenza, sold 50 tokens that grant holders ownership rights to one of his artworks. They are slated to be launched at the New York-based Bright Moments gallery. Investors plowed in $7 million to the collection that won’t go live until December.

This doesn’t come as a surprise to anyone who has been following Tyler’s work in the NFT space. The floor price of Fidenza stands at 135 ETH at the time of writing, and it has recorded 38.0K ETH in trading volume so far.

NFTs are speculative assets. Although many hail it to be a game-changer in asset ownership and transfer, much of their value is derived from this aspect in the present crypto climate. This is also the reason why haters call it a bubble waiting to burst. As more artists, celebrities, and brands jump on the NFT bandwagon, will the prices go down? Or, will it go up further?

Time will tell.

3. Rarity

Some NFTs are more expensive than others, despite belonging to the same collection.

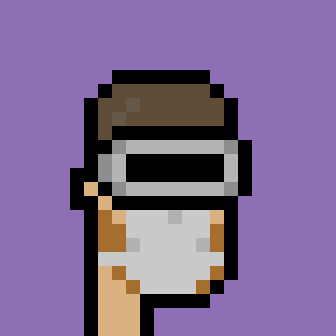

Take a look at this CryptoPunk for example.

It is one of the 6039 male Punks. The last sale was made 4 years ago at just around 0.41 ETH. The highest bid for this Punk was 30 ETH. That is, around 1,19,149.50 USD. Before you gape in shock, let’s check out another Punk.

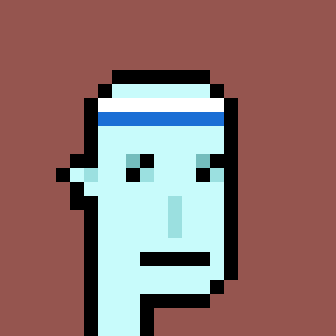

This is one of the nine alien Punks out there. Yes, very rare. It doesn’t have any accessories except for the headband. However, in the NFT world, lack of attributes is also a desirable attribute as long as it’s rare. So, rightly, the Punk was sold for 4200 ETH.

The rarer your NFT is, the higher the price you can claim.

4. Some are.. actually useful

There are NFTs out there with exciting utilities attached to them.

For example, Axies. The cute little pet NFTs on Axie Infinity, are bred, raised, and traded for profit. Axie Infinity is a video game similar to Pokémon in concept. However, it is hosted on a blockchain ecosystem where players can make money while playing the game. Here, the utility of the NFT is gamification.

More gaming projects have NFTs integrated as in-game collectibles; Sorare, CryptoKitties, and Decentraland to name a few. This ensures transparency in the transfer of asset ownership. Although their utility remains confined to a single project now, we can definitely expect them to be used across projects and blockchains soon. They are on the path to be a part of the metaverse.

Metaverse creates an expanded ecosystem that brings in more stakeholders while still retaining the integrity of the projects. That is when we will unearth the true potential of NFTs.

Related: Metaverse Powered By NFTs, The Next Giant Leap In Technology?

Airdropping tokens and more NFTs to NFT holders is another trend that is picking up. Bored Ape Yacht Club is a popular collection that promises rewards and privileges to holders down the line. In a few days into the launch of Loot NFT bags, holders were airdropped 10,000 AGLD (Adventure Gold) tokens each. At one point, AGLD was worth 7 USD!

Related: Loot NFT – Everything You Need To Know About The First Community-Owned Gaming Project

If integrated into real-life scenarios, this has a wide range of applications. Let’s say you own a sports team. Keeping fans engaged is critical to ensuring different sources of revenue for the team. You can mint out NFT collections and capitalize on the rage that is going on now. Many sports teams and players have already begun to do that.

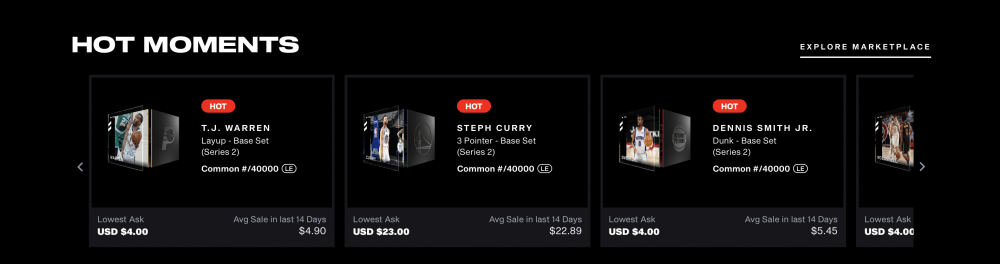

NBA Top Shot Moment™ Collectibles is a great example. It allows fans to collect and trade officially licensed NBA and WNBA digital moments. Of course, it doesn’t have to be just some random memorabilia that holders can lock up in their wallets. You can attach further utilities to them. Like a meeting with the team, or a signed T-shirt, or even a VIP ticket to the game.

Charity fundraising is another interesting aspect that projects can explore. All proceeds from the creation of Autoglyphs, the first “on-chain” generative art on the Ethereum blockchain, are donated to 350.org. It is an organization founded to combat climate change. Remember the million-dollar tweet we mentioned earlier? The proceeds from the auction were sent to Give Directly’s Africa Response fund.

Sent to @GiveDirectly Africa fund 🌍Thank you, @sinaEstavi. pic.twitter.com/aEZu07auLV

— jack (@jack) March 22, 2021

The takeaway

NFTs nurture novelty and creativity in industries that have for long been riddled with centralization and the distorted web of middlemen. It empowers creators, sellers, and buyers with transparency.

That being said, we can’t keep trading random pictures forever just because they are cool now. There are bigger ambitions NFTs have to pursue. Even if the fad fades, NFTs will have a sustainable future as long as they tap into their blockchain make-up, reduce their carbon footprint, and move towards an interoperable ecosystem.

May the flatulence burst into a metaverse revolution soon.