Important Dates: Token sale to be held in December/January. Exact dates TBD.

Number of Tokens: 21 Billion

Cap: $22 million

Token Type: Temporary ERC-20 Token prior to mainnet launch

Whitepaper: https://docs.zilliqa.com/whitepaper.pdf

What is Zilliqa?

Zilliqa is a new blockchain platform (e.g. similar to Ethereum) that is designed to securely scale in an open, permissionless distributed network. The core feature that makes Zilliqa scalable is sharding – the division of the network into several smaller component networks capable of processing transactions in parallel. As a result, the transaction rate in Zilliqa increases as the mining network expands. Zilliqa aims to rival traditional centralized payment methods such as VISA and MasterCard. In fact, with a network size of 10,000 nodes, Zilliqa will enable a throughput which matches the average transaction rate of VISA and MasterCard with the advantage of much lower fees for the merchants.

What is the problem Zilliqa wants to solve?

Current DApp platforms are not able to cope with a large amount of transactions. The most successful currently platform is Ethereum and its transaction capacity is quite poor. The popularity of CryptoKitties and subsequent network congestion only reinforces these points. If just one popular DApp can congest a network, how can start ups hope to build applications on top that have significant transaction volume? They will need a platform that DApps can built upon that has a high transaction throughput.

What is Sharding?

Sharding is described in the whitepaper as the below:

Zilliqa dynamically splits the network of blockchain nodes into different subgroups, called shards, with each shard formed to process and reach consensus on a subset of transactions. This way, disjoint subsets of transactions can be processed in parallel, and significantly boost the transaction throughput by orders of magnitude. Eventually, such transactions are merged into a new block that is committed to the blockchain.

What is Zilliqa’s Business Plan?

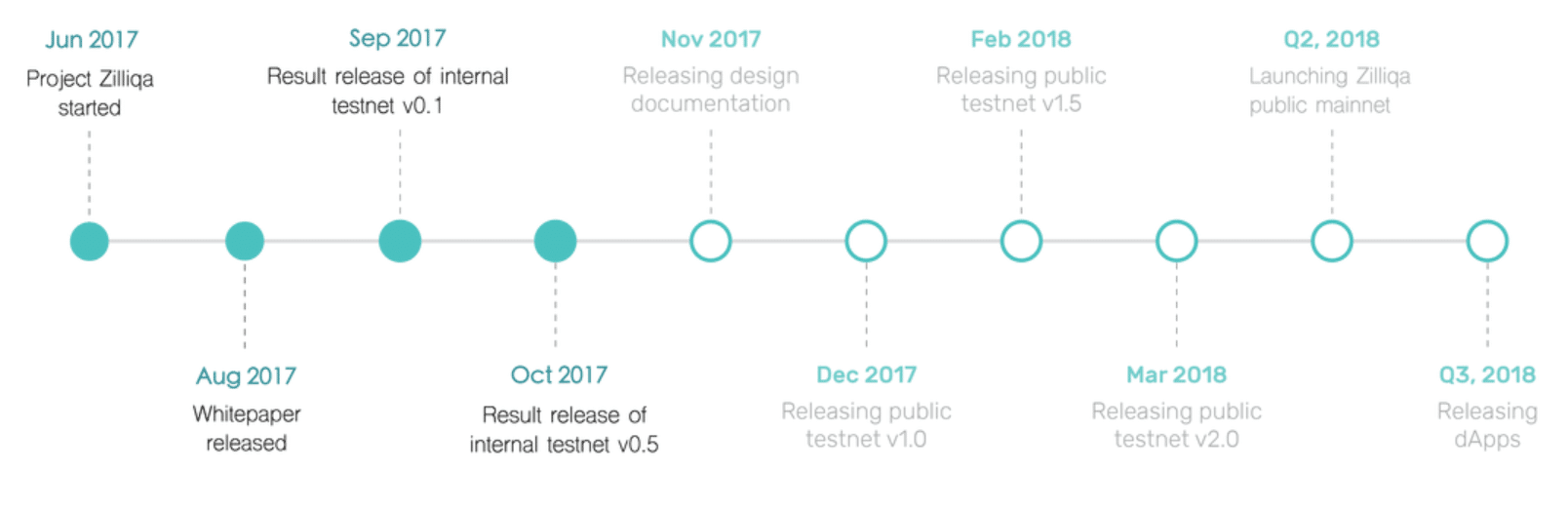

Business plans are not the strong suit of most ICOs, but most ICOs at least have a bit of information about how they intend to make money. I was unable to find anything about how Zilliqa intends to monetize its platform. They do have a road map that lists technical milestones.

ICO

Zilliqa has so much hype that they closed the whitelist to new investors in late November. Only people who were members of their Telegram channel or Slack prior to that date are able to participate in the ICO.

Token Utility

The ZIL token is used much as the same way Ether is used – which is to pay for transactions on the network.

The Team

The team is based in Singapore and is academically inclined, with plenty of PhDs represented.

The CEO, Xinshu Dong seems to have been working at the National University of Singapore until July when he joined the project full time. While I’m certain he has great technical skills, He has very little other work experience that suggests he is the best choice to lead a start-up.

Hype

Zilliqa has 4471 people in its Telegram channel. I lurk in a few slack groups that discuss ICOs and Zilliqa was heavily shilled in these groups. This kind of community interest is a great way to measure a project’s hype factor.

Competition

The platform space is becoming ever more competitive as time goes on. I have chosen a couple platforms to discuss that are competition to Zilliqa’s own platform.

Ethereum:

The Ethereum platform is definitely the most-used platform for DApps. However, network congestion is a persistent issue. In the summer, the network became congested during ICOs. The Metropolis upgrade in October helped relieve congestion somewhat, but Cryptokitties further demonstrated that the Ethereum blockchain needs a massive upgrade in order to be scalable.

NEO:

The Neo platform was developed in China. While not as popular as Ethereum, there are a number of DApps built on the platform and more in development. Unlike Ethereum, there have been no serious congestion issues. Unlike Ethereum, there are two native tokens on the blockchain, the NEO token, which is for Proof of Stake network security and GAS tokens, which are used to pay for transactions.

Risks

Competition: There are a number of projects that have already ICOed that promise to deliver fundamentally the same product as Zilliqa (e.g. Cardano, Eos).

Business Planning: There is no evidence that the Zilliqa team has made any attempt to market or plan how they will attract DApps to their platform. Zilliqa’s technology could be the best in the world, but without effective marketing and business planning, no one will know.

Fundamental Indicators

Concept: 5

The Zilliqa concept is good and sorely needed in the blockchain space. The first DApp platform that can process transactions effectively is like to have lots of interest from developers and start-ups that want to build blockchain applications.

Token Utility: 4

There is nothing particularly innovative about the ZIL token. However it is an integral part of the Zilliqa blockchain and the project would not work without it.

Status: 3

The team has been working on their platform for some time and already have a version in testing. This is good progress, but there is still sometime until mainnet launch in Q3 2018.

Team: 3

The team is very strong from an educational and technical background. Five of the ten team members have PhDs and education is prominently displayed on the website. This kind of team is great for designing a technical product, but maybe not so great for the business side of things.

Competition: 2

There is significant competition from existing DApp platforms in addition to those that will be released soon. Many of these have already launched or are further along in development than Zilliqa. While Zilliqa’s sharding technology offers a competitive advantage, other platforms are also working on improving scalability. This means that Zilliqa’s advantages may be moot by the time its mainnet goes live.

Strategy: 1

Zilliqa has not provided any detail about the business side of their project. The only information provided is a small note on their blog about how they will use $3 million from the ICO to fund ‘marketing & business’ development. This is wholly inadequate and should give pause to investors. Projects should provide more information about how they intend to monetize their product.

Technical Indicators

Market Cap: 4

Zilliqa has a low market cap of $23 million. This is a reasonable amount for a token sale and makes it more likely that investors can profit.

Hype: 5

There was such strong interest in Zilliqa that they have already closed the whitelist and will sell out prior to a proper crowdsale. Demand is much stronger than supply.

Investment Horizon

Short Term: There is great short term investment, primarily due to high hype. When token sales sell out in the pre-sale, there is certainly excess demand that can only be met on the secondary market.

Long Term: The longer term prospects are not as good due to strong to competition and other projects that have a head start. However, if Zilliqa is able to delvier its promise of being the DApp platform with the highest throughput, it could become the next Ethereum.

Conclusion:

Zilliqa looks like a sure fire short term investment but has cloudier longer term prospects. Nevertheless, a blockchain that can scale to accommodate thousands of transactions a second is needed, and at least one blockchain will succeed and lead the market in the future. It could be Zilliqa.

Overall Score: 3.8