- The number of validators on the Ethereum blockchain has increased rapidly, with 67,500 new validators arriving on the network from January 1, 2023, to the end of Q1.

- Currently, the number of ETH locked in the Beacon contract is over 18 million, representing 15% of the total supply, and the ETH price has risen 50% since the beginning of the year.

- The Ethereum blockchain network currently operates with 13,299 physical nodes in 81 countries, and the USA, Germany, and Finland have the highest node density.

Less than 10 days to Shanghai upgrade. With this upgrade, ETH stakers on the ETH 2.0 contract can withdraw their funds if they wish. This allowed the number of validators on the Ethereum blockchain to increase rapidly.

According to BeaconScan data, 67,500 new validators arrived on the network from January 1, 2023, to the end of Q1. The number of validators, which was 495,270 on January 1, increased to 562,787 as of April 1. On January 12, an important milestone was passed in the Ethereum blockchain, the number of validators exceeded 500,000. The biggest jump took place between February 25 and March 1. 16,700 new validators joined the network with the official date set for the Shanghai upgrade.

The Ethereum blockchain network currently operates with 13,299 physical nodes in 81 different countries. The three countries with the highest node density are the USA (36.57%), Germany (17.50%), and Finland (6.18%).

Number of Ethereum Validators to Decrease After Shanghai Upgrade

The process of staking ETH on Ethereum 2.0 started in December 2020. Since then, anyone who has locked their 32 ETH on the Beacon Chain can become a validator in the network and have a say in the consensus mechanism. The function of validators in the Ethereum network is to validate that transactions and blocks are valid

It is expected that the number of validators will first decrease and then increase again. Individuals and institutions can choose to stake ETH by being able to withdraw at any time.

Validators are currently rewarded with 5.2% APR for this. Someone who staked 32 ETH with an average price of $600 in December 2020 would have made a profit of around 3.5 times with staking rewards after about 2 and a half years. The profit rate will vary based on factors such as when the person stakes their coins and at what price they will sell them.

Will There Be Pressure To Sell?

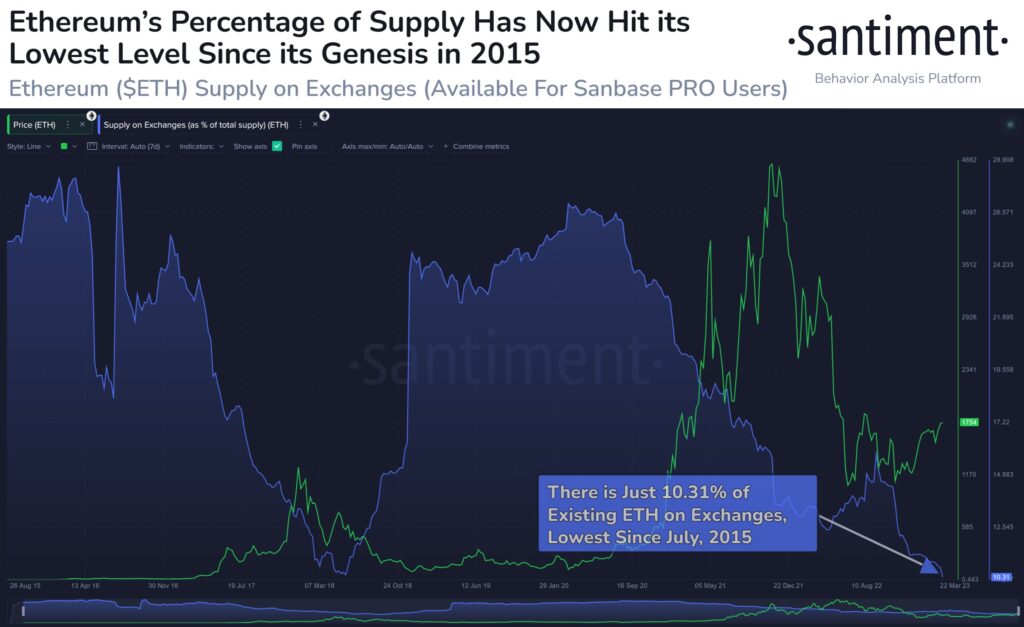

As of April 12, anyone who wants to can withdraw their funds also means they can sell their funds. This can lead to both a rapid price drop and a liquidity crisis. Santiment data shows that only 10.3% of the circulating ETH supply is found on crypto exchanges, the lowest amount since July 2015.

Currently, the number of ETH locked in the Beacon contract is over 18 million. This means there is around $32.5B worth of locked assets. 18 million ETH also represents 15% of the total supply. Delphi Digital has published a chart showing that Ethereum validators have earned 1.1 million ETH since December 2020. That’s almost $2B.

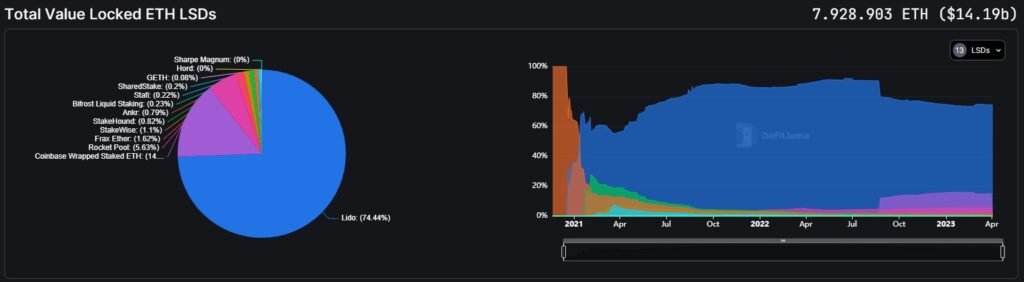

DefiLlama data, on the other hand, shows that 7.9 million ETH has been staked on liquid ETH staking protocols. Since the withdrawal option is open in these protocols, the amount of ETH in these protocols can change daily. Lido has the largest share with 74%, followed by Coinbase Wrapped Staked ETH with 15% and Rocket Pool with 5.6%.

Ethereum’s (ETH) price has risen 50% since the beginning of the year. We can expect high volatility in price, especially in the days before and after the Shanghai upgrade.