The massive carbon footprint left by the wild ride of cryptocurrencies is a point of debate doomsters love to hang on to. While the industry is taking small but significant steps towards reducing carbon emission, a new project has come forward with some unique value propositions that address global climate problems.

Inspired by Olympus DAO, Klima DAO has launched a carbon-backed digital currency and algorithmic climate protocol to tackle the illiquidity, opacity, and inefficiency in carbon markets. At the time of writing, the staking APY on the platform stands at 203989.2746%.

Klimates, we are live.

✅ KLIMA/BCT and BCT/USDC Sushiswap pools are deployed

✅ aKLIMA and alKLIMA redemptions are open

✅ IDO NFTs have been airdropped their KLIMAThank you for your patience. We will release a postmortem shortly.

— KlimaDAO (🌳,🌳) (@KlimaDAO) October 18, 2021

Let’s take a deep dive into how Klima DAO works, how you can earn rewards by staking and bonding on Klima DAO, and how the platform will be a game-changer in the low-carbon economy.

First, a little background

We must be one of the most blessed generations on Earth, thanks to the rapid industrialization and growth of technology. However, there is always a trade-off. The carbon emission from headlong development has begun to take a toll on the planet. That too, quite visibly.

So, should we give up the comforts and luxuries of the modern era for a greener, cleaner planet?

As idyllic as that sounds, the stake is huge as far as industries are concerned. They can’t just take their products out of the market. Or move to environmentally efficient production practices overnight. It takes time. Meanwhile, they can take actions to neutralize the negative environmental impacts of their activities. Carbon offsetting schemes help them do that.

In most countries, governments set a cap on the amount of carbon a company can emit based on carbon credits. Basically, it is a tradable permit that allows a company to emit a certain amount of carbon dioxide or other greenhouse gases. However, not all companies can meet their objectives. In these cases, they can purchase some from companies that have surplus credits. There are also voluntary carbon markets. Companies that are keen on maintaining their social and environmental responsibilities buy carbon offsets voluntarily. These supply and demand activities have given way to the creation of what is now called the carbon market.

There is a concern, though. Carbon offsets have become a license for companies to pollute. As long as the price of carbon offsets is lower than the cost of going green, companies are held back from taking actionable steps.

How to solve this dilemma?

Klima DAO proposes an excellent solution by driving the carbon offset market into a decentralized ecosystem.

What is Klima DAO

Similar to Olympus DAO, Klima DAO is a reserve-backed protocol. Here, instead of DAI and other generic crypto assets, verified carbon assets back the digital currency. This is a unique way of streaming capital to high-impact carbon sequestration and mitigation projects, bridging the gap between blockchain technology and traditional carbon offset markets. It is deployed on Polygon.

From the crypto perspective, Klima DAO has a monetary system and value accrual mechanism that closely resemble Olympus DAO, based on KLIMA tokens. It also serves as the governance token on the platform. In the long run, the token will mature into a sustainable asset and a medium of exchange with real value.

Related: What Is Olympus DAO (OHM) And Why Is It On A Gaining Spree

How does it work

Klima DAO is building a DeFi economy around carbon. The concept is simple. It incentivizes users to lock carbon assets within the treasury so that their supply in the traditional market is brought down. The result? A gradual increase in the price of carbon assets, and in turn, the cost of shelving green initiatives with direct, tangible results. In a nutshell, the growth of the Klima DAO economy will pave the way for the expedition of regenerative activities. A brilliant model that can potentially counter the whole ‘crypto is killing the planet’ narrative.

A quick look at the three tokens in the ecosystem will give us a better idea of how the protocol functions.

- TCT: Short for Tokenized Carbon Tonnes, TCT represents 1 tonne of carbon emissions expelled from the planet. It is backed by the retirement of a verified carbon unit from a validated and accepted third-party authority. It is an ERC-20 token.

- Base Carbon Tonnes (BCTs): The reserve asset on Klima DAO. It represents a basket of different tokenized carbon tonnes (TCTs) offsets. Regardless of the TCT accepted, BCT is the token for the base carbon pool.

- KLIMA: An ERC-20 token backed by a TCT locked in the Klima DAO treasury.

The intrinsic value of KLIMA is derived from the price of the carbon asset locked in the treasury. The protocol can mint a new KLIMA token only if users deposit at least 1 BCT and lock it away from the market. This drives the price of BCT over time. Since each BCT is backed by a carbon credit that guarantees the removal of 1 tonne of carbon, Klima DAO internalizes the cost of carbon. As demand for KLIMA increases, so will the demand for BCT, increasing the status quo of carbon markets. The supply of carbon offsets to the traditional carbon markets will go down, giving a perk to the prices.

Incentivization for long-term participation

DeFi has changed the way people source capital for a common cause. Unlike in the traditional systems where people wait for an unaccountable leader to initiate an action from the top-down, in decentralized ecosystems, the motive comes from within. The transparent, trustless nature of smart contracts fuels collaboration and innovation. Blockchain technology has become a foundation to pool funds, coordinate actions, and incentivize contributions without middlemen intervention.

Similarly, on Klima DAO, the community drives the platform and accrues value from its growth. This is enabled by staking and bonding.

Staking on Klima DAO

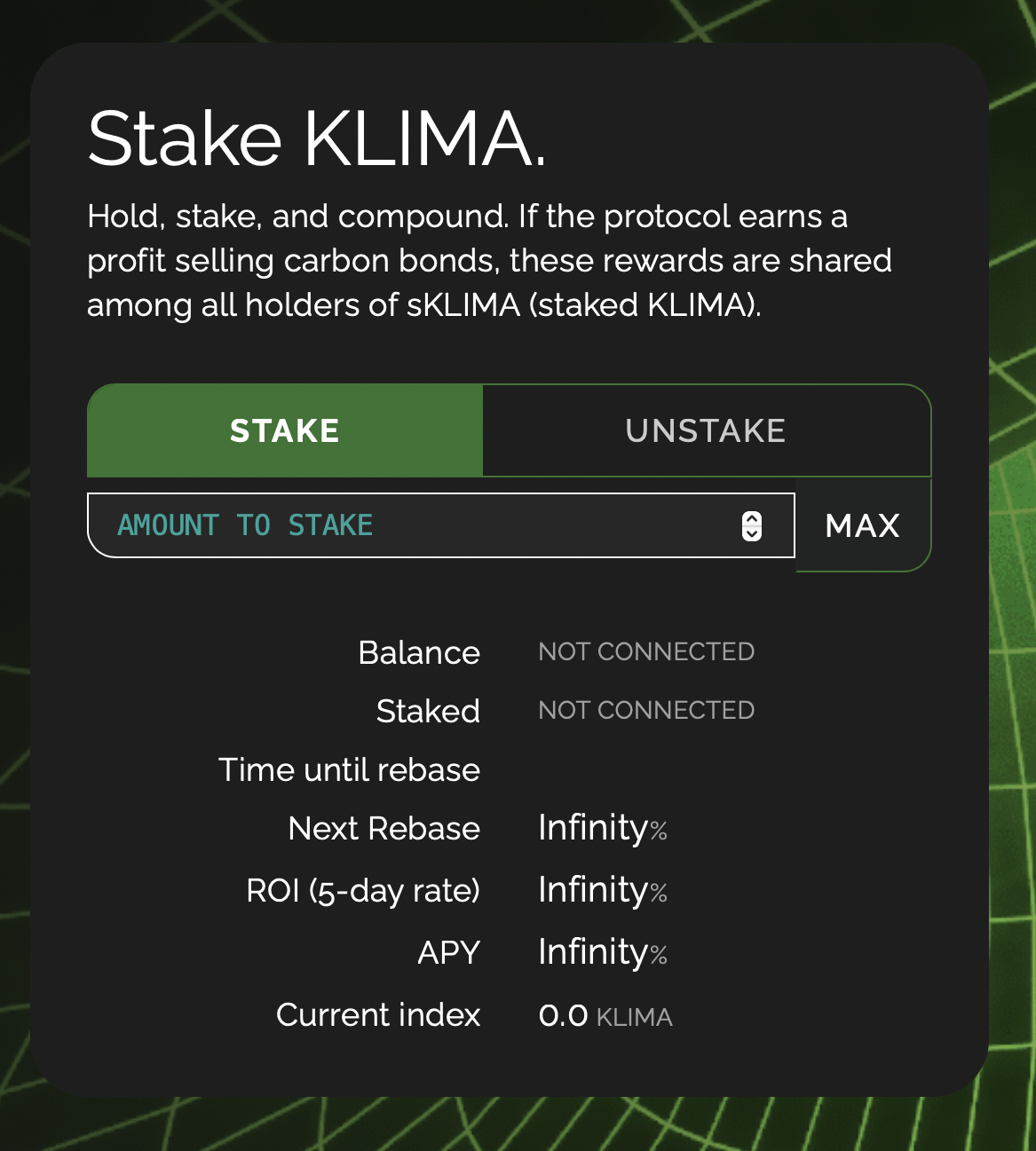

The best way to earn profits via Klima DAO is by participating in staking. That is, by locking up your KLIMA tokens for a long period of time in the contract. It is designed to incentivize holding. The rebasing mechanism on the platform allows the tokens to compound without any manual intervention. When staking, users get sKLIMA in return for each KLIMA sent to the contract. It is important to note that the transfer of sKLIMA is restricted. It is only to be used for holding.

The staking rewards are distributed from time to time in KLIMA tokens and compounded automatically. Over time, the number of KLIMA increases in proportion to sKLIMA in the account. The rebase corrects the difference. When unstaking, users are given KLIMA tokens in a 1:1 ratio for the sKLIMA tokens in the account.

KLIMA staking is a passive strategy, as it doesn’t require you to keep a keen watch on the market or employ your technical prowess. Olympus DAO has certainly made an impression in the crypto community with its profit accrual strategies. From the game theory standpoint, staking is the most beneficial action for Olympus DAO inspired protocols and participants. You must have come across the (3,3) meme on the internet often. Among those who have taken it up are celebrities like Grimes.

(3,3)

— 𝔊𝔯𝔦𝔪𝔢𝔰 (@Grimezsz) October 17, 2021

How to stake KLIMA tokens?

Klima DAO went live on Polygon mainnet on 18 Oct 21. If you already own KLIMA tokens, you can start staking on the platform. Click the STAKE button and input how many KLIMA tokens you would like to stake. In exchange, you will get sKLIMA coupons. You can click on the UNSTAKE button to redeem your tokens. However, the longer you hold the tokens, the higher the number of tokens you will earn.

Stakers have been experiencing a small glitch in the first few hours after the launch of the platform. However, the team is onto resolving it. If you are having trouble, check out this step-by-step guide to fix the bug. The first rebase is to be paid out to stakers 12 hours into the launch.

Related: How To Stake AXS Tokens On Axie Infinity: A Beginner’s Guide

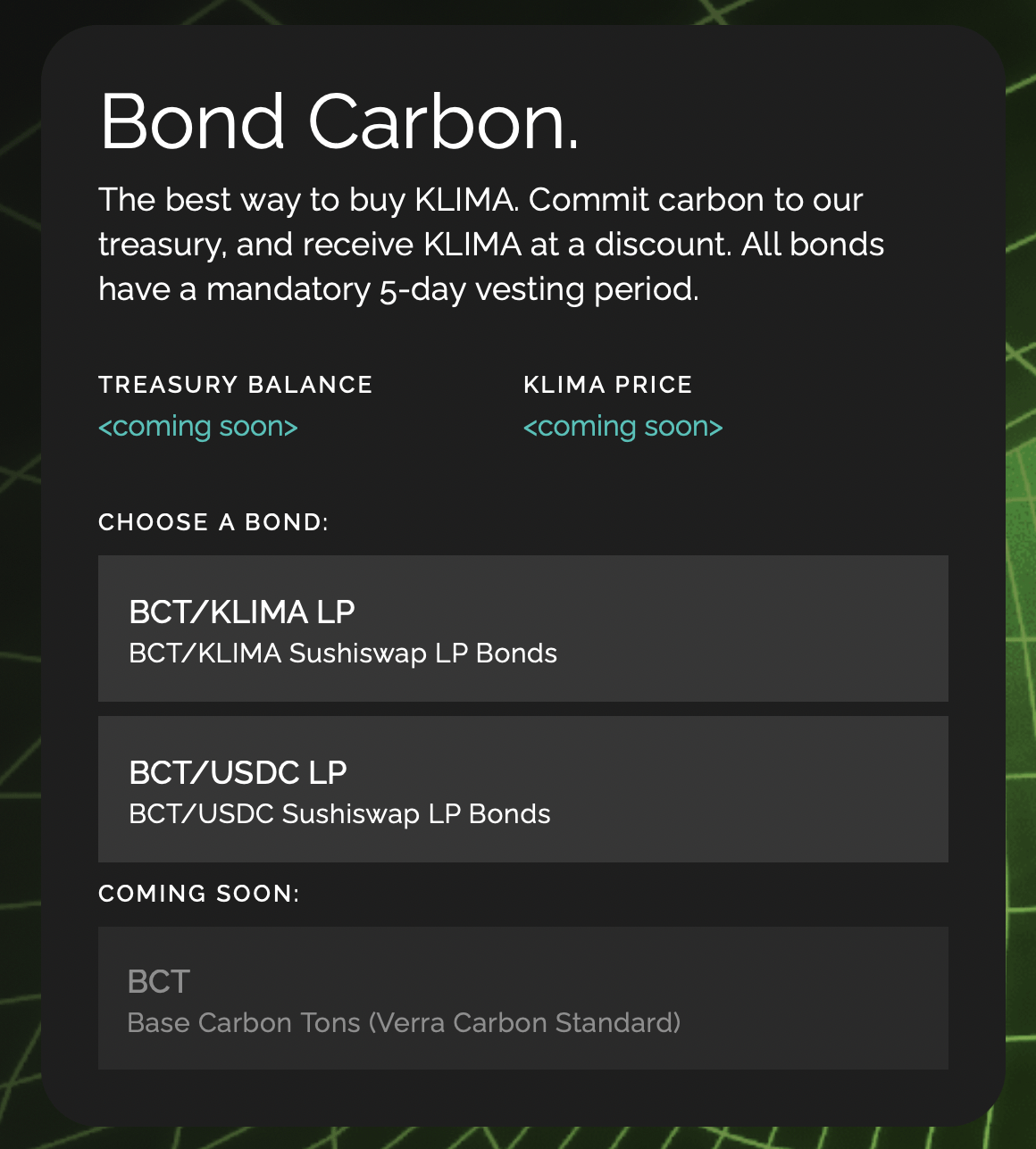

Bonding on Klima DAO

Bonding is how Klima DAO issues new KLIMA tokens to market participants. By depositing tokenized carbon tons to the bond contract, participants can get KLIMA at a discounted rate in a few days’ time. In addition to TCTs, the contract would also accept LP tokens. This is a strategic mechanism introduced by Olympus DAO that allows the project to bolster its treasury through over-collateralization. By accepting LP tokens along with BCTs for bonding, not only does the supply of KLIMA tokens increase, but also its purchasing power.

To bond carbon, you need LP tokens from BCT/USDC or BCT/KLIMA pools on Sushiswap. The vesting period is close to 5 days. While LP bonds are available 24 hours from the launch, naked BCT bonds will not be enabled until several weeks after launch.

What is aKLIMA

If you have been wondering what this aKLIMA listed on exchanges is and whether it comes from the project or is just a dupe, this should help you.

The initial circulating supply of KLIMA tokens is limited to just 250,000. This includes the tokens in the initial liquidity pools and tokens allocated during the Initial Discord Offering (IDO) and Liquidity Bootstrapping Pool (LBP).

During the IDO, the platform distributed NFTs from Sven Eberwein (custom-built for the platform) to participants. The NFT holders received 50 or 100 KLIMA tokens as deemed by the NFT after the launch. On the other hand, LBP participants were sent aKLIMA (or alphaKLIMA). aKLIMA tokens can be bridged to Polygon and exchanged with KLIMA at a 1:1 ratio. So yes, aKLIMA is from the project. However, they need to be turned into KLIMA before being used on the platform.

Is it a Ponzi game

Olympus DAO’s clever pricing mechanism and market dynamics have earned it a huge following in the crypto community. The market cap of the project also climbed to new highs owing to its high APYs. The rapid mass adoption of the OHM token has led many to doubt whether it is all part of a Ponzi game. It is no wonder Klima DAO faces the same question now. If the token is going to sell at a high premium compared to the intrinsic value, it could all tumble down over time. Isn’t that what the (3,3) meme signifies?

When asked about the same, the team replies:

“It may appear Ponzi on the outside, as stakers are perpetually rewarded. However, the staking rewards are not being generated from thin air. They are getting generated out of bonds. One KLIMA is worth one BC. The more people purchase bonds, you have this over-collateralization that kind of occurs. You have so many assets in the treasury that if everyone pulled out at the same time, they would still get a certain amount of money based on the Risk Free Value.”

Risk Free Value denotes the funds the treasury guarantees to use for backing KLIMA tokens in this case.

Related: OHM Market Cap Skyrockets 240.3% In A Month Without Hoo-Ha

What does the future look like

Despite being a reserve-backed currency protocol, Klima DAO is not aiming for a stable price anytime soon. That would come along the way, but the initial goal is to host the carbon market in a blockchain ecosystem — to give a platform for users to engage with the market, vote on what it should look like, and get a fair share of the profit generated. The protocol will be fine-tuned by token holders through policymaking as the market evolves.

While volatility and profitability will be inherent to the growth of the platform in the early years of development, the token is expected to strike a balance between supply and demand in the carbon market in two to three decades.

Coming to the environmental goals, the project hopes to reduce carbon emission with tight policies. Blockchain adoption is expected to increase liquidity and transparency in the carbon markets, while strategic incentivization opens up the market to more participants.

A new, regenerative monetary system is in the making.

How to buy KLIMA tokens

KLIMA and BCT tokens can be bought from KLIMA pools on Sushiswap. (KLIMA tokens can also be directly minted from Klima DAO through bonding.)

Klima DAO runs on Polygon. Users will need MATIC to interact with the protocol, instead of ETH. Since Polygon is a layer-2 chain, the fees on Klima DAO are expected to be considerably lower.

aKLIMA (from the Liquidity Strapping Pool) and alKLIMA (through Crucible rewards), are to be bridged to Polygon before using to get KLIMA tokens in exchange. This expels the primitives out of circulation.

Wrapping up

Klima DAO is an experimental project that ventures beyond the financial aspects of DeFi and blockchain technology. It taps into DeFi’s underlying role as a tool for global coordination and innovation. The project successfully addresses carbon emission and climate issues, which have for long been neglected by nations, institutions, and individuals alike for lack of coordination in pooling human and financial resources.

With a carbon-backed cryptocurrency, Klima DAO expects to deliver the change required. The ambitious goals and well-defined market dynamics have certainly made an impression in the crypto realm.

However, It still raises many questions.

What if the project backfires and disincentivizes voluntary carbon offsets due to rising prices? Or, is carbon offset even the answer to rapid climate changes? More importantly, are we ready to adopt the monetary policies and tools it puts forward?

Let’s look forward to how those discussions unfurl.

Disclaimer: NOT financial advice