Important dates: March 2018 (exact date TBD)

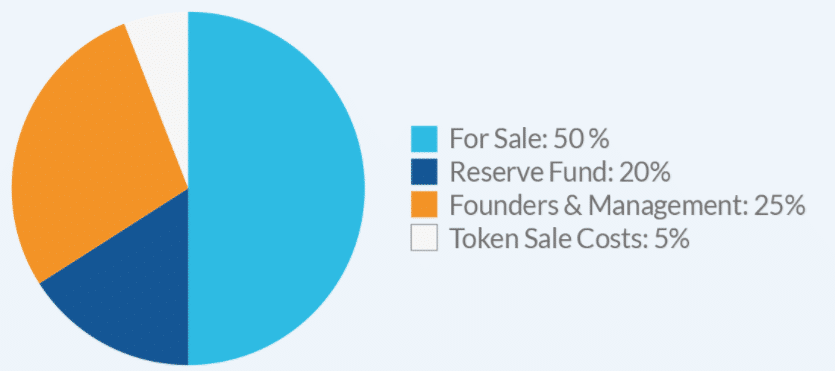

Number of tokens: 20 million – 10 million to be sold in the ICO

Cap: $8 million

Token type: ERC-20 token built on the Ethereum blockchain

Token ticker: CHX

What is Chainium?

Chainium allows business owners to sell equity in their business in return for capital from investors. Businesses can use the Chainium platform to issue equity shares based on the blockchain and investors can use Chainium to buy these shares.

What is the problem Chainium wants to solve?

Raising capital through equity in the traditional way is a complicated and costly process. Running an IPO takes months of planning, multiple engagements with advisers, negotiations with banks and law firms to gain regulatory approval, and pitches to attract institutional investors. The process takes a minimum of twelve months, attracts hefty fees, and the end result is uncertain. With Chainium, raising capital becomes simpler and removes all of the intermediaries. This makes capital-raising faster, simpler and cheaper for everyone involved.

What is Chainium’s business plan?

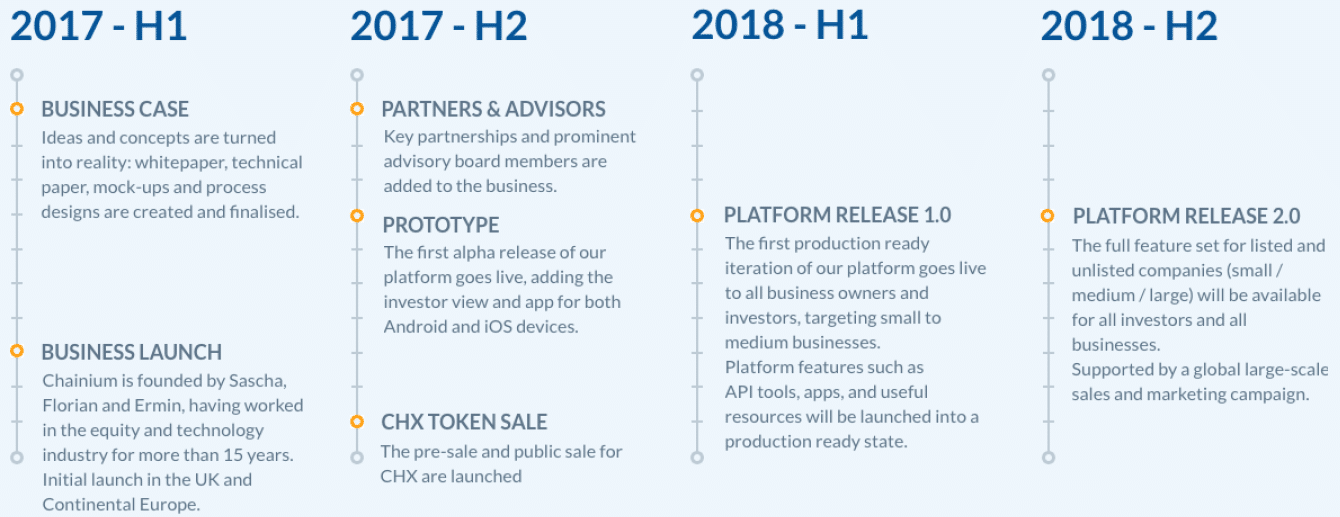

Many ICOs have now started to write two white papers: a technical and a business version. In the early days of ICOs, it was usually just the technical paper that was published. This is a refreshing trend that Chainium is a part of and makes it much easier to evaluate projects. Chainium’s business plan is well-thought-out and detailed. As seen from the road map below, the platform is set to release in the next few months.

ICO

Chainium’s ICO plans to raise $8 million and will be held at some point in March. $1 million will be allocated to a pre-sale and the rest to a public crowdsale. Tokens allocated to the team will vest over a 24-month period.

Token utility

The CHX token is used by businesses that want to issue shares using the Chainium platform. In order to issue shares, a business must buy CHX tokens and stake them for the life of the shares. These tokens will remain locked. This staking mechanism will reduce the quantity of CHX shares available on the open market. Fees for the platform may also be paid using CHX tokens.

The team

The team is based in Liechtenstein and looks good overall. The CEO is Sascha Ragtschaa, who has extensive experience working in technology for large companies. The rest of the team looks good too, with a strong technology experience.

The white paper points out that the advisers to the project are incentivized via equity, and will not be granted any tokens. This is refreshing as it means that there won’t be an adviser token dump after exchange listings.

Hype

Chainium has 1,749 people in its Telegram channel, which is quite low. Sentiment for the project is still quite positive, with favorable social media mentions far outweighing negatives.

Competition

The white paper has a detailed section that outlines existing crypto projects and compares them to Chainium.

Asset tokenization: the white paper asserts that existing platforms such as LAToken are not working within regulations and are thus risky. Chainium would apply for a banking license.

Equities clearing and settlements: projects such as Chain and T0 are trying to tackle inefficiencies within the existing system, but Chainium plans to look at more than just the clearing and settlement system.

P2P lending: projects like Salt and Ethlend are providing loans based on crypto collateral, but unlike Chainium they are not helping companies sell equity.

Risks

Competition: while Chainium has made a compelling argument for how it stands out in a sea of competitors, they still have traditional investment banks to deal with, as well as blockchain startups.

Marketing: it will be challenging to attract businesses to list their shares using Chainium. It is an unproven product, a new concept, and a new technology to most. It will take some great connections and time to develop a significant user base.

Investment Horizon

Short term: the market cap of Chainium is very small (only $8 million) which gives tokens plenty of upside.

Long term: the long-term potential of Chainium is excellent. The staking mechanism will gradually remove tokens from the open market. The more Chainium is used, the fewer tokens will be available, thus making the token price appreciate.

Conclusion

Chainium is strong project with a good idea, sound token metrics, and a strong team. Its distinct idea makes it stand out in a crowded field of blockchain projects and makes it a strong contender for the future.