As one would assume from the term, cryptocurrencies were initially meant to serve as crypto’currencies’.

But how many of us would dare pay for our groceries in BTC? Or, lend and borrow ETH?

The highly volatile nature of the market deems most cryptocurrencies unfeasible for day-to-day transactions. If crypto is to go mainstream, it should provide a stable foundation on which an economy can be built. This is the ambition that drives OlympusDAO.

So, let’s find out what OlympusDAO (OHM) is and how it matters.

What is OlympusDAO (OHM)

Simply put, OHM is a decentralized reserve currency that runs on the Olympus protocol backed by a basket of assets.

Okay, to decode, OHM is a first-of-its-kind token that was introduced as an alternative to both cryptocurrencies and stablecoins as they function today. Unlike stablecoins, the value of OHM is not pegged to another currency. It is backed by a reserve of currencies — unlike cryptocurrencies, which derive most of their value from speculation. This gives it an intrinsic value that it can’t fall below. It achieves stability while still maintaining a floating market-driven price. The unique economic and game-theoretic dynamics it brings to the market through staking and bonding is nothing less than revolutionary. (Although yet to be proven.)

With its knotty concepts and jargon, the project may come across as newfangled nonsense, but there is definitely more to it. And that explains the 335.2% rise in OHM market cap over the last 30 days alone.

How is OlympusDAO (OHM) relevant to the crypto market

Cryptocurrencies have little to no utility today as a medium for the exchange of value. They are used more as an investment asset owing to the huge volatility in the market.

So, how to leverage blockchain technology to build a currency, in its real sense?

Stablecoins proposed an excellent solution. These are cryptocurrencies that are pegged to some external reference. They are designed to maintain a fixed price, regardless of the fluctuation in token demand and supply. Some popular examples are USDT, USDC, and DAI. These coins are pegged to the value of the US dollar or close to it. With them, you can actually use cryptocurrencies to pay bills without worrying that the price may go through the roof overnight, and you just gave up a fortune.

However, if you look at it, the idea of dollarized stablecoins is ironic. They claim to be decentralized. But how can they be when their value is pegged to a centralized currency? In effect, they are just digitized dollars with fluctuating purchasing power. The relevance of OHM further comes to light if we analyze how the policies of the Federal Reserve, the US government, and the US economy influence the value of the dollar. To cite a recent example, the stimulation policies in the aftermath of the pandemic. They have brought down the purchasing power of the dollar.

This is a problem. It robs stablecoins of their decentralized essence. If the total market cap of the global crypto market cap is $2.37T, the total market cap of top stablecoins is above $100B. A shame, given that cryptocurrencies were designed to give centralized agencies a run for their money.

OlympusDAO (OHM) strikes a balance between stability and decentralization

Olympus aims to build a policy-controlled currency system. Instead of a centralized institution, here, the DAO decides the behavior of the OHM token for the most part. This way, it remains immune to the inflationary policies in the traditional economy.

Now that we know what is OlympusDAO, let’s take a better look at the three core features of OHM token and how they help it achieve a floating value while never letting it fall below the value of its backed assets.

1. Treasury

How to maintain price stability without pegging to a fiat currency? OHM realizes this through a treasury. The token is fully collateralized by a basket of crypto assets.

Initially, each OHM token was backed by 1 DAI in the treasury. Now the treasury has expanded to include other cryptocurrencies and LP tokens. There are also plans to include cryptocurrencies like BTC in the coming stages. Much like a central bank the treasury manages OHM using these reserve assets.

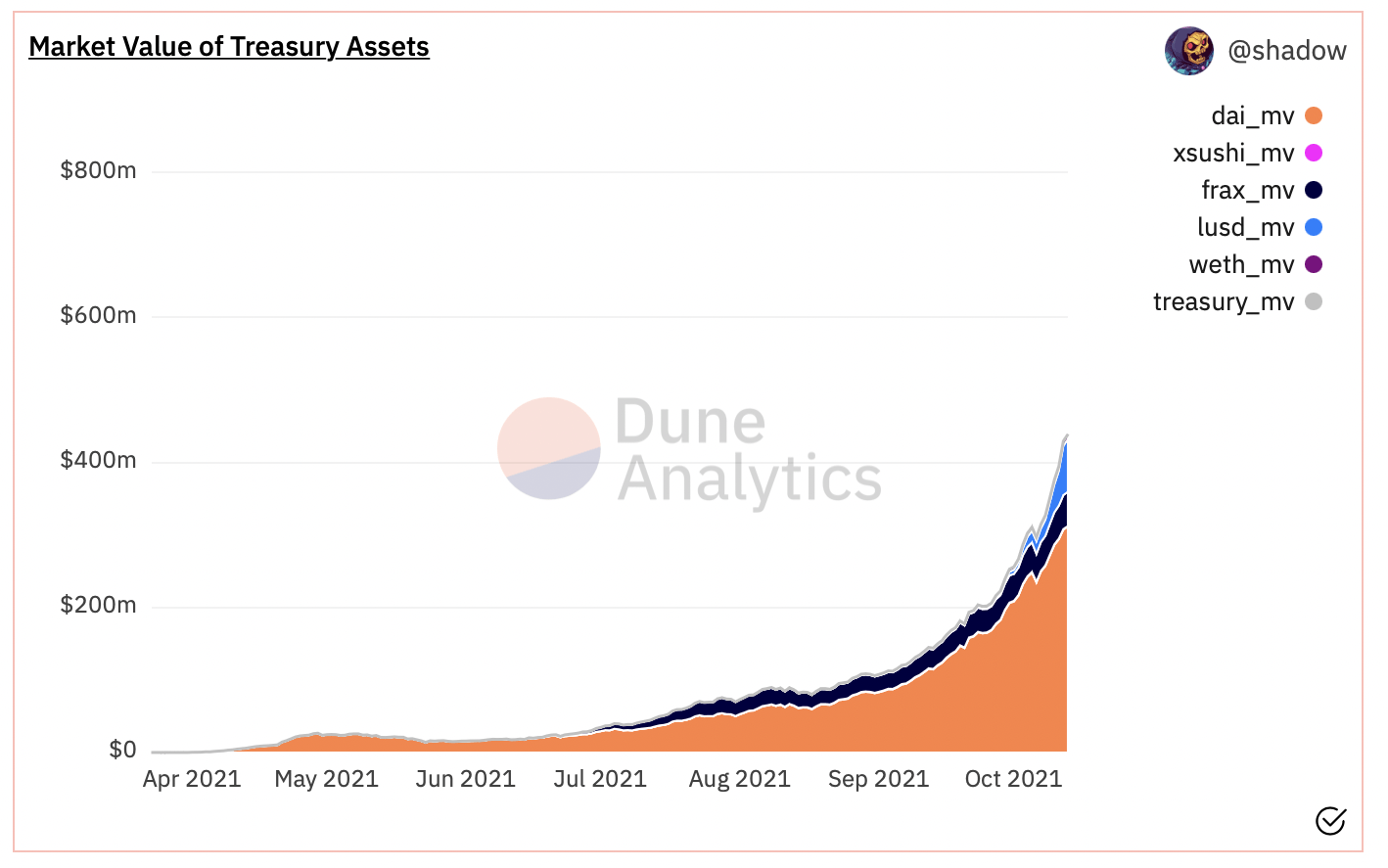

Currently, the market value of treasury assets stands at $434,561,976. The basket includes FRAX, LUSD, XSUSHI, DAI, and WETH.

2. Open market operations

OHM uses the Olympus protocol to influence its price. In most cases, to stabilize the price. If OHM price soars beyond what is backed by the assets, the protocol takes action. It mints and distributes new OHM to the market. In effect, increasing the circulating supply and bringing down the value of the token. On the other hand, if OHM price drops below what is backed by the treasury, the protocol buys OHM tokens from the market and burns them! This brings down the supply and gives a perk to the price.

This way, the algorithm helps maintain a desirable price for the OHM token, regardless of how the supply and demand fluctuate.

However, the protocol is not autocratic. It burns and mints tokens only if the market demands it. Also, the community makes the changes to the protocol through DAO. Not the team.

3. Free market price determination

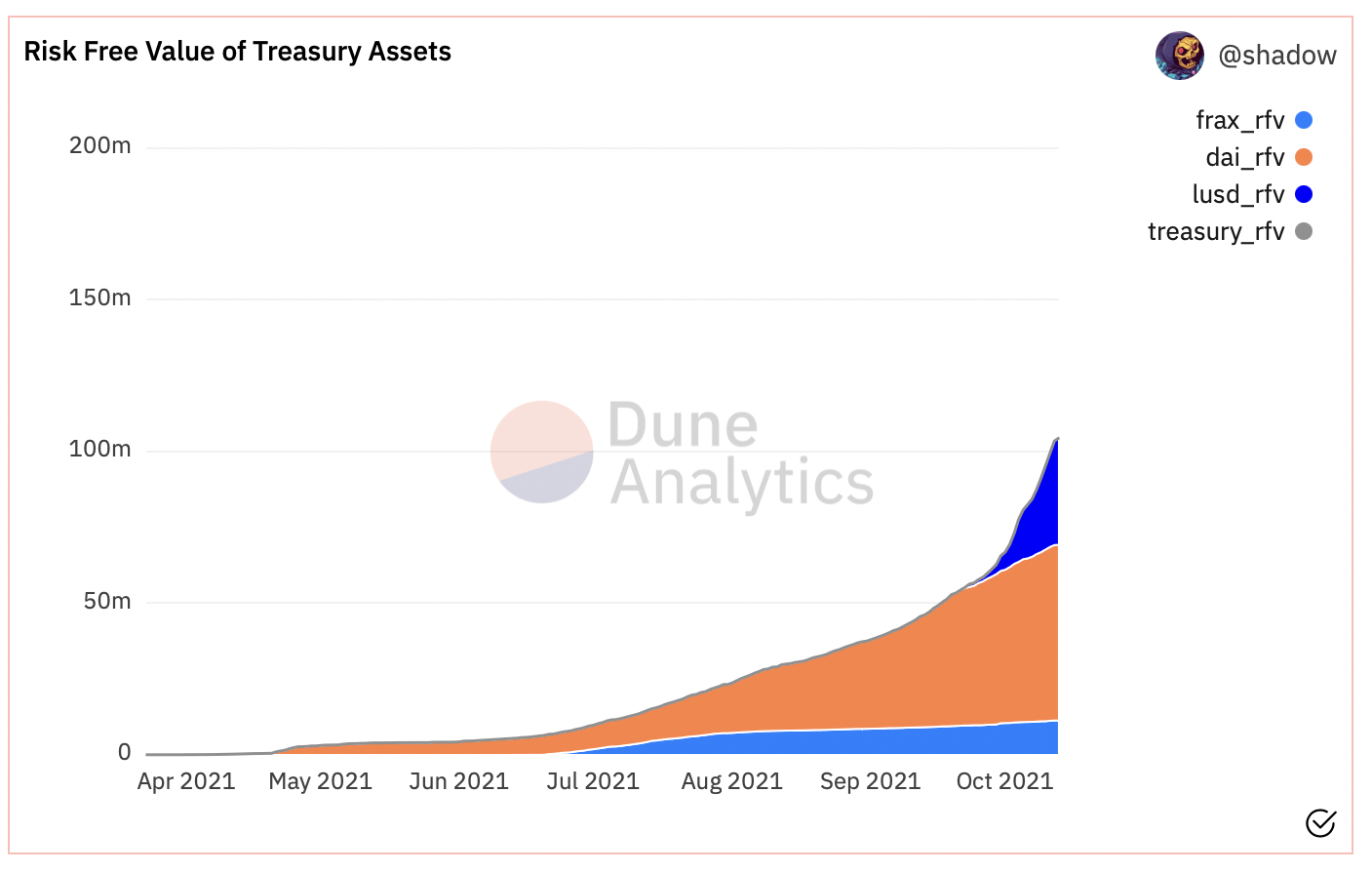

Olympus protocol comes to the rescue of OHM if the price falls or rises above a point, yes. However, the price of OHM token is determined by the free market. The supply and demand allow the price to float, similar to most cryptocurrencies. RFV represents the amount of funds the treasury guarantees to use for backing OHM.

Although OHM has a floor price and RFV, it sells at a premium in the market. This allows the protocol to increase the supply over time, dilute the market, and bring down the price again.

Value accrual strategies on OlympusDAO

During the launch, each OHM was worth close to $384. The price stands at $1231.96 now.

So, can we say OHM is stable?

OHM never claimed to be a stable coin. It aims to become an algorithmic reserve currency with a free-floating value that users can always fall back on. In the long run, this system will optimize for stability and consistency so that OHM can function as a global unit-of-account and medium-of-exchange currency. For the short term, it has its eyes on growth and wealth creation. This is realized through two value accrual strategies.

1. OlympusDAO (OHM) Staking

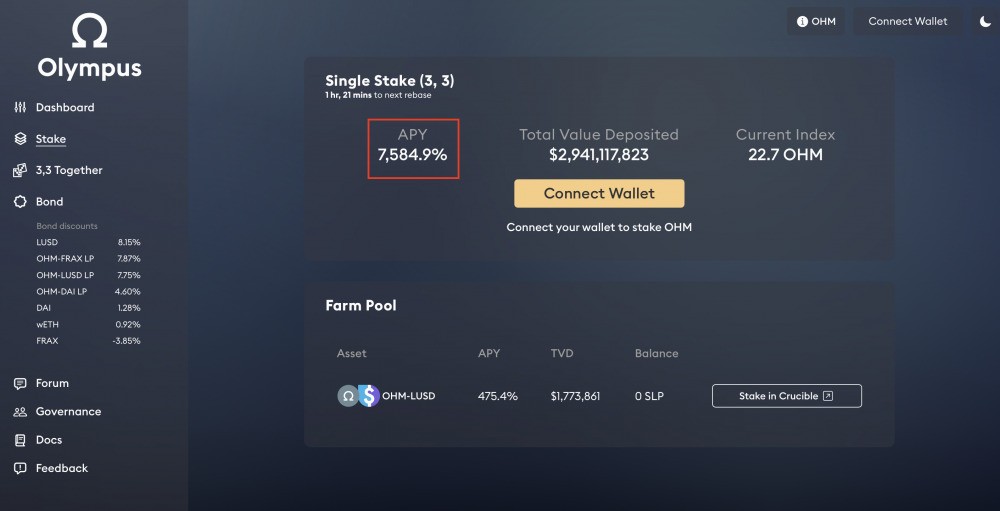

The primary way one can use OlympusDAO to make money is through OHM staking. Users don’t have to scout around for platforms to stake OHM, the website features staking with rebase rewards accrued from bond sales.

The staking rewards are prone to changes based on the number of OHM staked and the reward rate defined by the protocol’s monetary policy.

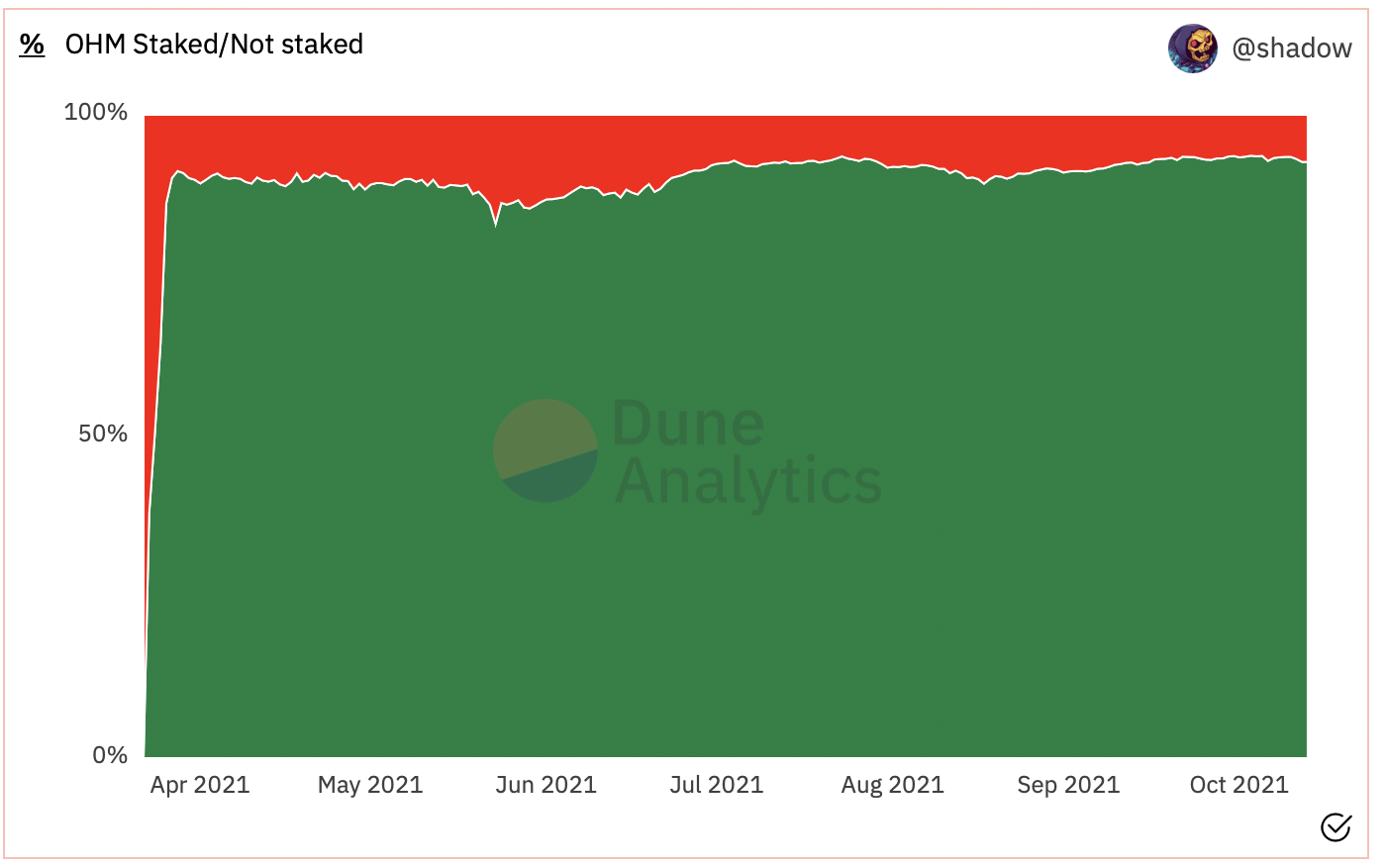

Staking is designed to lure, as the protocol depends on it to issue new OHM. This increases the total supply of the token while reducing market dilution. The huge returns promised by the protocol helps users hedge against unforeseen market volatility. Even if OHM goes below the price you bought it for, the rewards you accumulate over time is expected to mitigate the element of risk. Moreover, staking requires minimal management. It is the most profitable passive, long-term strategy for holding OHM.

The current APY on OHM staking is 7584.9%.

How does it work?

When you stake OHM, you get sOHM (a transferable token) at a 1:1 ratio. It rebases up automatically at the end of every epoch. And if you choose to unstake, an equal amount of sOHM tokens are burned. The rewards are distributed three times a day, although there could be slight variations. And yes, they are compounded every 8-ish hours, explaining the high APR.

As of now, over 92.7% of the OHM supply is staked, living up to the 3,3 call. But more on that later.

2. OlympusDAO (OHM) bonding

The secondary method to earn rewards on OlympusDAO, bonding, allows the protocol to acquire its own liquidity or POL along with other reserve assets.

POL stands short for Protocol Owned Liquidity and denotes the amount of LP owned and controlled by the treasury. More POL, the better, as it ensures that there is always locked exit liquidity in the trading pools. Assets accrued through bonding grow the RFV and expands the treasury, increasing the ability to mint new OHMs while paying high yields for stakers.

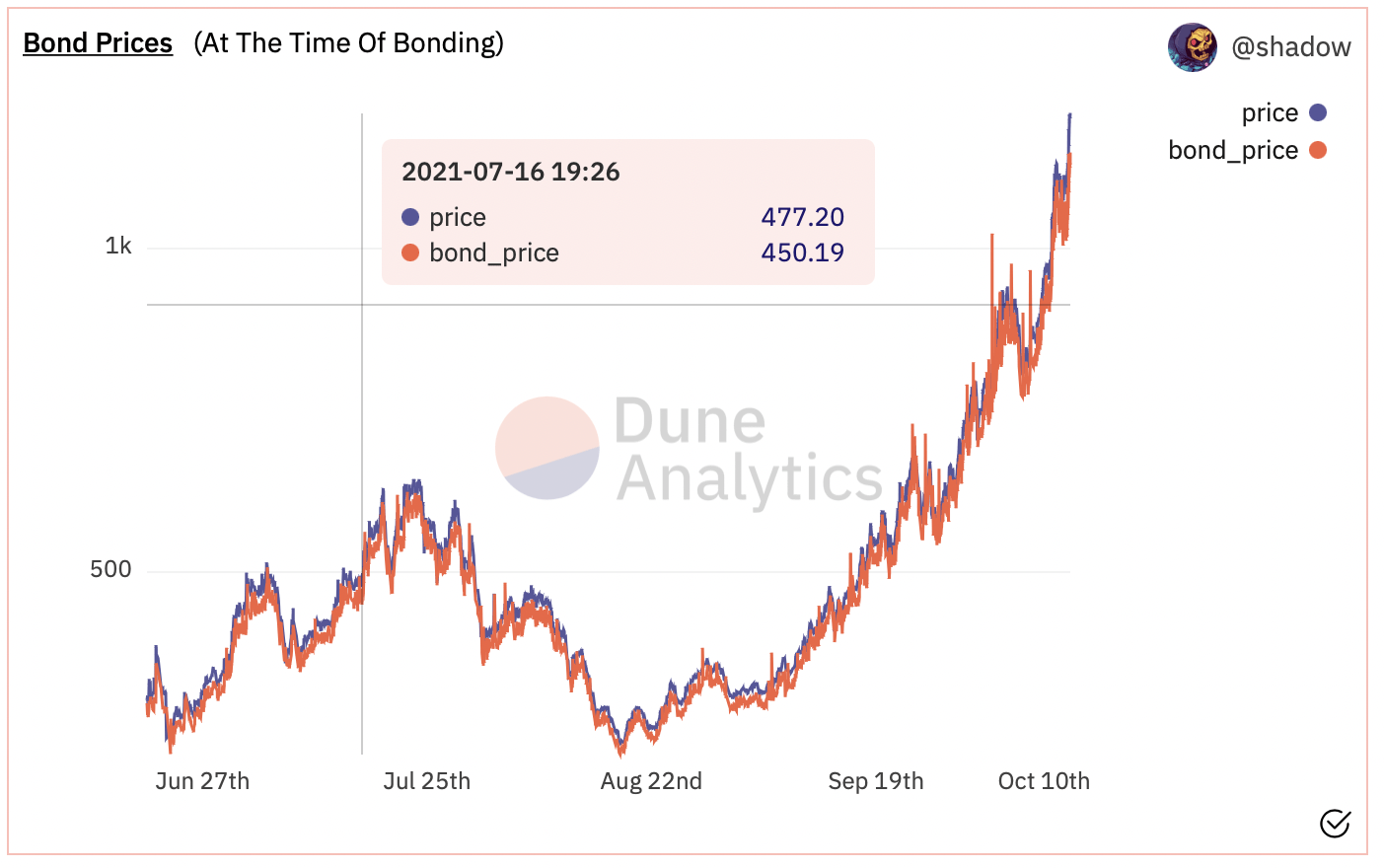

As far as users are concerned, bonding is an active, short-term strategy. It is recommended for seasoned investors as bond discounts are more or less unpredictable. One has to keep tabs on the prices closely to earn a significant profit from bonding.

How does it work?

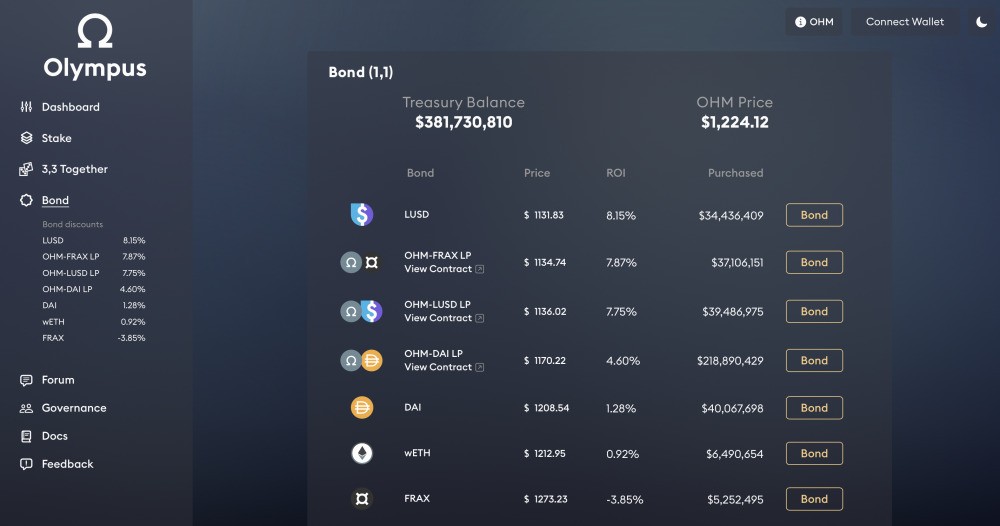

In bonding, you sell a listed asset to the protocol and you get discounted OHM by the end of the vesting period. Currently, bonding is offered on seven assets with dynamic ROI.

Rewards are claimable partially from time to time. The vesting period is close to 5 days, by the end of which the full amount can be withdrawn.

OHM game theory: (3,3) decoded

What is this (3,3) meme going around on the internet?

If you are feeling FOMO, we are here to help you out.

Economics is a science, as well as an art. It is not solely based on mathematics and facts, but also human behavior, which can’t be accurately defined by a set of equations. That is the reason why economic theories are developed based on behaviors. Economists study behaviors and devise mechanisms to incentivize or disincentivize them.

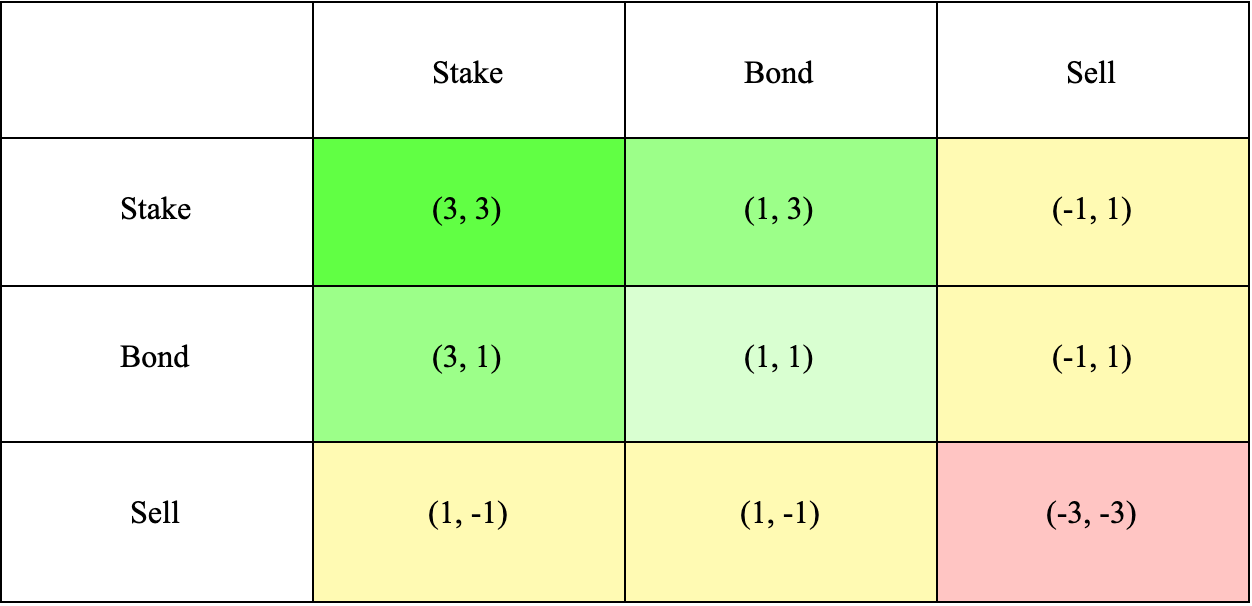

This is exactly what OlympusDAO has tried to do with the OHM game theory table.

There are three expected behaviors in the OHM economy — staking, bonding, and selling.

Staking: Considered the best behavior as it takes the token out of supply for a long period of time. This drives the price of the tokens. With high yields, it gives passive income for stakers too. A win-win situation for both the token and holders. Staking has 2 points.

Bonding: Considered good behavior. This is how the treasury accumulates liquidity. But then again, it doesn’t drive the price of OHM, but rather increases the number of tokens in the market. Bonding has 1 point.

Selling: This is bad. Selling OHM tokens not only brings down its price, but also triggers a bearish trend in the market. Selling has -2 points.

The table lists out how all possible actions of two players can affect the protocol.

For example, if you and I stake, it serves the best results for both of us and the protocol. On the other hand, if I stake and you bond, it’s not bad. I take OHM out of the market and you provide liquidity to the treasury. However, if I sell when the price seems right, it takes a toll on your efforts and the protocol. And if both of us sell, it creates a downward trend in the market. This is bad — for you, me, and the protocol.

OHM (3,3) Together

Olympus recently announced the launch of 3,3 Together.

3,3 Together has launched!

Deposit your $sOHM for a chance to win the rebases of all participants after 3 days.

Join us & @PoolTogether_ for our 3,3 Together AMA Sat. Oct. 9th @ 6:00PM EST | 10:00PM UTC in the Olympus Discord. https://t.co/tBvYF6Sjf6https://t.co/oYhqYv1u0g pic.twitter.com/93RC2VpCx6

— OlympusDAO (@OlympusDAO) October 8, 2021

Partnering with PoolTogether, a decentralized and open-source blockchain-based prize savings account, Olympus will offer sOHM depositors a chance to win prizes without losing their deposited funds. Since the prize pool is made of interest that accrues on all deposited funds, the risk is mitigated. As long as the protocol operates as planned, there is no chance of losing the money. In fact, no depositor has lost money on PoolTogether in the 2 years of operation.

However, there is always room for hidden perils. So, do your research before depositing your money.

The chances of winning depend on the amount deposited. There is a 24-hour cool-down period before users can check and claim their prizes.

OHM vs BTC

OlympusDAO has no plans to compete with stablecoins like USDC or USDT or DAI. Instead, OHM token is aiming to be a stable alternative to bitcoin. Like the way Satoshi Nakamoto envisioned.

But the question pertains. How can OHM be used as currency when its price is so high? To penetrate the mainstream market, the value of a currency has to be close to 1 or 2 dollars. In the present circumstances, if we were to use OHM for payments, we will have to quote in decimals. Will OHM introduce new units for mass adoption?

“Similar to the dollar, the decrease in value of OHM will occur over time. The dollar was once worth a hundred plus times what it is today. Over the course of the last 100 years, it depreciated as the USD network has grown. I would expect a similar kind of dynamics in the OHM economy. As the network gains value, the token value will reduce. One dollar is the floor point. That will be hit when there is no more growth to be had on the network,” says OlympusDAO founder, who identifies himself as Zeus.

Utility and partnerships

Olympus was launched back in April 2021. With a market cap of $3,248,155,205, OHM ranks 52 among cryptocurrencies. It has managed to win the trust of the market despite the novelty and complexity of the economy. Along the way, it has joined forces with some top projects in the industry including SushiSwap, FRAX, LUSD, Rari Capital and more.

Olympus recently launched Olympus Pro, a service for protocols looking to utilize bonds in their emissions programs with low overhead and maximum impact. The program provides partners with infrastructure, expertise, and exposure as long as they bring a token and an objective.

OHM is the governance token on OlympusDAO. It stimulates the community and binds together the interests of all participants in the ecosystem. The team is working on adding more integrations and utilities to the token. It will be interesting to see how OHM serves money markets with its gripping price mechanism.

Should I buy OHM tokens

That depends on how you plan to use the token. Are you in for the long-term or the short-term? Are you a keen follower of the market, or just looking for a passive source of income?

If you are planning to hold, staking is a great option as it offers compounded rewards. If you are an experienced investor with time to spare, you can try bonding.

But then again, do you believe in the monetary experiment introduced by OlympusDAO?

You have your answer.

Wrapping up

OlympusDAO has a revolutionary pricing mechanism and incentive system that claims to eventually bring real utility to cryptocurrencies without relying on centralized institutions.

DeFi is an experimental realm. Out of a hundred projects deployed, only a few succeed. But it’s hard not to pay attention to some. OlympusDAO falls under that category. Whether OHM lives up to its promises or not, it has managed to turn heads for all the right reasons.

Disclaimer: NOT financial advice