The 2017 ICO market opened opportunities for a very wide audience to get in the position of investor or day trader. That happened due to its cheaper accessibility. As stock day trading requires at least $30,000 to start, some crypto traders have taken advantage of this opportunity with as little as $1,000.

The hype generated by crypto and the massive influx of ICO investors have made many people rich very fast. According to CoinSchedule, the beginning of 2018 featured lots of successful ICOs that raised decent sums of money:

At the same time, even more investors have lost their money: some because of the high scam level, and some because their ICO tokens were never listed on exchanges, so now they are stuck with non-liquid crypto-assets.

Let’s investigate how to make a profit by becoming a crypto investor with Simon Cocking, a successful influencer in the world of crypto! He will share with us his extensive experience and help our readers improve their investments in 2018 to generate more profits and more liquid assets in their portfolios.

Interviewer: Simon, there are lots of unconfirmed rumors surrounding an anonymous person — Satoshi Nakamoto. Who do you personally think he is?

Simon: That’s quite an interesting and tricky question. When chatting with Bobby Lee last week, I got to know that he was pretty sure Satoshi is a collective of three people. I was taught by Michael Clear, the Irish PhD crypto student who was also named as a potential Satoshi. He is definitely smart enough to play such a role, but at the same time, he seemed very modest and keen to quash those kinds of rumors.

So, maybe I have met Satoshi, but it is not easy to find out the truth! Personally, I think the guys behind Bitcoin have played it the right way. And the point of interest should be not who is Satoshi? but that their team has launched a global transformative technology.

What do you think the most efficient decision for crypto investors was in 2017 for making a profit as a crypto stakeholder?

The smartest decision was to buy an equal amount of all top 30 (or even 100) currencies at the beginning of January. This move would certainly have made you a very rich person by the end of 2017!

And on the other hand, in order to protect our readers from crucial mistakes, what was the worst decision for crypto investors in 2017?

All of us observed the rapid “rise and fall” period of Bitcoin and Ethereum. Bitcoin reached over $20,000 USD and then the price quickly lowered to $5–7,000 USD, while the Ethereum price was almost $1,500 USD.

So, the worst mistake, I suppose, was to panic and sell off these currencies. There is a lot of sense in holding crypto — you will never get a profit if you sell currency at low and falling prices.

There is also one important thing to remember before investing — you must do proper research about future liquidity in order to avoid price fluctuations. The main factors to pay attention to are:

- token utility: which problems does a particular token solve?

- exchange acceptance

- acceptance by various networks

- cryptocurrency regulations

Simon, let’s talk about how you managed to reach success. What has played the most important role in your crypto adventure so far?

It has definitely been the ability to apply all the lessons I have learned from managing businesses in my previous 30 years of work.

In addition to this, dealing with people is also a key issue in reaching success. It is important to treat other people as you would like to be treated. I have always tried to trust people until proven otherwise. Strategically, this requires allocating small amounts of trust at a time, so that no one takes you for a ride.

In my experience, there are a lot of trustworthy people to do business with, and the scammers and crooks are in the minority.

Let’s be honest. If we could get back in time — could you list at least three things with regard to crypto and blockchain that you would never do again?

Hmm, a rather difficult question. Let me think. I feel we are in such a ‘new’ place, with an immature and volatile market, that we are all learning fast.

Therefore, it is all about how we accept things happening around us. I don’t consider my past decisions as ‘mistakes,’ but as necessary elements in helping me acquire the wisdom and insights I now have.

Good business sense is a learned skill, built up by experience; therefore, there is no point in lamenting what you did or didn’t do twelve months ago.

We live in a fast-moving world, and we are all making the best possible decisions that we can with the knowledge and information that we have NOW! Hindsight is always 20/20, but that is not the most relevant aspect when it comes to making decisions in real time.

The crypto world is a very crowded place, and it’s becoming more overpopulated by ICOs daily. What are the market opportunities that still haven’t been taken advantage of by ICOs and investors?

Sure, ICOs are penetrating almost every industry nowadays. The cryptocurrency total market cap is over $300 million USD, and at the beginning of 2018, more than 400 ICOs were launched. But some of them are of no use.

As for market opportunities, I can affirm that the most advantageous ones are those which require the measurement of microtransactions, and can be improved by the use of blockchain-related technologies.

By all means, it is important to remember that not every business or startup needs blockchain implementation, or is made better by tokenization.

Our readers are interested in ICOs in terms of regulations. Everyone is talking about regulations, but we hardly know if all blockchain projects need them. Can you share your point of view, please?

My advice is: regulations are vital, necessary, and really important.

They will bring a better experience for users, help protect investors, and root out scammers. It’s still an immature environment, and regulation is worth implementing. If there are no regulations for ICO projects, all investors will not be protected from hackers, scammers, and fraud. Anyone who says otherwise should be very carefully evaluated.

In addition to regulations, what kinds of mechanisms or infrastructures is the crypto market missing today?

It would be good if more people owned less Bitcoin and other cryptocurrencies. Current market manipulation is still a problem.

All investors want to be sure of token liquidation opportunities, which are very useful if you want to avoid rapid price changes. Mostly, they have to wait before tokens are listed on exchanges in order to trade them. However, there are platforms like Bdaq, which solve the problem of low token liquidity and give investors the opportunity to trade their digital assets immediately without losing profit.

What about American investors? There seems to be enough smart money in America: many VCs, angel investors, family offices, etc. Looks like all those interested organizations could influence the SEC to speed up the regulation process and get the opportunity of investing in ICOs and cryptocurrencies openly. What is the current obstacle for this?

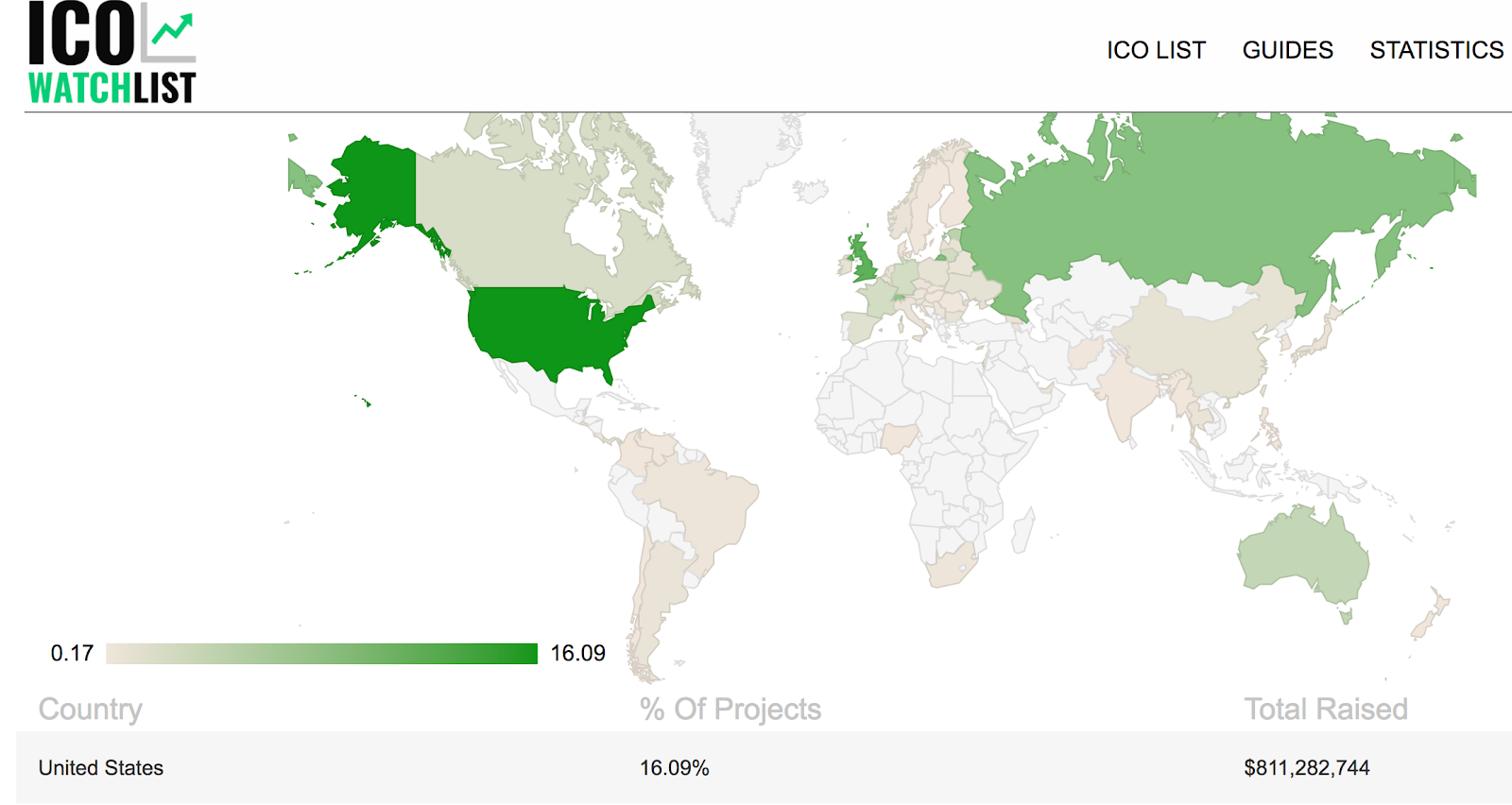

U.S. investors are gaining majority among other countries (16%).

This is why regulation is a good thing, and so are the activities of the SEC — which will help bring greater clarity and understanding about what is (and is not) legitimate. This is a fast-changing area, and even by Q4 of this year and into 2019, we should start to have a clearer roadmap of what tokens are, and how they can be used. All of this will bring more and more investment from traditional investors, as crypto becomes de-risked.

What is your forecast about the future of the investment market? Are crypto funds the ones that are going to take over and leave traditional VCs behind? Or this is just a temporary thing?

In my opinion, traditional investment will move into this area. They are already doing so, and the rest are planning to, as well. We know this for sure because they are contacting us and asking for our advice!

One last question. What to do with non-liquid, locked tokens that have never been listed on exchanges? Are there some potential ways to avoid such situations?

Unfortunately, there is nothing much you can do with it today. And that is a big problem, because investors now are experiencing additional risks that keep them away from backing promising ICOs. Most of these investors still hope to get some liquidity for their non-listed tokens. So this all generates additional stress for the entire market.

Consider this the exact reason why I am keeping a close eye on Bdaq. The team is building a decentralized exchange platform in which any token can be bought and sold, even if it is not listed on an exchange. There is a matchmaking mechanism for connecting perfect crypto investors with perfect tokens. There is lots of good stuff out there, and a mechanism like this could change the market.

I hope to see Bdaq eventually become the exchange with the highest trading volume in the crypto world.

This gets pretty clear once you look into the product and the team. Just have a look at the timeline and the technical side of the white paper here:www.bdaq.io or in their telegram: https://t.me/bdaq_io

I really hope this is a market-changer, as we all need Bdaq.

Let’s express our gratitude to Simon Cocking, professional crypto advisor and enthusiast, for sharing his insights on how to become rich and successful through crypto investing in 2018.

You can read the original article here on medium.com.