Price Action

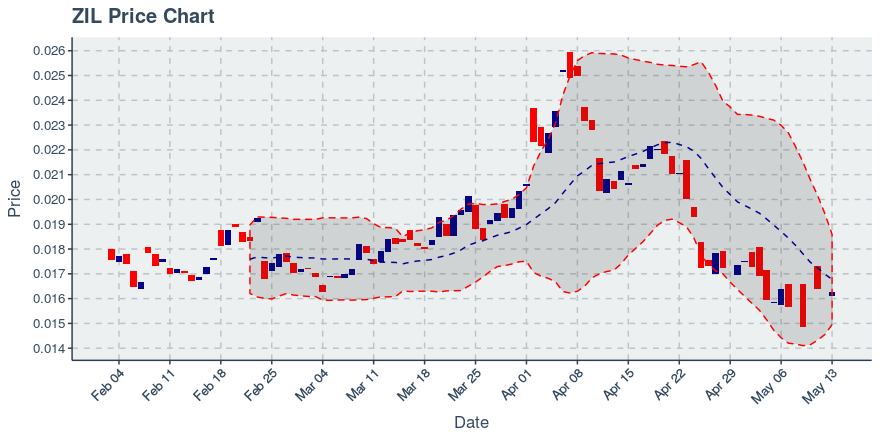

Since last week, Zilliqa’s price went down by -0.61%. It is below its 20 day moving average by 2.52%, so it’s fairly close. Zilliqa’s bullish momentum, based on its distance from its 20 day moving average, is pretty far negative compared to the other coins we’re covering, and thus may be due for a correction upwards or some kind of a period of low volatility. In terms of volatility, Zilliqa exhibits greater price volatility than approximately 50% of coins in our index, so it’s volatilty is about what you’d expect for a cryptocurrency in our index. Looking ahead, if the upcoming week mirrors the volatility of three past three weeks, the price range for Zilliqa in US dollars is expected to be between $0.01466203 and $0.01874097.

Where to trade Zilliqa (symbol: ZIL): Gate, Yobit, Binance, DDEX, Ethfinex

Volume Update

Over the past week, Zilliqa saw its daily volume range between 64,665,785 and 270,803,221 units of its own currency. In the three weeks prior, the trend in volume does not have a clear direction, while the price trend is clearly down. Zilliqa experienced a turnover rate of about 2.11% over the past week, which means that is the percent of its available money supply that is traded daily. Its trading turnover percentage is higher than about 57.14% of the coins we’re tracking, so it’s middle-of-the-pack; investors/traders may thus wish to consider their liquidity requirements to make sure the coin matches their needs and their expected trading volume.

Engagement Update

Zilliqa saw the number of wallets holding its coin go from 36,608 to 36,548 over the past week — a change of -0.16%. In terms of blockchain-recorded transactions made by these wallets since their inception, that number changed from 396,438 to 398,714, which translates to growth of 0.57% for the week. Zilliqa’s combined growth rate — meaning the sum of its growth rate in holders and transactions — is 0.41% which puts it ahead of 36.11% of the coins in our index. One interpretation of this may be that its change in engagement is below average, at least on a percentage basis.

Technology Development Status

Zilliqa currently has 17 public repositories on GitHub, with the oldest one now 1.6 years young. Its last public update to any of its repositories was within the past day, which is pretty good, as it suggests the coin is still under active and rapid technical development. Zilliqa’s public repos now have 1097 which is pretty good, relatively speaking; specifically, that’s more than 70 % of the top 100 coins we’re looking at. The coin has 174 issues reported across its public repositories. Its number of watchers, when viewed against its open issues count, is a bit below average, and thus potentially concerning. We view the ratio of open issues on Zilliqa’s GitHub repos relative to the number of developers who follow its repos as a way to quantitatively assess the health of a coin’s software development processes, and for Zilliqa we see that it fares better than only 39% of the coins we group Zilliqa in.

Zilliqa News and Commentary

The top 3 themes being discussed about Zilliqa in the past week are listed below. If available, we added an excerpt from the article to help give a taste of what it is about.

Sharding implementation -Ethereum, Zilliqa and

Altcoin News: PepsiCo Appreciates the Advantages of Using Zilliqa Blockchain in M

Zilliqa — New listing on Loopex – Loopex

Key Extract:

Introduced in 2017, Zilliqa (ZIL) is centered around the idea of ‘Sharding’ and was designed to enhance the scalability of cryptocurrency networks such as Ethereum.

Where to Buy

You can trade Zilliqa, listed under the symbol ZIL, through the following exchanges: Gate, Yobit, Binance, DDEX, Ethfinex.

Article by SixJupiter