The boom of the Initial Coin Offering (ICO)

Since The DAO was crowdfunded via a token sale in May 2016, it set the record for the largest crowdfunding campaign in history through an ICO.

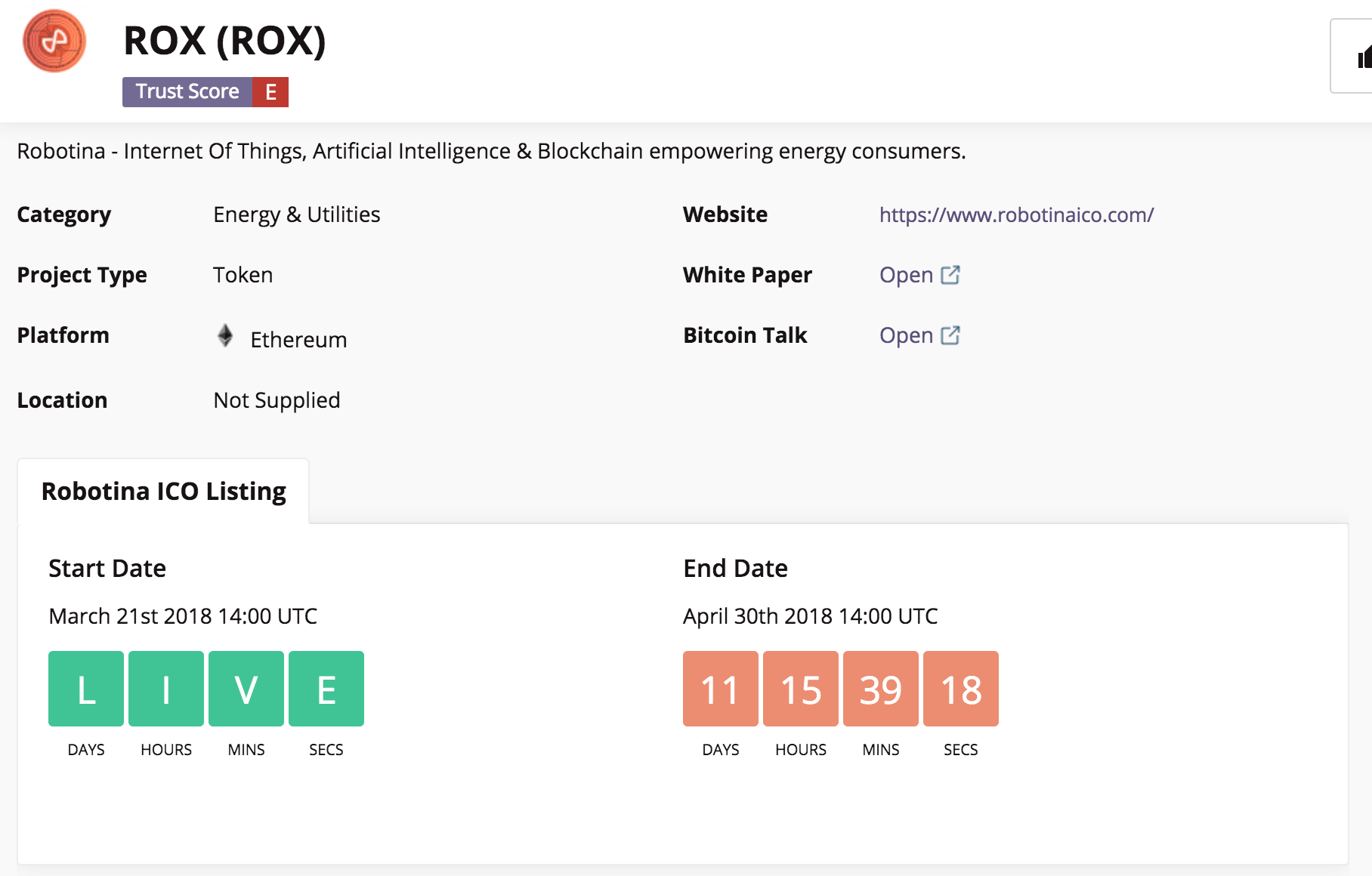

After The DAO, the last two years have been an ICO boom where many startups and some established companies (Robotina) saw an opportunity to seek financing through an ICO for their business projects because of the many advantages offered compared to traditional ways. Because of this, governments are now regulating for security reasons such as cases of fraud, tax evasion and security.

CoinSchedule: ICOs that can be trusted

Platforms such as CoinSchedule have been created for enthusiasts that are searching new opportunities in the blockchain industry. Here you can obtain quality information about projects financed through ICO. CoinSchedule offers various data and information that makes it easy to analyze the ICOs in your market:

Platform filter: allows you to select the platform on which the ICO will operate.

Category filter: allows you to search ICOs that will work in a specific area.

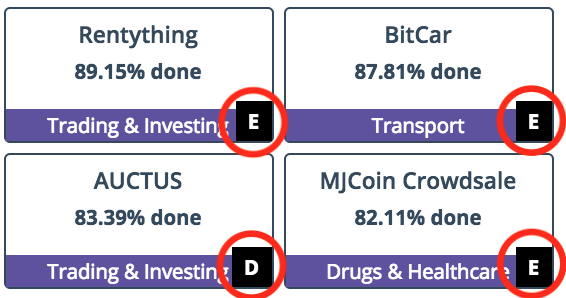

Trusted score: is an algorithm that uses AI techniques to determine the amount of credibility of an ICO. A (best) to E (worst) and F when the ICO has not yet been scored.

ICO information: displays all ICO information like start and end date, website, whitepaper, etc.

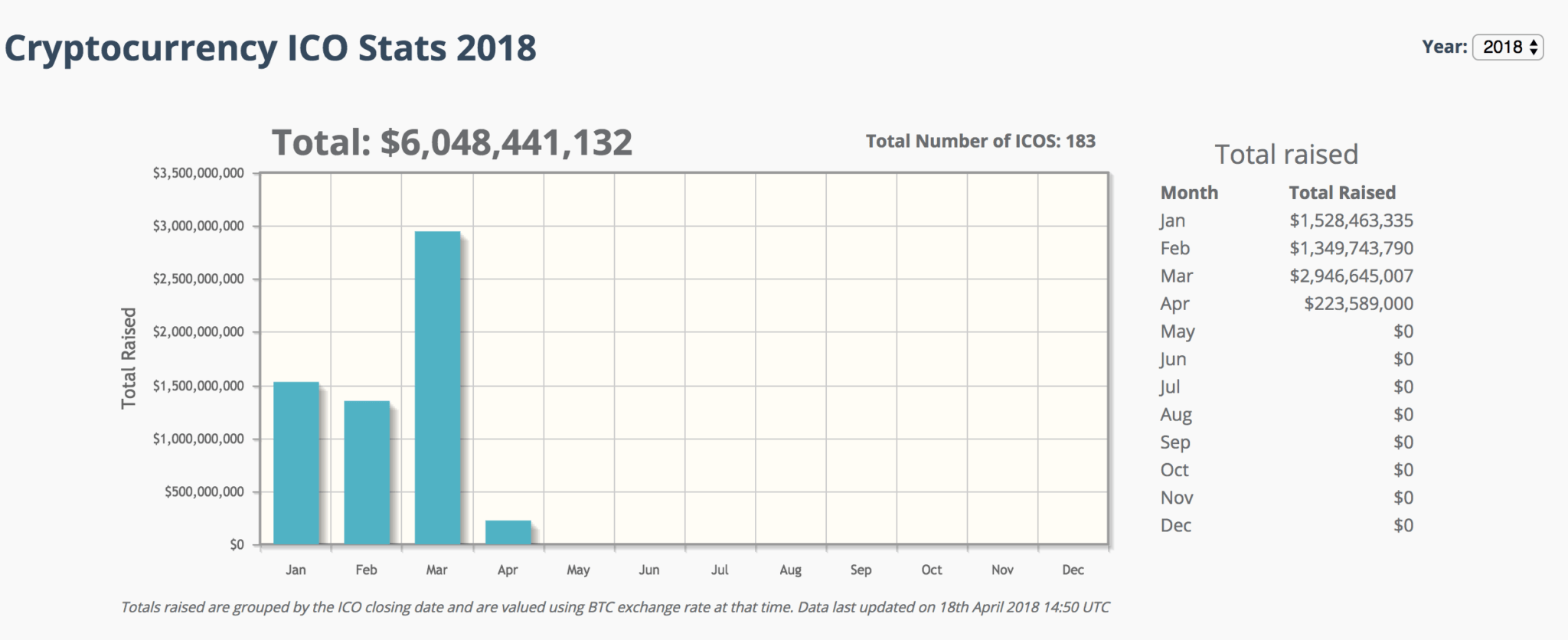

ICO stats: shows the amount of money in USD that the ICO has managed to capitalize monthly and annually since 2016.

Top Ten ICOs: shows the ICOs that have raised the most capital in a year.

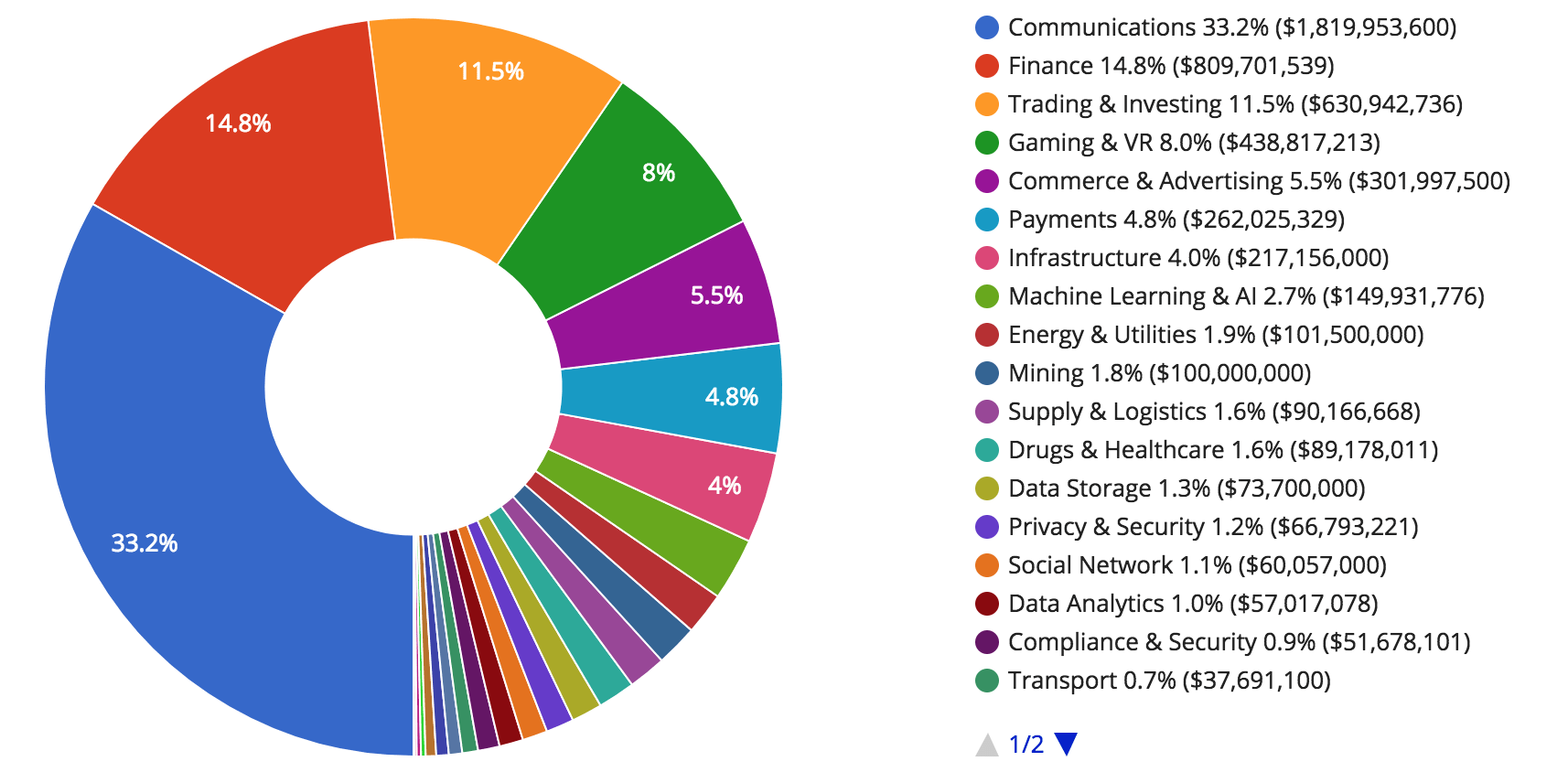

ICOs by category: is a pie chart showing the dedicated percentage of capital by category in a year. CoinSchedule is an invaluable web tool that can help us look for quality ICOs, similar to ICOBech and TrackICO.