The cryptocurrency market currently struggles to find and develop two main solutions: bringing new products to market more efficiently, and fixing liquidity of each virtual coin that comes to market.

Out of all the platforms listed today on Coinmarketcap, only 5% have an appropriate liquidity, meaning the 95% can’t provide a service that fits quality standards. This makes it difficult to occupy and remain in a market where all resources behave similarly, and continue to offer trading tools for niche markets.

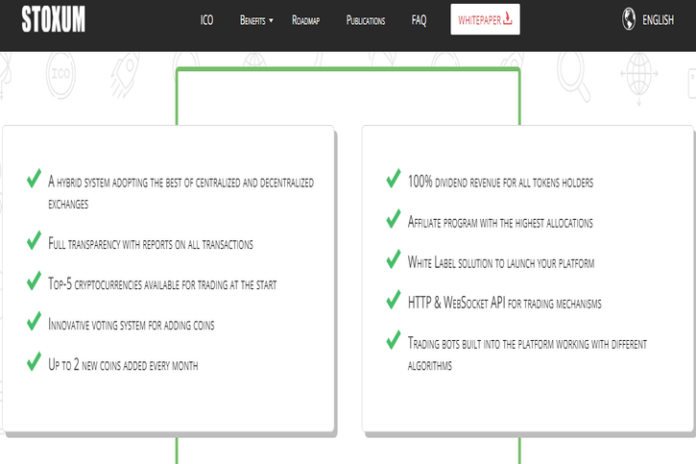

To resolve these problems, a brand-new project is being developed under the name of Stoxum, offering the world’s first hybrid cryptocurrency exchange with an aggregated pool of liquidity that will mix the benefits of centralized solutions with the trustability of decentralized platforms.

Subsequently, all of the financial indicators will be completely open on the platform, and the liquidity pool will unite third-party projects that could work on a system’s ‘Whitelabel’ platform. Through this system, the platform will give space to others to build their own exchange, providing them with the appropriate tools and the technical and liquid bases for facilitating project deployment.

While developing the project, it is crucial to determine that trading volumes on the platform are directly proportional to the number of registered and active users. As a result, a business model can be built by only knowing the value of attracting a potential client. Put simply, the project team realized that by determining the required money to draw the attention of a client, there’s a greater chance of seizing the market.

Dividends as liquidity solution

The project uses dividends as a social marketing method. It functions on a simple formula where the total amount of dividends is equal to the total income of the platform. For instance, if a user has 1% STM tokens, and the platform earns $100 in 10 minutes, then it will receive 1% of that revenue every 10 minutes.

Stoxum manages a concept whereby any token holder can become an owner on the Stoxum main exchange, and any company or third-party developer can refine the code and functionality of the project since it will be publicly available.

Next steps for Stoxum

Currently, the project is preparing to release an alpha version of the platform, which will be available for testing at the end of August. The project is 80% complete now, and the main purpose is centered on creating an easy solution for third-party companies that want to launch their crypto exchange through the Whitelabel system.

Similarly, the efforts will be gathered on making this process very simple. The goal is that, even for a non-technical specialist, the process would be so easy that there is no need to hire or expand a staff of developers to run the exchange.

Stoxum ICO

The team is currently deploying an Initial Coin Offering (ICO). The closed pre-sale will start on April 30th, having a 30% bonus. Its first public pre-sale will commence on May 10th, with a 25% bonus as well, and the ICO process will close on August 10th this year.

The collected funds will be distributed: 10% for advisors, bug-bounty and bounty program, 40% for development, hosting, software, hardware and 50% for marketing.

All going well, immediately after the completion of the ICO, and the launch of the beta version of the platform, the team will begin an aggressive marketing campaign to attract users.

The dividend concept in this matter will serve as a catalyst for social marketing among the holders of the token, which at the same time will allow Stoxum to reach a daily turnover of $1 million in three months.

Visit stoxum.org to learn more.