Are you curious about Ripple’s native currency, XRP, and its role in global transfers? XRP is a unique digital currency owned by Ripple, designed to facilitate seamless and secure cross-border transactions for banks and financial institutions. While Ripple faced challenges in 2020, the new year holds promise for its growth and expansion. The value of XRP is influenced by factors such as bank adoption and cryptocurrency regulations. If you’re an enthusiast in the world of cryptocurrencies or a thematic investor in the financial sector, XRP could be an intriguing investment opportunity. However, it’s important to note that XRP is highly volatile, offering short-term trading possibilities. Market trends, mainstream adoption, and technological advancements also play a significant role in determining the value of XRP. Furthermore, the ongoing SEC vs. Ripple lawsuit has the potential to impact the regulatory landscape of the entire cryptocurrency industry. Whether you choose to buy and hold XRP, trade it, or explore other investment avenues, the opportunities surrounding XRP are worth considering.

Overview of Ripple and XRP

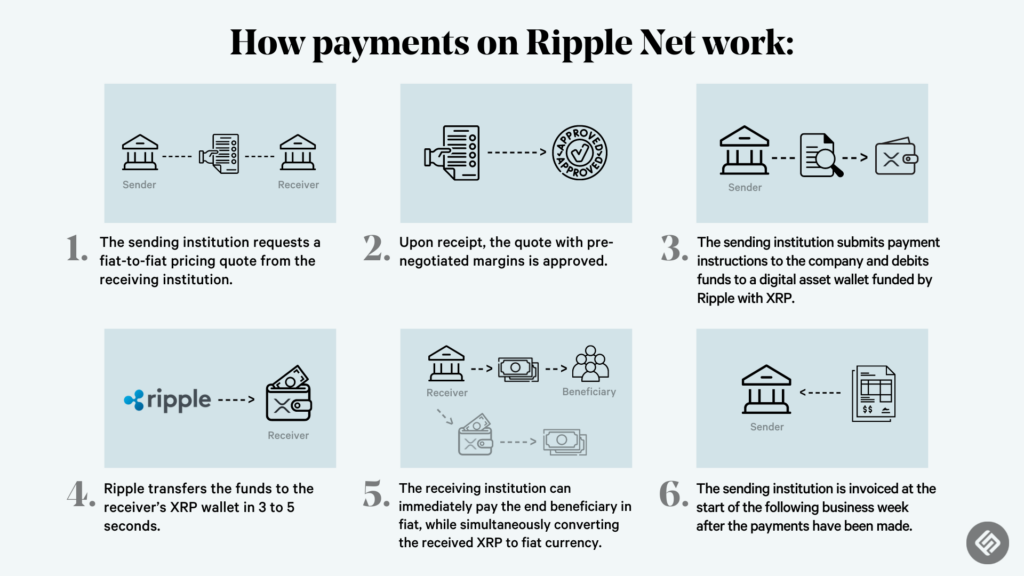

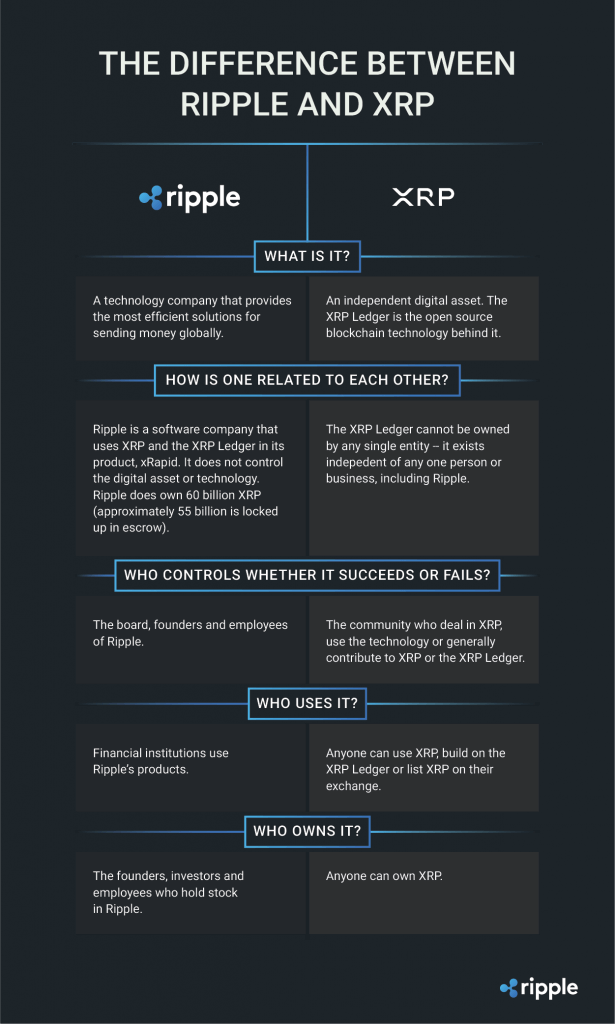

Ripple is a blockchain-driven payment system designed for global transfers. It operates using its native digital currency, XRP. What sets XRP apart from other cryptocurrencies is that it is wholly owned by Ripple and primarily aims to serve banks as a transfer of value. Ripple’s payment protocol is built on a distributed open source internet protocol consensus ledger, which allows for fast and secure money transfers. This makes it an attractive solution for financial institutions looking to improve the efficiency of cross-border payments.

Factors Influencing the Price of XRP

The price of XRP is influenced by various factors. One of the key factors is the adoption of Ripple by banks and financial institutions. As more institutions integrate Ripple’s payment system into their operations, the demand for XRP is likely to increase, thereby impacting its price. Additionally, the regulatory environment surrounding cryptocurrencies also plays a significant role in determining the price of XRP. Any new regulations or restrictions imposed on cryptocurrencies can affect the overall market sentiment and, in turn, the value of XRP.

Growth Potential of Ripple in 2021 and Beyond

Ripple faced its fair share of challenges in 2020, including the ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). However, despite these obstacles, Ripple still has significant room for growth in 2021 and beyond. The company continues to establish partnerships with major financial institutions and expand its presence in different regions. Additionally, as the global adoption of blockchain technology and cryptocurrencies increases, Ripple is well-positioned to capitalize on this growing trend.

Investment Opportunities and Considerations

For cryptocurrency enthusiasts and investors, XRP presents an attractive investment opportunity. Its close association with Ripple and its potential to disrupt the traditional banking system make it an intriguing option. Additionally, thematic investors who are interested in the financial sector can consider investing in XRP as a way to gain exposure to this industry. However, it is important to note that investing in XRP comes with risks, particularly due to its high volatility. Therefore, investors should carefully consider their risk tolerance and conduct thorough research before making any investment decisions.

In addition to long-term investment opportunities, XRP also presents short-term trading opportunities. Its volatility can create favorable conditions for traders looking to capitalize on price fluctuations. However, trading XRP requires careful analysis and understanding of market trends, as well as the ability to react quickly to changing conditions. Traders should have a solid trading strategy in place and be prepared for the potential risks associated with short-term trading.

Factors Affecting the Value of XRP

Several factors can affect the value of XRP. First and foremost, market trends play a crucial role in shaping the price of XRP. Investor sentiment, overall market conditions, and the performance of other cryptocurrencies can influence the demand for XRP and ultimately impact its value. Additionally, mainstream adoption of Ripple’s payment system and XRP by financial institutions and businesses can significantly affect its value. The more users and entities adopt Ripple, the stronger the network effect becomes, potentially driving up the value of XRP. Technological developments within the Ripple ecosystem and advancements in blockchain technology as a whole can also contribute to the value of XRP.

The SEC vs. Ripple Lawsuit and Its Implications

the ongoing legal battle between the SEC and Ripple has garnered significant attention within the cryptocurrency industry. The SEC alleges that Ripple conducted an unregistered securities offering when it initially sold XRP. The outcome of this lawsuit has the potential to impact the regulatory landscape not only for Ripple but for the entire cryptocurrency industry. If the SEC’s allegations are proven, it could lead to stricter regulations and guidelines for cryptocurrencies. On the other hand, if Ripple successfully defends itself, it could provide clarity and regulatory certainty for the industry, ultimately benefiting Ripple and XRP.

Multiple Investment Strategies for XRP

There are various ways that investors can approach investing in XRP. One common strategy is buying and holding XRP, which entails purchasing the digital currency with the intent of holding it for an extended period. This strategy allows investors to benefit from any potential price appreciation over time. However, it is important to keep in mind the high volatility of XRP and the associated risks.

Another investment strategy is trading XRP. Traders can take advantage of the short-term price fluctuations of XRP to generate profits. This strategy requires active monitoring of the market and the use of technical analysis to identify potential entry and exit points. Traders should also implement risk management strategies to protect their capital.

It is important to note that mining is not applicable to XRP. Unlike other cryptocurrencies such as Bitcoin, XRP is not mined. This is because all XRP tokens were pre-mined and distributed at the time of creation. Therefore, mining is not a viable investment avenue for XRP.

In conclusion, Ripple and its native digital currency XRP present unique opportunities and considerations for investors. While Ripple’s payment system has the potential to revolutionize the global financial industry, it also faces challenges and uncertainties, such as the ongoing legal battle with the SEC. Investors should carefully evaluate their risk tolerance and conduct thorough research before making any investment decisions related to XRP. By understanding the factors influencing its price, the growth potential in the coming years, and the various investment strategies available, investors can make informed choices regarding their involvement with Ripple and XRP.

Investing in Ripple in 2023: A Viable Venture?

Armed with insights into Ripple’s recent history, assessing its viability as an investment in 2023 necessitates a comprehensive understanding of a few key considerations.

One must determine whether they align with the profile of an XRP holder and trader and if the coin meets their requirements. Equally crucial is grasping the drivers behind XRP’s price and whether its role as a disruptor in the transaction industry remains relevant.

XRP caters to various styles of traders and investors. It appeals to general cryptocurrency enthusiasts, as it stands as an altcoin distinct from Bitcoin. Yet, its prominent position within the top five coins and its established market lend it a sense of credibility and stability.

Simultaneously, XRP appeals to thematic investors who recognize its potential to cater to the banking industry’s unique needs. This aligns with Ripple’s aspiration to facilitate swift and effortless cross-border value transfers for financial institutions.

As the landscape of cryptocurrency and finance continues to evolve, Ripple’s role remains distinct and potentially promising. However, given the volatility inherent to the cryptocurrency market, prospective investors should exercise prudence and stay informed about the ever-changing dynamics that influence XRP’s trajectory.