Ethereum’s token model has been consistently deflationary over the past seven days with a net issuance of -8,878 ETH.

Deflationary token model ahead of curve

In early August 2021, the London hard fork went live on the Ethereum network, making strong changes to the tokenomic model of the leading smart contract platform. The largest change was the implementation of EIP-1559, which switched out the former gas fee auction with a flat fee model, with fees being burned instead of being distributed to the block miners.

As a result of this EIP, it was expected that ETH would have a deflationary token model by the time the Proof of Work ETH1 blockchain merges with the Proof of Stake ETH2 network. As things stand currently, expectations seem to already have been surpassed, as the website watchtheburn.com reports a negative net issuance of ETH over the past 7 days.

According to the website, a total of 93,749 ETH that were issued in block rewards were matched with 102.627 ETH that were burned through gas fees. In total, 8,878 ETH worth almost 39 million USD were permanently removed from circulation. It is estimated that Ethereum runs deflationary on gas prices at 150 Gwei and above.

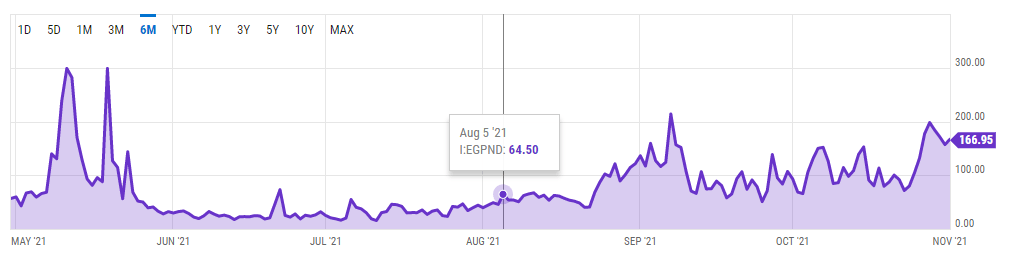

Gas prices still exploding

When London went live, many people predicted that the network upgrade will not have a major effect on gas prices. As it turns out, they were right, as the following graphic shows, although gas prices decreased temporarily in the days after the hard fork was activated.

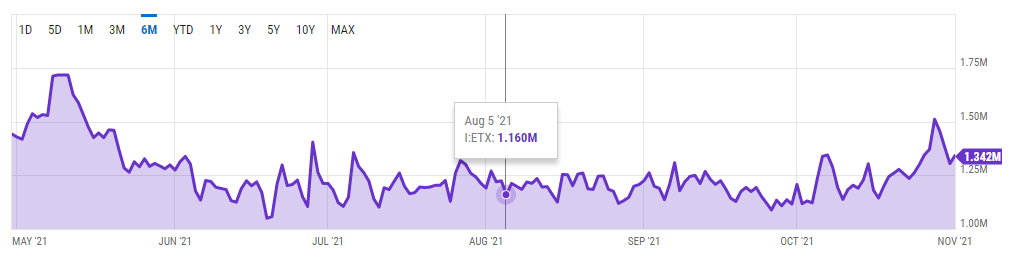

The hard fork also introduced a flexible block size limit. This led to speculations that the Ethereum network will be able to process more transactions at the same gas price. However, daily transactions did not change significantly either.

In conclusion, it can be said that the deflationary token model was the largest change to the Ethereum network that resulted from the London hard fork. As an interim solution for the high gas prices, Layer 2 networks will likely gain further significance, until sharding will be activated on Ethereum 2.0, which is scheduled for some time in 2022.