- Yam Finance and UMA have opened a joint derivatives platform called Degenerative Finance.

- Their first product is a derivative token that tracks the average monthly gas price on Ethereum.

- uGAS can be used to short or long the gas price or to hedge against unexpectedly high gas prices.

Thanks to a partnership with UMA, the yield farming platform Yam Finance has issued a derivative token called uGAS, that lets users long and short the gas price on the Ethereum network.

How uGAS Works

Together with UMA, Yam Finance has started a collaborative platform for DeFi derivatives called Degenerative Finance. On this platform, users can deposit Wrapped Ether (WETH) in order to mint uGAS derivatives tokens which settle to the average gas price recorded in one month on the Ethereum blockchain. Minters can then supply their uGAS to a Uniswap liquidity pool to earn liquidity mining rewards in UMA tokens. A recent proposal has been passed almost unanimously that redirects more rewards towards liquidity mining to facilitate the trading of uGAS.

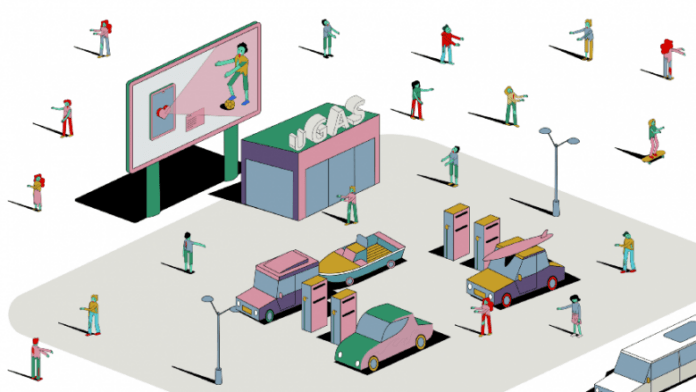

Dive into our visual user guide on Degenerative Finance and $uGAS!

Our ELI5 handbook shows how to

– MINT + LP uGAS (and EARN $UMA!)

– LONG + SHORT uGAS

– MANAGE uGAS

– SETTLE uGAS (after buying)

– REDEEM uGAS (after minting)Read in link below 📖https://t.co/nlUg3uWatr

— Yam DAO (@YamFinance) February 7, 2021

Since uGAS is collateralized with WETH, simply minting uGAS and supplying them to the liquidity pool is price-neutral. Positions are however at risk of getting liquidated if the gas price rises too high or the price of ETH drops too low.

In order to short the Ethereum gas price, users need to mint uGAS first and then sell them on Uniswap. In order to long the gas price, users can simply buy uGAS on Uniswap and hold them until the end of the respective month. After each month, one issue of the uGAS tokens settle and holders can redeem their tokens for WETH.

Hedging Against Rising Gas Prices

uGAS tokens can also be used as a tool for DApps or users who regularly send Ethereum transactions to insure themselves against the risk of rising gas prices by minting the tokens on Degenerative Finance or buying them on the secondary market. Should they incur losses to the high gas fees, they are compensated at the end of the month by redeeming their uGAS.

The next asset to be listed on Degenerative Finance will be UMA’s uStonks index token, which tracks the ten stocks most commented on r/WallStreetBets. The consensus vote for the listing has already passed, reaching the necessary quorum of 200,000 YAM.