Key highlights:

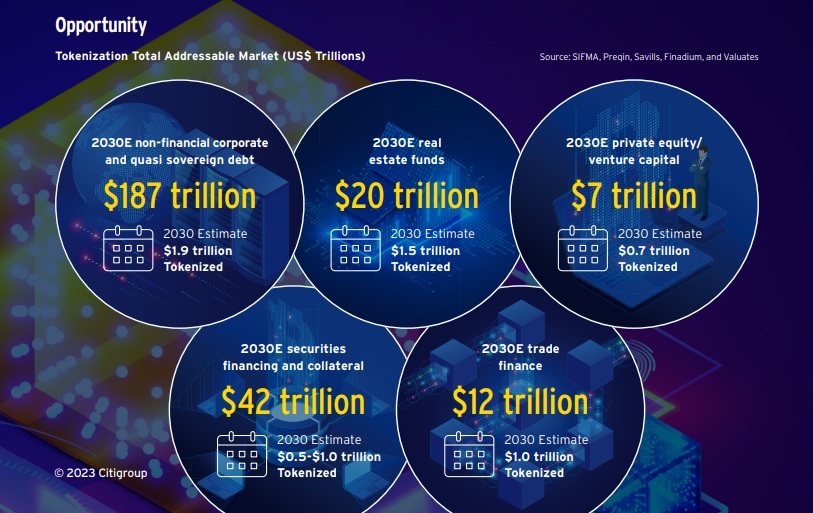

- Asset tokenization involves representing real-world assets on blockchain in the form of digital tokens, and according to Citi, up to $5 trillion in assets could be tokenized by 2030.

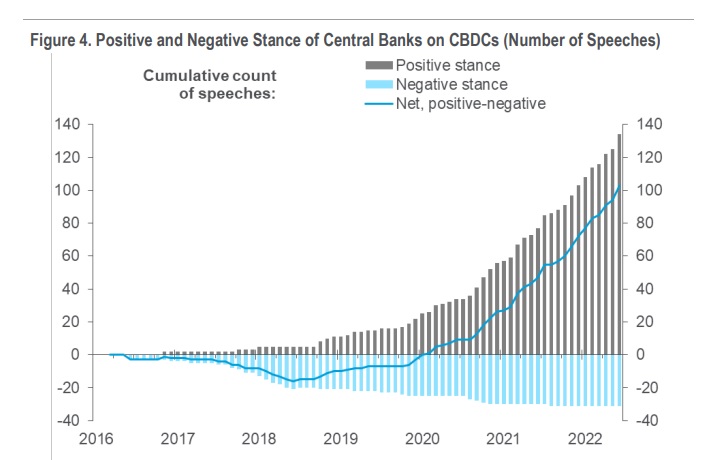

- CBDCs have the potential to create a more efficient and accessible financial system, and their development could be a significant driver for the mass adoption of cryptocurrencies.

- The combination of tokenization and CBDCs could create new opportunities for investment, entrepreneurship, and wealth creation across the globe, while also improving financial inclusion for billions of people who are currently unbanked or underbanked.

The winds of change are blowing in the financial sector. According to a new report by Citi, asset tokenization and central bank digital currencies (CBDCs) could reshape finance as we know it in the next decade. Citi predicts that up to $5 trillion in assets could be tokenized by 2030, unleashing a wave of innovation that will make financial markets more efficient, transparent, and accessible.

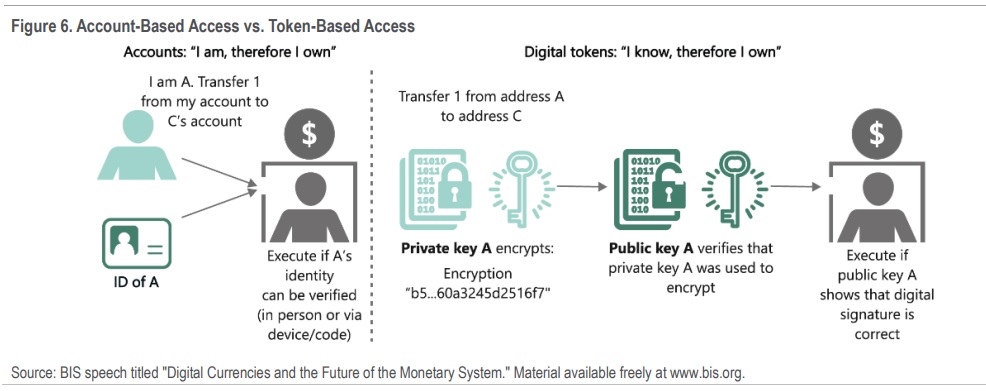

Asset tokenization refers to representing real-world assets like stocks, bonds, real estate, or commodities on blockchain as digital tokens. These tokens can be traded, bought, and sold much like cryptocurrencies, opening up a world of possibilities for investors and businesses alike.

Citi’s GPS report states that market tokenization could reach between $4 and $5 trillion in trade finance volume by 2030. 1.9 trillion dollars of debt, 1.5 trillion dollars of real estate, 0.7 trillion dollars of private equity and 0.5 to 1 trillion dollars of securities can be tokenized. This means an 80x increase in the value of real-world assets currently on the blockchain.

Central Bank Digital Currencies: The Key to Mass Adoption?

These are digital versions of fiat currencies, like the US dollar or the euro, issued and regulated by central banks. CBDCs have the potential to create a more efficient and accessible financial system, and their development could be a significant driver for the mass adoption of cryptocurrencies.

Several countries including China, Sweden, and the Bahamas have already launched or are piloting their CBDCs.

Fractional ownership enabled by tokenization lowers investment barriers, allowing more people to own stakes in assets like real estate, private equity, or hedge funds. CBDCs could also bring financial inclusion to the unbanked.

Mass adoption is expected to take 6 to 8 years. Venture capital and private equity funds may have a 10% share in the sector’s total addressable market, followed by real estate with 7.5%.

The Role of CBDCs in Financial Inclusion

One of the most significant potential benefits of CBDCs is their ability to improve financial inclusion. With a digital wallet and access to the internet, anyone could participate in the global financial system, opening doors for billions of people who are currently unbanked or underbanked. Tokenization, combined with a CBDC-based financial infrastructure, could create new opportunities for investment, entrepreneurship, and wealth creation across the globe.

Traditional processes and systems restrict financial asset ownership and trading, according to Citi. Platforms that create tokenized versions of companies’ funds are: Provenance Blockchain, Hamilton Lane, KKR, Apollo, Securitize, and ADDX.

The widespread implementation of CBDCs could accelerate the tokenization of assets, as it would provide a more seamless and secure way to transact in the digital realm. Tokenized assets could be easily exchanged for CBDCs, creating a unified financial ecosystem that integrates traditional and digital assets.

The $5 Trillion Future

In conclusion, the tokenization revolution is upon us, and with the potential for $5 trillion in assets to be tokenized by 2030, the future of finance looks more exciting than ever. From the tokenization of unconventional assets to the development of CBDCs, the next decade will be a transformative one for our financial systems.

While there are risks and challenges to address around regulation, privacy, and adoption, it’s clear that finance is on the cusp of a new era. Tokenization and CBDCs have the potential to make financial markets borderless, inclusive, and transparent.