A controversial governance vote to reduce the maximum borrow rate on Vires Finance has been struck down, but a new one is already in the planning.

Liquidity suppliers locked in

In the aftermath of the price manipulation on WAVES, the total supply of USDC and USDT on Vires has been borrowed. This means that liquidity suppliers can’t withdraw their tokens unless the debt is repaid or the debtors get liquidated. Apparently, the Vires team seeks to prevent the latter from happening.

There are three whale wallets that have supplied Neutrino USD (USDN) on Vires in order to borrow large amounts of USDC and USDT for a total of 566.9 million USD. At the moment, those three debtors pay an APR of slightly more than 80% on their positions, while they receive just 7.5% APY on supplying USDN. This means that their debt is growing every day.

3PEEsRmcWspCxhKqobvKY3axW1846AMRwzr is the largest of the three whale addresses, which has supplied more than 500 million USDN in order to borrow 410 million USD in the other two stablecoins. At the current rates, this account loses almost 1.3 million USD in interest every day. It is rumored that the address belongs to the Waves developer team and was used to create a supply squeeze on the WAVES token.

Another whale address, allegedly belonging to Alameda Research, supplied 41 million USD in USDT and USDC each and borrowed 31 million USD in WAVES. Waves founder Sasha Ivanov accuses Alameda of paying shills to spread a targeted FUD campaign against Waves to back up this short position. On April 08, the WAVES debt of the Alameda address was paid back at a marginal profit.

Vires calls governance vote to protect whales

Many people seemed to believe Ivanov’s FUD narrative. Meanwhile, Vires has taken measures against shorting WAVES, by suspending the option to borrow any assets on the DeFi protocol.

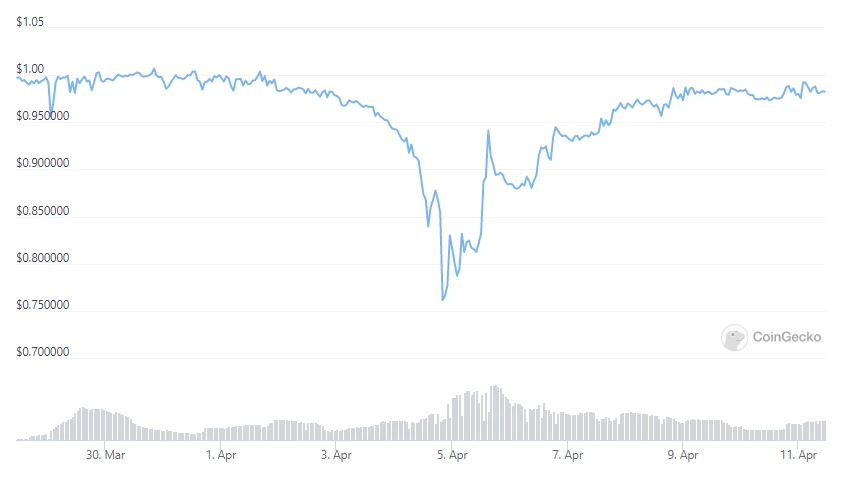

The announcement also defended the practice of hard-setting the value of USDN to 1.00 USD in Vires. If a price-feed oracle had been used instead, the borrowers would have already been liquidated during the USDN de-pegging event, when the price of the stablecoin crashed to as low as 0.72 USD. USDN has since largely recovered but is still short of its USD-peg.

Furthermore, a governance proposal was launched that would immediately liquidate all debts in WAVES and USDN. The proposal would also decrease the maximum borrow rate to 40%.

This proposal raised concerns within the Vires community, since it would have decreased the incentive for the three whales to repay their debts. Most comments on the Vires forum were strongly opposed to the proposal. Many of the USDT and USDC liquidity suppliers accuse the Vires team of having a vested interest that favors the whale borrowers.

If at first you don’t succeed…

After initially gathering support during the early days of voting, the contentious proposal was ultimately struck down yesterday with 35,100 votes in favor and 54,300 votes against. Even before the vote closed, a new governance proposal has been launched, again with the intention of decreasing the borrow APR to 40%.

Just like the first proposal, there is a massive opposition on the forum. One user found out that the account that launched the proposal was funded by the largest of the three whales. Another one pointed out that the whale account has enough governance power to overrule the community, but refrained from doing so in the first vote. In order to be eligible for voting, VIRES tokens must be staked at a lockup period with a gradual release over eight months.