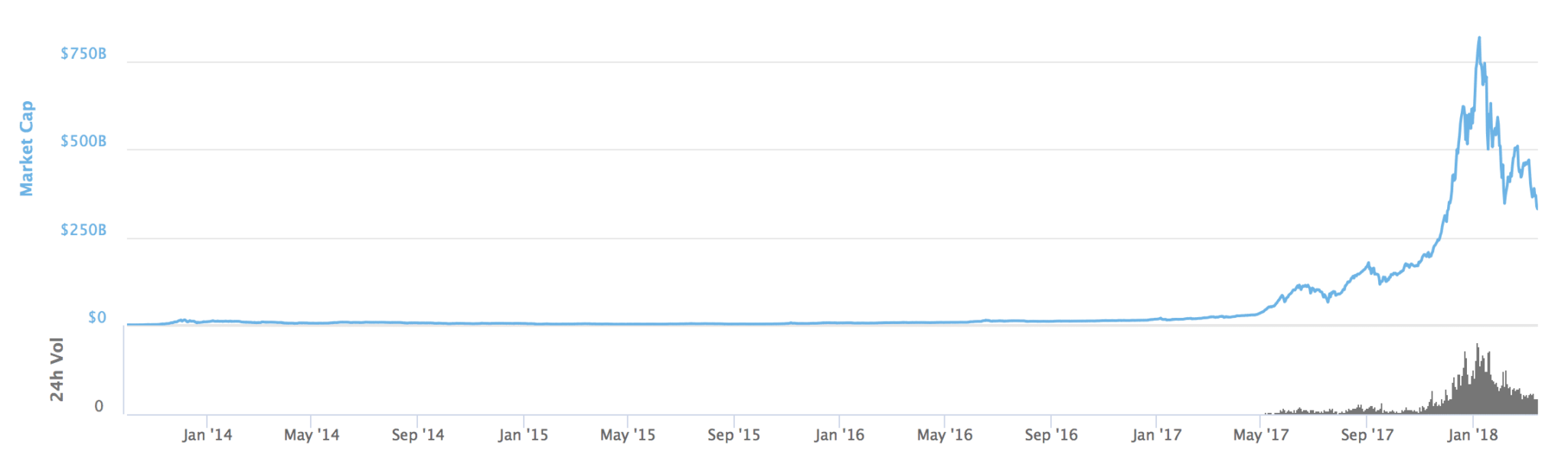

It is no longer a secret for anybody that the global market cap of all the cryptocurrencies has been reaching its lowest point. Although the value had slightly recovered recently, reaching the number of $380 billion, it yesterday decreased again at 10%, staying now at $300 billion.

At the same time, trading volumes increased up to $18 billion, making a huge difference with the early February sell-off when the volume was valued at $12 billion.

Current global crypto market cap

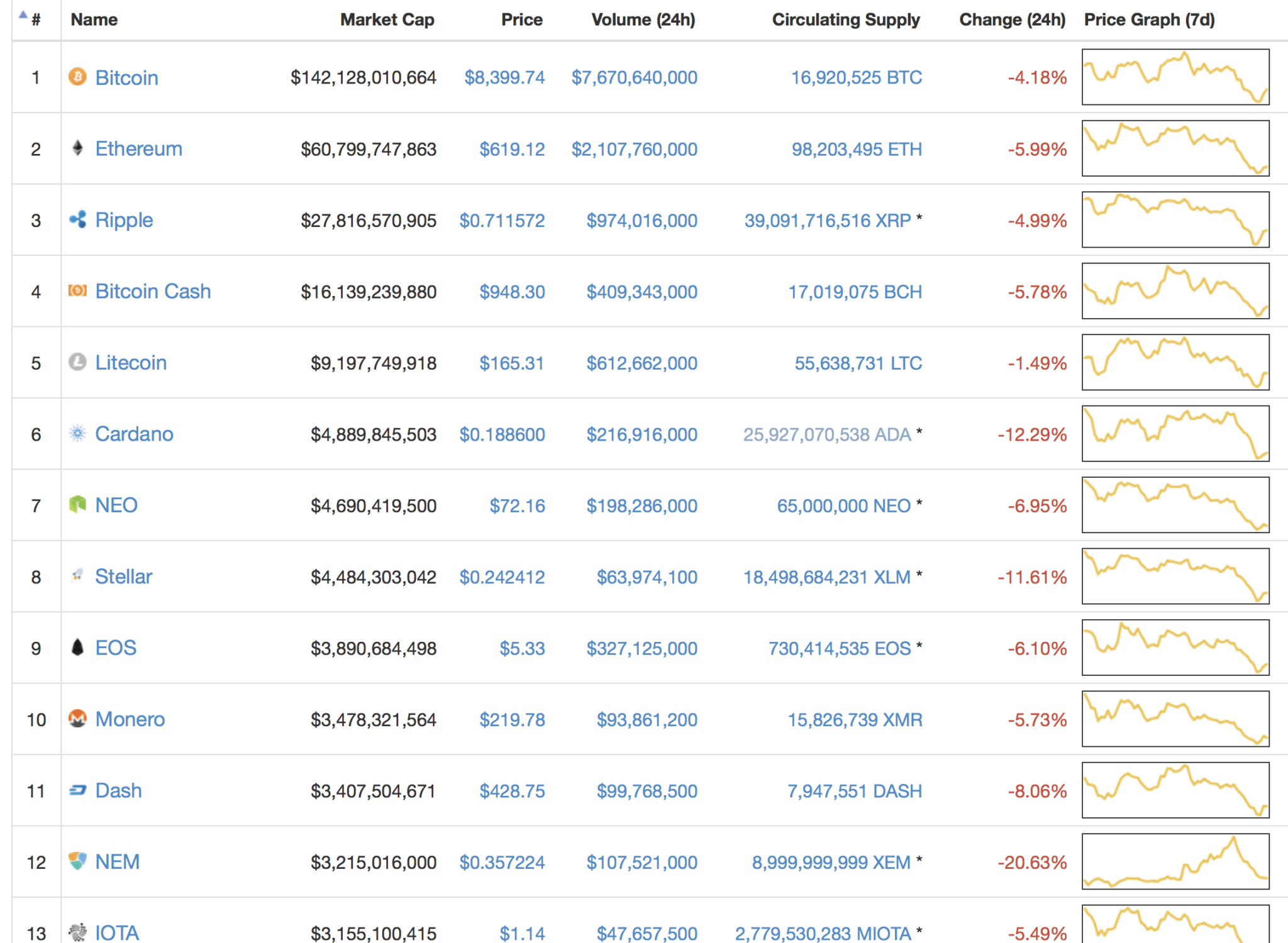

The numbers have suffered an outstanding decrease; we can see all the encrypted currencies at ranges oscillating between 5% and 10%, but there are even some cases with ranges lower than 20%.

The numbers have suffered an outstanding decrease; we can see all the encrypted currencies at ranges oscillating between 5% and 10%, but there are even some cases with ranges lower than 20%.

These changes are such that some crypto companies have had the most shocking winter’s sell-off, like Ripple, who has seen a surprisingly increasing market cap reaching levels almost higher than the cryptocurrency leader, Bitcoin.

But in spite of reaching the incredible number of $130 billion, it has now decreased to $30 billion or less.

Current top cryptos

Another cryptocurrency that has suffered the changes in the market, is BCH, who has also seen a brutal sell-off passing from $70 billion to only $16 billion now.

Another cryptocurrency that has suffered the changes in the market, is BCH, who has also seen a brutal sell-off passing from $70 billion to only $16 billion now.

In the same way, Ethereum has decreased from $134 billion to $60 billion; although this seems a little less worrying since the number decreased almost only by half. A similar fate faced the cryptocurrency leader, Bitcoin, which has gone from around $330 billion to now $140 billion.

With this being said, only one question stays on the table: how will cryptocurrencies behave into the future? This is a matter we can not be certain of, but one thing’s for sure; all of the digital currencies have faced the most brutal sell-off.

There is another pertinent query today: why is the cryptocurrency market so unstable? It seems like as soon as prices go up, they go down again; metaphorically speaking it is like we are on a Crypto roller coaster.

A probable cause for these sudden movements may be related to the fact that cryptocurrencies are open to everybody, therefore, retail investors are ruling the market instead of the institutional investors.

Consequently, people’s opinions seems to be more important than the actual fundamentals when the prices go up; that’s the moment when some people decide not to sell and that leads to a complete lack of liquidity and an accelerated price movement.

That is not the case with other markets, and the reason for this is because the bids and petitions the high-frequency stock traders make are, in fact, much closer to the market price. The expectation then is to earn out the difference in price between the bid and ask.

Applying this action could be very profitable, but at the same time incredibly competitive. That is exactly what happens with small markets where the propagation is way too fast; increasing the risk and making it non-liquid.

This is what we are observing now on the crypto market because even when we see a large digit trade volume, it is still a very small one compared to other markets such as the stock market or exchange markets.

In conclusion, the volatility of the crypto market could remain for a while until some regulations are made. Meanwhile, the only option is to invest in long-term and avoid the short-term investment risk.