Key highlights:

- While the Bitcoin price is at the door of $25,000, records are being broken for the number of non-zero Bitcoin addresses, average block size, and long-term investors.

- Transactions that increase the average block size on the Bitcoin blockchain are due to Ordinals, which brought the NFT feature to the network.

- The rate of investors holding BTC for at least six months is this high for the first time: 78%.

Bitcoin price reached its highest level since August 2022 today. Bitcoin, which is priced at around $24,500, has reached ATH in different metrics over the past week. With the number of non-zero Bitcoin wallets, average block size, and the number of long-term investors breaking records, there are important signs for the future of Bitcoin.

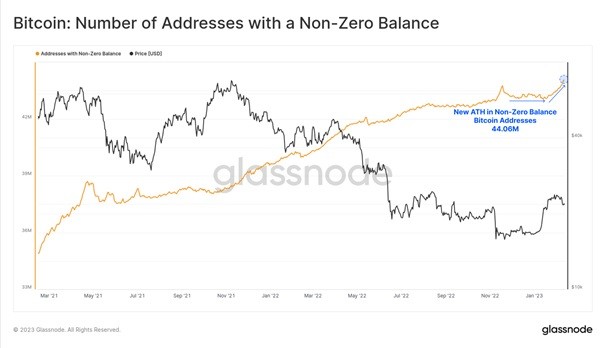

The number of Bitcoin wallets with non-zero balances is a metric directly related to Bitcoin adoption. According to the data provided by Glassnode, the number of Bitcoin addresses with non-zero balances has exceeded 43.8 million. With the increasing importance given to non-custodial wallets by users, especially with the bankruptcy of CEXs, more investors than ever prefer to keep their BTC in their own wallets.

The BTC price has risen by about 48% since the start of the year, reassuring investors that the bear market is over. The number of non-zero wallets is likely to exceed 50 million soon as new investors buy BTC and old investors who fled the risks of the market come back. The chart also shows that the number of small investors is increasing, not the number of whales in BTC.

Bitcoin Block Size At All-Time High

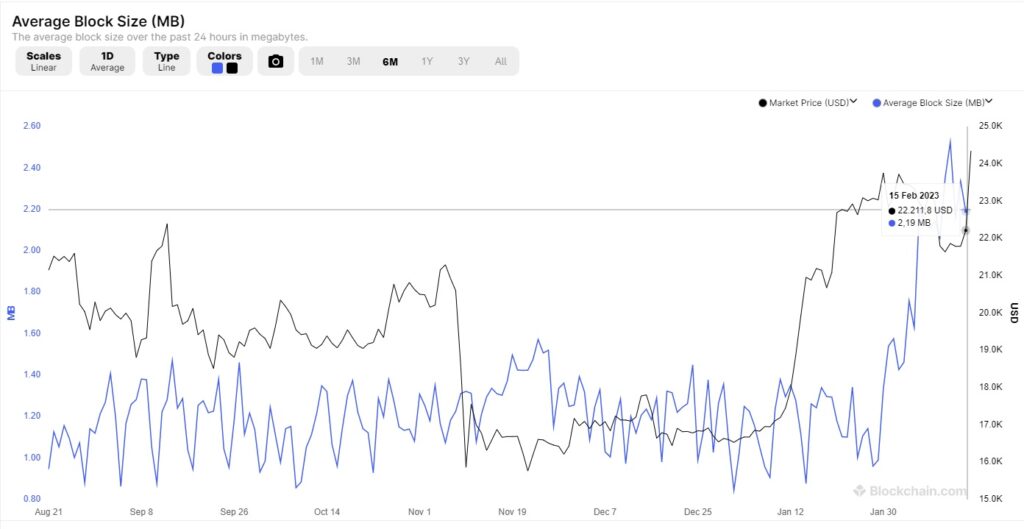

As Bitcoin continues to attract new investors, there are different movements in the blockchain network. A new protocol called Ordinals has launched on the Bitcoin blockchain network and allows NFTs to be recorded on Bitcoin transactions. The joining of Ordinals to the network not only increased the block size but also played a role in increasing the number of wallets with non-zero balances.

Launched on January 21, Bitcoin Ordinals uses the enumeration method to randomly assign data to satoshis and encode NFT-like images. The protocol, which has recorded close to 100,000 NFT-like photos and motion pictures in the intervening 26 days, has been criticized by some communities for diverting Bitcoin from its peer-to-peer electronic payment system function.

According to Blockchain.com data, the Bitcoin block size was usually between 0.80 MB and 1.65 MB, but by the beginning of February, it gradually exceeded 2 MB. Currently, the average block size appears to be 2.19 MB.

Long-Term BTC Holders Confident

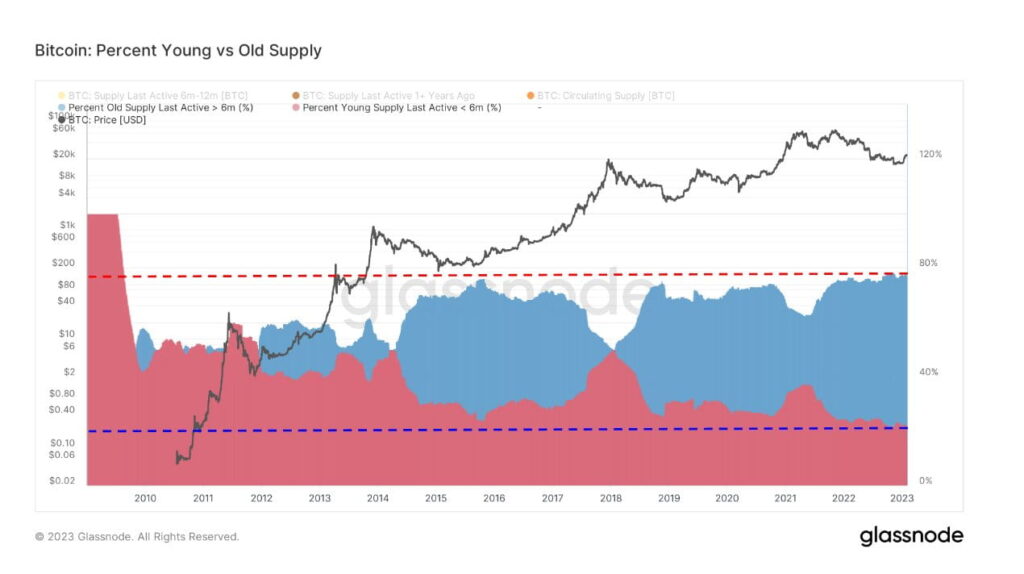

Although the number of new wallets and addresses with non-zero balances is increasing, long-term BTC holders still hold most of the supply. Long-term owners hold 78% of the circulating supply, which is a new record. To be considered a long-term owner, a HODLer must have purchased their BTC in their wallet 6 months or more ago.

Long-term holders referred to as the “diamond hands” of the market, are holding BTC so heavily and decisively for the first time in Bitcoin’s history. Although many new investors are entering the market, the investment plan of the investors seems to have turned into the idea of HODLing.

What Do These Metrics Tell Us?

The increased number of both long-term holders and Bitcoin addresses with non-zero balances is an indication that more and more investors believe in Bitcoin’s potential to become more valuable in the future. The more long-term holders of an investment tool, the less volatile it tends to be. Considering that people are afraid of the volatility risk of the cryptocurrency market, this is a good metric for the market to mature further.

On its way to becoming a stable, predictable, and more widely accepted investment vehicle, Bitcoin has gained about 48% since the beginning of the year. Whether this is the quick start of a new bull rally or a huge bull trap is a matter of debate among investors. However, it seems that more people are adopting the idea that bull season has begun.