The complexities of equity markets are sometimes hard to fathom. These financial

environments offer little help to the uninitiated, instead becoming almost

exclusively accessible to those with deep knowledge of economics, or a sharp eye

for business.

Consequently, the appreciation, identification, and quantification of the value of

a particular equity market is a hard undertaking.

The advent of blockchain technology has enabled Sharpe Capital to develop a

proprietary trading algorithm that offers participants the possibility to express

contextual sentiment about global equity markets. Participants then receive a

service fee proportional to the accuracy of the sentiment they offer.

The sentiment data collected is then processed and complemented with Natural

Language Processing (NLP) strategies for linguistic analysis and emotional

responses.

The finalized data becomes an invaluable insight source for hedge funds and asset

managers, and a prized revenue stream generated by the sale and trade of this

insight.

This piece is a full disclosure, a statement of facts without any intention of

advice or endorsement about the Sharpe Capital value offer.

Sharpe Capital: Understanding Market Dynamics in the Blockchain

The volatile nature of financial markets worldwide is well known. Market dynamics

are fluid and unpredictable at best, and downright chaotic at worst. Formulating

educated sentiments about global markets is not easy.

Sharpe Capital offers a two-pronged approach to resolving the issue of global

equity market sentiment: The Financial Markets Protocol, and Investment Platform.

Financial Markets Protocol

Our #token #presale is filling up quickly. Whitelist your contribution so you don't miss out on up to a 30% discount. #blockchain #crowdsale pic.twitter.com/Sndj8rAv6S

— Sharpe (@sharpe_social) September 15, 2017

Sharpe Capital intends for this protocol to become the new standard for hedge

funds, whereby crucial governance decisions are made by the community.

Investment Platform

A great summary of the Sharpe Platform was recently published by #AmaZix – https://t.co/0LeLPn1MAT #Blockchain #FinTech #RegTech #Investment pic.twitter.com/NoAGLjAnPz

— Sharpe (@sharpe_social) September 15, 2017

Sharpe Capital’s proprietary quantitative model that combines state-of-the-art

advances in economic theory and cognitive science, integrated with statistical and

machine learning analysis.

The Investment Platform is built using Amazon Web Services technology.

Sharpe Capital: A few quick facts

- Founded in – 2015

- Headquartered in – London

- Token Name – Sharpe Platform token (SHP)

- Token Pre-sale begins on – 14.00UTC, November 6, 2017

- Hard cap during Pre-Sale – $8m

- Token Crowd-sale events begins on – 14.00UTC, November 13, 2017

- Hard cap during Crowd-Sale – $20m

SHP: Pre-sale and Crowd-sale events

I just published “Sharpe Capital — Pre-Sale” https://t.co/jM0n1wf8Re

— Sharpe (@sharpe_social) September 2, 2017

Pre-sale

Working hard building our unique trustless smart contracts – much anticipated #ICO #whitepaper to be released Monday! #blockchain #investing pic.twitter.com/xeL0wUJlIQ

— Sharpe (@sharpe_social) July 29, 2017

The Pre-sale event commenced recently, on November 6 2017.

It is open to investors willing to make large contributions.

Investments made during this period will be rewarded with the following discounts:

Pre-Sale Token Discount – 10%, 20%, 30%, based on minimum and maximums of 10k-50k, 50k-250k, and 250k-500k, respectively.

Ethereum payments must be submitted during the Pre-sale event.

Crowd-sale

Ahead of our upcoming Token Generation Event, we're sharing some more detail on our reserve funds and vesting rules https://t.co/3FizjnWoOk

— Sharpe (@sharpe_social) October 5, 2017

Sharpe’s token-generation event (‘crowd-sale’) will commence seven days after the

Pre-sale, on November 13, 2017, exactly at 14.00UTC. SHP will be issued during this

period.

SHP will be issued at a rate of 2,000 SHP to 1 ETH, which will remain constant

while the crowd-sale is ongoing. SHP will be used primarily to support the

Investment Platform.

An additional 2,000 SHP will be held in reserve for future fundraising purposes.

There will be no further minting of SHP after the end of the crowd-sale event.

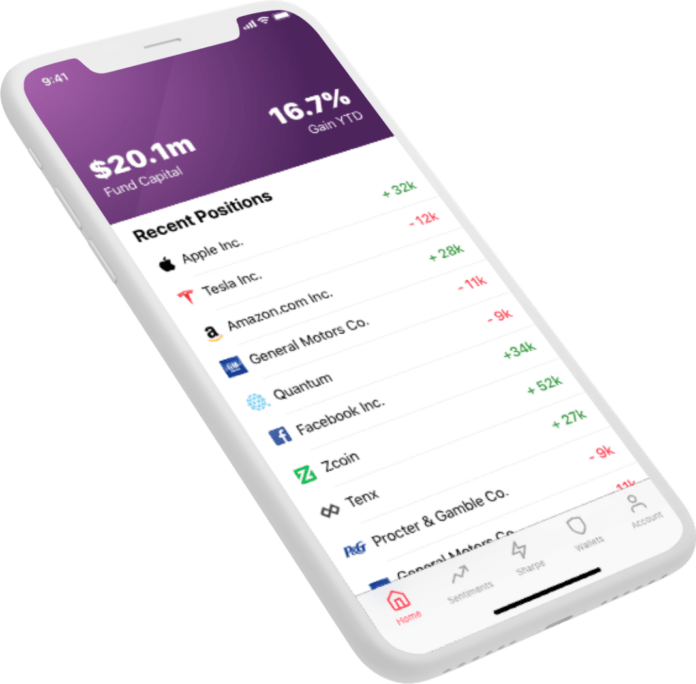

Sharpe Capital’s Sentiment Platform

The core of Sharpe Capital’s value proposition is its sentiment platform, which

will be first made available to a limited number of customers during Q2, 2019.

Using a mobile app, customers will earn Ether in return for providing opinions on

global equity markets and blockchain assets.

Customers will be presented with news announcements, to which they must express a

positive or negative sentiment. Over time, these contextual expressions of

sentiment will build up a reputation score on the Ethereum blockchain.

The Sharpe Capital Team

Introducing our CTO and Lead Developer: check out our latest blog post https://t.co/zo0mIW7FIC #Blockchain #FinTech – welcome on board guys! pic.twitter.com/ATtjvTBX1G

— Sharpe (@sharpe_social) September 16, 2017

The human force driving Sharpe Capital is limited in number, but well rounded and

with a great deal of relatable experience.

Five people form the core team, fielding a balanced strike force with some

impressive backgrounds in their respective missions, from business-related

responsibilities to blockchain technology.

Very happy to announce two new team members have joined us, Mieke and @lexiGao. It's fantastic to have such a diverse team of experts #ICO 🎉 pic.twitter.com/vEzZukepOz

— Sharpe (@sharpe_social) August 10, 2017

There are also six people on the Advisory Board, each with equally

impressive backgrounds in their fields, from legal studies to algorithm

development.

As a whole, the team appears cohesive, with the right people to do the job they are

supposed to do.

As a footnote, Sharpe’s roadmap specifies that they intend to grow their team

during the first quarter of 2018, adding more expertise in software & business

development, machine learning, and marketing.

We’re very excited to welcome Dan & Arthur – fantastic groth https://t.co/tq5OITH0te pic.twitter.com/8HOxHMzfHC

— Sharpe (@sharpe_social) October 1, 2017

White Paper

Our #whitepaper leveraging the #Ethereum #Blockchain, defining a new gold standard for #investment funds is here! https://t.co/PuLGX7c5Yy 🎉 pic.twitter.com/QcWgXaP1uF

— Sharpe (@sharpe_social) August 19, 2017

I have reviewed quite a few ICOs at this point, so I’m quite familiar with their

framework, which usually includes a White Paper. Sharpe Capital’s one stands out because the White Paper is amongst the most comprehensive, detailed, and thorough I’ve read.

It is a very professional-looking document that goes into exhaustive detail about

Sharpe Capital, its proposition, and a myriad of related financial concepts. The

paper includes a table of figures, which is rare, and also a list of tables.

Overall, Sharpe Capital’s White Paper is certainly worthwhile.

Roadmap

Security audit on our smart contracts is complete. Read the report here: https://t.co/kOOT3DyEaM 🎉 Very well done to our talented dev team! pic.twitter.com/40mO9wwv4j

— Sharpe (@sharpe_social) October 10, 2017

Sharpe Capital’s current Roadmap goes from Q1 2018 to Q1 2019, starting with the

establisment of the company’s HQ in London early in 2018, to the formation of

strategic partnerships with hedge funds late the following year.

In between, Sharpe intends to launch its platform to a number of selected customers

and community members at some point during the second quarter of 2018. After that,

they will launch their mobile app, and a hackathon later in 2018. The year 2019 is

scheduled to feature Sharpe Crypto-Derivative (SCD) tokens, and then commence live

trading during the second quarter. The first dividends are intended to be paid to

investors during the third quarter.

Website Quality & Layout

Website v2.0 coming soon! #fintech #startup #branding pic.twitter.com/dgnaO2D7MY

— Sharpe (@sharpe_social) July 9, 2017

Website design for ICOs tends to be hit and miss. Some sites, particularly from

countries where English may not be the first language, tend to be riddled with

grammar and spelling issues, which taints the experience slightly and makes them

less trustworthy, in my view.

Sharpe Capital’s site does not fall into this category, however. Much like its

White Paper, the website is professional-looking and well constructed. All the

links work, the layout is neat and tidy, and the site features all that you would

expect from an ICO, including a link to purchase their tokens.

The website is secure, of course, as it includes a valid SSL certificate and it’s integrated in the Cloudflare framework.

I just published “Smart Contract Security Auditing & More” https://t.co/iNTNmQzzHm

— Sharpe (@sharpe_social) August 25, 2017

Sharpe’s website gets a thumbs-up.

Social Media & Digital Footprint

A solid presence on Social Media is a must for any ICO (or any other professional

entity, for that matter), if they wish to garner a steady following.

Sharpe Capital’s current digital footprint is somewhat limited, for now at least.

Here’s the numbers, at the time of writing this piece (November 2017)

Social Media presence is the one aspect where there is plenty scope for improvement

for the company. Sharpe Capital could do with a series of media advertising

campaigns.

Conclusion

Sharpe Capital offers a solid, comprehensive, considered value proposition.

All the materials presented are professional and neatly designed. Once again, the

White Paper merits special mention due to its exhaustive treatment of the subject

matter, and the incredible amount of detail that it offers.

Sharpe Capital’s only weak point, if it can be thus deemed, is its media presence.

A few targeted advertising campaigns would provide a much needed boost at this

point in time.

Read Sharpe Capital’s White Paper for more information.