Price Action

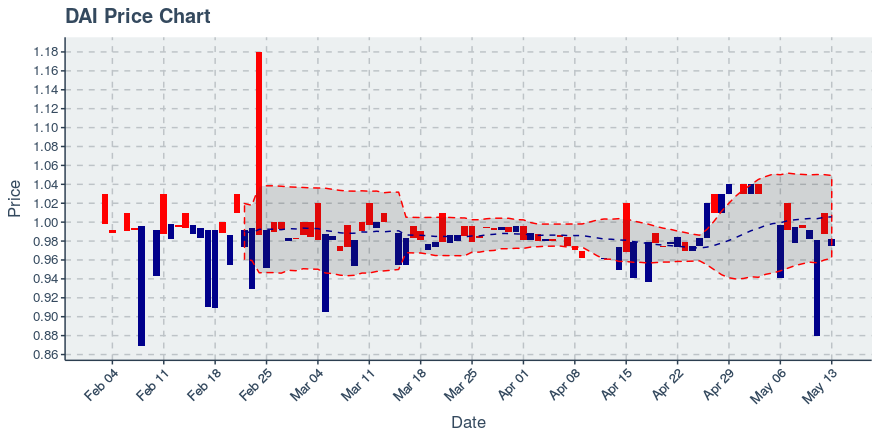

Since last week, Dai’s price went down by -1.42%. It is below its 20 day moving average by 2.62%, so it’s fairly close. Dai’s bullish momentum, determined by its distance from its 20 day moving average, is pretty far negative compared to the other coins we’re covering, and thus may be due for a correction upwards or some kind of a period of low volatility. In terms of volatility, Dai exhibits greater price volatility than approximately 4% of coins in our index, so this coin might not move much — something traders and investors will certainly want to keep in mind. If volatility over the past three weeks is any indication of what’s to come, we can expect Dai to bounce between 0.9626239 and $1.055146 US dollars per coin.

Where to trade Dai (symbol: DAI): Gate, Yobit, DDEX, Ethfinex

Volume Update

In the week prior, the daily volume for Dai has ranged between 196,899.9 and 2,930,090 currency units. In the three weeks prior, volume has a clearn upwards trend, but the trend in price is not as clear. The past 7 days saw Dai’s trading turnover — meaning the percentage of its available supply that was traded — come in at 1.48%. Its trading turnover percentage is higher than about 44.9% of the coins we’re tracking, so it’s middle-of-the-pack; investors/traders may thus wish to consider their liquidity requirements to make sure the coin matches their needs and their expected trading volume.

Engagement Update

The number of wallets holding Dai went from 22,255 to 23,100 in the past week, marking a change of 3.80%. As for overall transactions, they increased from 934,815 to 984,688 — an increase of 5.34%. The combined engagement growth rate (growth rate in holders plus growth rate in transfers) of Dai is thus at 9.14% which, relatively speaking, is ahead of 88.89% of the cryptocurrencies we’re tracking. One interpretation of this may be that the coin may be on track to getting and sustaining actual usage.

Technology Development Status

Dai currently has 60 public repos on GitHub, with the oldest one clocking in at 3.68 years young. Its most recent public update was within the past day, which is pretty good, as it suggests the coin is still under active and rapid technical development. Dai’s repos that are visible to the public collectively have 920 watchers — specifically, that’s more than 63 % of the top 100 coins we’re looking at. The coin has 70 issues reported across its public repositories. Relative to the number of watchers it has, though, its open issues count seems to be in good shape. To elaborate: the ratio of open issues to developers who are watching Maker’s GitHub repos is more favorable than 62% of similar coins in our index.

Dai News and Commentary

Over the past week, we found 2 links about Dai that we found especially interesting. If possible we included a brief excerpt from the article — be sure to click through for the entire piece.

Bridging Stablecoin Dai to Broken Economies – Airtm

What is Dai and how does it work? – Airtm

Where to Buy

You can trade Dai, listed under the symbol DAI, through the following exchanges: Gate, Yobit, DDEX, Ethfinex.

Article by SixJupiter