by Jerry Witkowicz and Sayed Wayzi

Today there are over 1,600 post-ICO (Initial Coin Offering) blockchain startups with over 300 more either live or planned. Not all blockchain startups are poised to succeed.

According to the deadcoins website, as of the date this article was written, 864 blockchain startups had already failed and the three key reasons cited are: Scam, Parody and Deceased. In the screenshot sample below are examples of these dead coins and the startup companies that were behind them.

Today in the 1,600 startups along with the 300 new companies that are about to enter the market, over 90% of these blockchain startups are not positioned for success. BenchMrkPro analyzed hundreds of blockchain startups that are in post- and pre-ICO stages and we discovered that at least 93% of the startups have no business plan on how they will earn revenue. What this means is that when and if their technology projects complete, they will need to find buyers who will see value in their solutions and who are willing to pay for them.

This has to change or the list of dead coins will continue to grow. Just imagine how many investors who purchased tokens that are on the list of dead coins have lost their total investments? This is sad but it is avoidable. Investors need to do a greater due diligence to learn about the blockchain startups before making an investment decision. Here are some tips to follow.

Common sense – There is a lot of truth in the saying that if it doesn’t make sense it’s probably wrong. As an investor, you don’t have to be a blockchain expert to understand the company and their solution. The onus is on the startup company to clearly describe their business and solution so that non-technical investors will understand. If you find the company whitepaper confusing and not making sense, this suggests that the company has not communicated their value proposition clearly. And if the investor cannot understand, neither will their potential paying customers.

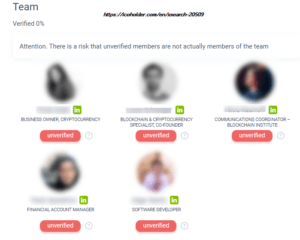

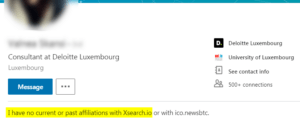

The core team – No sports coach ever won a game singlehandedly without a strong core team. In business it’s no different. When analyzing the ICO whitepaper, look at the core team. You should expect to see strong and experienced business leaders who have managed successful businesses and have a good track record. Check them out on Linkedin and the companies they worked with before. If you find that the core team is primarily technical people and particularly in blockchain technology, that’s a red flag. Remember, blockchain technology is still in its infancy and very few blockchain solutions have been adopted widely in the industry. The experience level in this industry is still very young. Selling blockchain solutions is difficult and the new startups will need a strong and experienced business team to execute on their plan. Above all, make sure that the team is truly a team that is associated with the ICO startup. Here is an example of an ICO that just completed and whose team has not been verified and, in fact, the team members shown on the company website are different than the ones shown on https://icoholder.com. Several team members shown on the company website denied any association with the company and one even filed a police case in his location against the company for using his Linkedin profile without consent. Would you invest in a company whose team is falsified? Many have and they are now at risk of losing their investment.

Business model – For any business, regardless of technology, to become profitable it must have a believable business model. Building a piece of technology is not enough. There has to be a business model that clearly answers in the whitepaper: What business problems are being solved, Who needs this solution and will eventually pay for it, How will the company sell and deliver their solution and Where are the users and where the company plans to promote and sell their solution. These four elements MUST be present in the whitepaper or the company has no business model and is simply building a piece of technology

Stay informed – Even after you analyzed the startup and their whitepaper, stay informed about the company. Blockchain technology is an extremely fluid vertical. Many startups are simply unprepared for real successful business. Many are caught up in the blockchain hype and promise more than they can deliver. Often significant changes in the company direction, team structure and even the company sustainability are forced upon the company. Just look at the list of the 864 dead coins and the companies behind the coins. Don’t ever rush into investing. Remember, it takes a lot of effort and hard work to earn your money and it should also take time and effort to part with it when investing.

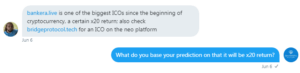

Decide wisely – When you do reach a decision point, summarize the key reasons why you believe that the startup will be a good investment. Don’t ever rely on free and unverified advice such as the one below. Always ask for clarification.

In the above example, this promoter did not respond to our question. We are not surprised. This is someone who is likely being compensated for luring uninformed investors to buy into the new ICO. Always do your own verification before investing. If it sounds too good to be true, guaranteed that it is. Decide based on your facts and you will decide wisely.

To avoid being part of the dead coin graveyard, follow these simple tips. If you are unsure about how to analyze a potential company, send us a note. We don’t offer investment advice but will be happy to answer questions about the company you may be looking at.

Authors:

Jerry Witkowicz

As a co-founder of BenchMrkPro, I leverage more than four decades of entrepreneurial experience in helping companies put the value of their solutions to work on behalf of their balance sheet.

Sayed Wayzi

As a serial entrepreneur and co-founder of BenchMrkPro with 15 yrs of experience, I am passionate about helping companies bring value to their customers and growing their business.