As the second quarter of 2018 draws to a close, now seems a good time to look back at the ICOs launched in the first half of the year.

A cursory glance at the numbers is a revelation in itself – the $5.5 billion raised in the last six months almost equals the $6.1 billion raised in the entirety of 2017.

Bear in mind that 2017 was ‘the year of crypto’ – the year that cryptocurrency truly announced its arrival. Indeed, this was crypto’s breakout moment, and the number of ICOs launched almost doubled in each quarter of 2017, with 45 being launched in December alone.

Quantity vs quality

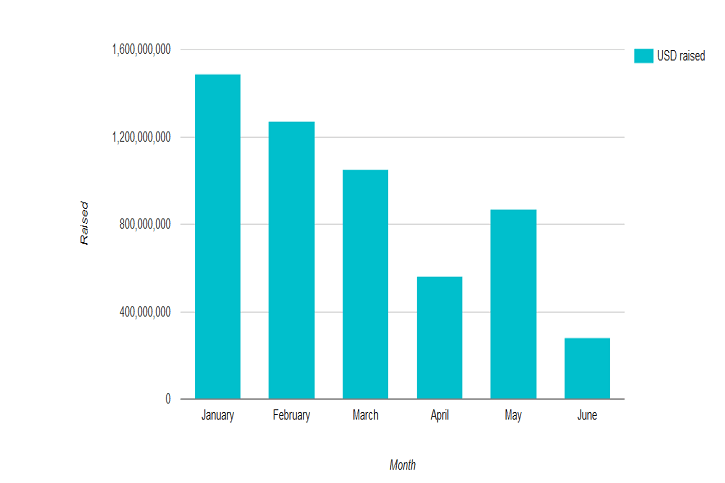

As you can see in this infographic from ICOdata.io, the majority of the funds raised came at the start of the year. This is unsurprising considering the strength of the market in early January.

However, following the crash of January, the amount of money being thrown at ICOs shows a marked decline. The ICO market lost 60% of its value by the time April came along. A stronger performance in May bucked the trend, but June’s numbers suggest the downward slide will continue.

It’s interesting to note that while the funds being raised by ICOs is on the decline, the number of ICOs being launched is actually on the increase.

According to Coinschedule.com, ICOs launched in 2018 can be broken down monthly like so:

January – 71

February – 49

March – 57

April – 113

May – 125

June – 25

As you can see, after a dip in February, the number of initial coin offerings skyrocketed from 49 to 125 within the space of a few months. More than four ICOs were launched every day in May alone.

The combination of a saturated ICO market coupled with a reluctance on the part of investors to continue pumping money into ICOs should be a worrying sign and may point to the onset of apathy among crypto enthusiasts in the face of countless ICOs appearing every day.

However it should be noted that regardless of the monthly decline in ICO investments, the numbers are still way above those of the same time last year.

2018’s best performers

As you can see from Coinschedule’s charts, the encrypted messaging app Telegram holds the record for the highest funds raised by an ICO in 2018.

Telegram recently canceled their public token sale, however, the $1.7 billion raised in their two pre-sales earlier in the year far outweighs anything else so far.

The next most successful ICO belongs to Petro, the controversial cryptocurrency of the communist Venezuelan government. The Petro launch came amid the financial collapse of the Venezuelan economy and is claimed to be backed up by the nation’s reserves of oil, gold, and natural mineral reserves.

Petro’s private pre-sale succeeded in raising $735 million, even amid controversy and suspicion of corruption.

Blockchain projects

If we take Telegram and Petro out of the equation and focus solely on what we might call traditional crypto projects, then we see that Dragon Coin achieved the greatest ICO success, raising $320 million.

This is followed closely by Huobi Token which raised $300 million and has only gone from strength to strength since its inception. An HT token price of $1.20 in February shot up to a price of $5.95 in early June – an incredible 400% increase in four months.

After Huobi, the amount of money ICOs have managed to raise this year drops off significantly. Bankera managed to raise the sizeable sum of $150 million, but this only amounts to half that of Huobi. Following Bankera is Basis, while the rest of 2018’s Top 10 is made up of Orbs, Envion, Elastos and U.CASH.

Conclusion

Just over 200 ICOs were launched in 2017 – a record at the time.

It only took three and a half months for 2018 to break that record, and while June has seen a sudden decline, the ICO market continues to boom.

The total amount of money being invested in ICOs is on the rise. However, with ICO saturation coming into effect it will be interesting to see how investors and the market reacts.