Important Dates: March 27th – Token sale begins

Number of Tokens: 129,498,559

Cap: $30 Million

Token Type: ERC-20 token built on the Ethereum blockchain

Token Symbol: RMESH

What is Rightmesh?

Rightmesh is decentralized network protocol that allows smart phones and other devices with wi-fi or Bluetooth capabilities to act as nodes and share data.

What is a Wireless Mesh Network?

A wireless mesh network is a communications network made of radio nodes that is decentralized. It does not rely on infrastructure like routers. Instead data is forwarded by nodes in the network. The network is reliable because if one network fails, there are still other nodes that can maintain the network.

What is the problem Rightmesh wants to solve?

Rightmesh asserts that the world is underconnected and the internet brings opportunities to disadvantaged people in developing countries. The whitepaper notes that there are already millions of IOT devices and smartphones in areas with poor internet infrastructure. Rightmesh plans to use these devices to form a mesh network so that people can connect to the internet without using traditional infrastructure.

What is Rightmesh’s Business Plan?

The roadmap has not been finalized so it is unclear about how far along the project is. However, the team has been working on the project for 3 years.

Rightmesh has a brief marketing plan in the whitepaper in which they say that:

Marketing efforts will be focused predominantly on supporting the developer ecosystem, providing token incentives and our mesh software development kit to encourage adoption of our platform. An SDK will be provided to developers for free. A developer could deploy a mesh application in just a few lines of code (that is, reconfigure an existing application to support mesh network connectivity).

The initial token economy will be kickstarted by selling utility tokens to app developers, publishers, advertisers, and other enterprise clients. After all, it will be these organizations who receive early utility from the platform as they achieve their business goals and reach into new markets.

It is still a little bit unclear how they hope to actually get partners interested in the project. This is needed in order for the project to be successful.

ICO

The ICO date will take place on March 27th. There will be a finite supply of 129,498,559 tokens. No further tokens will be created. A hard cap of $30 million will be placed on the token sale, with no soft cap. The team has already been working on the project for 3 years and mentions that the project will go ahead regardless of token sales.

Token Utility

MESH tokens will allow participants in the ecosystem to facilitate the purchase and sale of goods and services, be it data and Internet access, device storage, battery, and processing power, or other digital goods and services created by mesh participants.

.@Right_Mesh Co-Founder Chris Jensen is preparing to share with #NamesCon 2018 attendees how to move from Domainer to Cryptopunk. Learn more about one of the speakers for our upcoming conference: https://t.co/L3aOMn4eEp pic.twitter.com/i6s8qmwIPr

— NamesCon (@NamesCon) December 26, 2017

The Team

Rightmesh is a subsidiary of a company called Left, which has 80 employees and is based in Vancouver, Canada. Over half of Left’s employees are working on Rightmesh.

The team is very experienced and comes mostly from the parent organization, Left. The advisors look ok too, but there is only one advisor with crypto experience. I think they could’ve beefed this segment up a bit.

Season’s greetings from the entire crew here at #RightMesh. We hope your holidays will be filled with joy and laughter through the New Year. #MerryChristmas pic.twitter.com/pD08sG2n4x

— RightMesh (@Right_Mesh) December 24, 2017

Hype

There are currently about 500 people in the Telegram Channel and Twitter has 2369 followers. These numbers aren’t great from a marketing perspective, however as the token event is still over a month away, RightMesh has the opportunity to build on these numbers and generate more buzz.

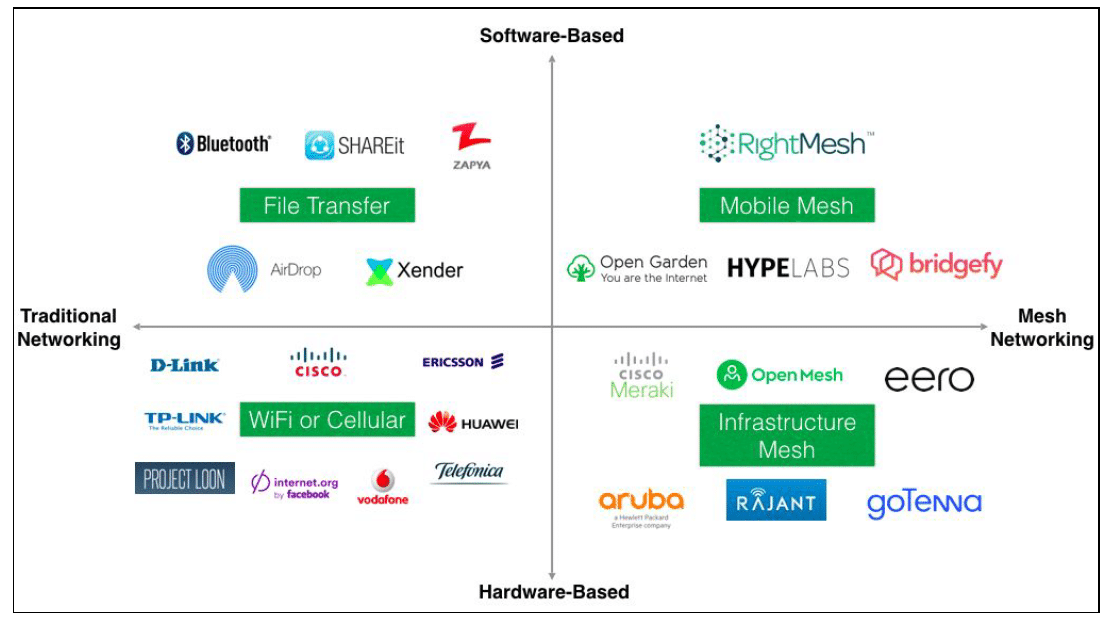

Competition:

Rightmesh has helpfully identified its competitors in its whitepaper.

Hype Labs: This is a startup whose product is currently in beta testing. The company is based in San Francisco.

Open Garden: This company was founded in 2011 and is also based in San Francisco. Their mobile mesh product is called Firechat and has been mentioned in the media as allowing connectivity during protest movements.

Risks

Technological: For a project that will rely on micro-transactions, the cost of transactions needs to be very low. This is currently not the case on the Ethereum network, as the authors acknowledge in the technical whitepaper. The authors are hope that improvements to the Ethereum network will bring down transactions costs but it is unknown when this will happen. The team also suggested that different scaling solutions may be used, including Raiden or Ripple.

Market: Rightmesh is targeting developing markets where local people have limited connectivity. However, I am not sure how a project like Rightmesh can reach those people effectively. Considering the challenge of buying cryptocurrencies these days (everyone who has bought knows what I mean), I can’t see an impoverished farmer buying Rightmesh. The ease of buying and using crypto will have to change substantially in order for Rightmesh to be successful.

Scores

Fundamental Indicators

Concept: 5

RightMesh has a fantastic concept that could be very useful in developing parts of the world. I’m not certain whether a native token is right for this project, but otherwise like the idea.

Token Utility: 1

It is unclear why a token is needed for this project. The whitepaper claims that the decentralized apps could be built on the RightMesh network that would use the token, but couldn’t they just use Ethereum? It is also unclear how Rightmesh expects Ethereum to be used in their network, as each participant will also need Ethereum to send MESH tokens. The whole token part of this project is poorly thought out.

Status: 3

Because there is no roadmap on the website, I am unclear about how far along the project is. However, I assume it must be reasonably far along based on the fact the team has been working on it or three years.

Team: 4

The team is very good and has lots of good experience. It also helps that this project is being driven by an existing company with revenues that staff can be drawn from.

Competition: 4

There are competitors with Mesh networks with a working product (e.g Open Garden), however, RightMesh is clearly targeting a different market than these products which lessens the competition. I was unable to find any competitors that are developing a mesh network targeted at developing areas.

Strategy: 3

Rightmesh’s strategy makes sense – they hope to build an ecosystem around their product. However, I hope that Rightmesh is able to find partners to help develop their ecosystem, otherwise the project will be unsuccessful.

Technical Indicators

Market Cap: 3

The market cap is at the upper limit of being acceptable. Projects north of 30 million usually cannot reach their cap and offer lower potential returns to investors.

Hype: 3

For a project without a confirmed ICO, the number of people in Telegram and Twitter followers is not bad. This score reflects the early stage of this project, and could change closer to the ICO date.

Investment Horizon

Short Term: Good. Rightmesh has a unique product that has been worked on for three years. Assuming the marketing machine picks up in the weeks before the token sale, there should be enough interest to ensure good returns.

Long Term: Rightmesh also has strong long term potential. They anticipate earning revenue in 2019 and assuming they can bring on board strong partners, will have a compelling product.

Conclusion:

I really like Rightmesh. It has a compelling product, a good team and a vision for underserved people. Not only does the project have a good social impact, but it could also provide good returns to investors.

Overall Score: 3.2

Telegram: https://t.me/RightMesh_Official