Image from pixabay here.

Selling Bitcoin is possible through the same media as buying it, namely, on exchanges / online markets, ATMs and by meeting the buyer in person. There’s a variety of payment methods that the seller can use to pay for your BTC.

Online

Selling Bitcoin online is the most popular way of selling that can take place either as a direct trade, as an offer on the online exchange or on a peer-to-peer marketplace.

In exchange for your Bitcoin, you can either receive fiat or another cryptocurrency. If your choice is fiat then you can receive it as an online bank transfer, local or international, on your credit card directly or via PayPal.

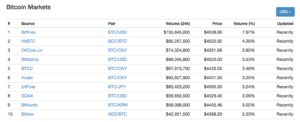

The choice of an appropriate service heavily depends on the factors such as your geographical location, the fees charged by the website, the payment method you prefer, the trading volume of the site, etc. On coinmarketcap.com, for instance, you will find at least 400 exchanges. Again, take into consideration the most popular among them that are used most often and therefore, are the most reliable.

Source: coinmarketcap.com

In most cases, you will need to register an account on the chosen website and verify your identity. After that, you can place a selling order. Some websites will require you to accept their exchange rate, some will not. In the last case you can define the rate yourself and once it is reached, the order will be satisfied automatically. Exchanges also allow you to choose from the existing list of orders. So if you see a buyer willing to acquire Bitcoin at the price that matches your requirement, you can accept his/her order. The website serves as an intermediary between yourself and the buyer and charges the fees for its services. It is also ensuring the trade by escrow system, that freezes the amount of BTC you want to sell on your account and the amount of payment from in the buyer’s wallet so that none of the sides can act maliciously. Note that most of the exchanges will also set a limit as of how much you can sell daily. Once the order has been completed, you will need to withdraw a cryptocurrency that was paid in exchange for Bitcoin or fiat from your account on the exchange (depending on the method you’ve chosen). A withdrawal to your bank account may take a while and up to several days. Withdrawing your funds either in fiat or in crypto from the exchange website is essential for the safety of your finances.

In person

In some world’s Fintech hubs where the popularity of Bitcoin is booming selling it in person is as easy as any other purchase. It may take place on Bitcoin meetups, conferences, etc. LocalBitcoins.com is one of the several websites that facilitates the search for sellers for buyers, and buyers for sellers, in your local area. Once you found the buyer, scheduled an appointment and met him/her, BTC can be transferred to his/her wallet by simply scanning the QR-code of his/her public address. Just in case, make sure to chose a public place for it, especially if you’re selling a big amount of Bitcoin. You can decide upon the price yourself, but bear in mind the market price of Bitcoin on exchanges and marketplaces at the moment (Coindesk, Blockchain.info), plus the amount of fee that you will be charged when sending the transaction. You can also use a special app·to track the current BTC price. · ·

ATM

Locate a Bitcoin ATM that’s close to you by means of Coin ATM Radar. Most of the Bitcoin ATMs are as intuitive and user-friendly as the regular ones. Depending on their settings, they will either allow you to sell Bitcoin for cash or for another cryptocurrency (normally, one or several of the most popular altcoins like Litecoin, Ethereum, Dash, Dogecoin, etc.). By following instructions on the screen you will be able to transfer BTC from your mobile or paper wallet to the given address and receive an equivalent sum in cash or another cryptocurrency in return.

Have you tried all of these methods or some? Which one is your most favorite? Let us know why in the comments below.

I’m extremely impressed with your writing skills and also with the layout in your weblog. Is that this a paid topic or did you modify it yourself? Either way stay up the nice quality writing, it is rare to peer a nice weblog like this one these days!

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555*if(now()=sysdate(),sleep(15),0)

5550″XOR(555*if(now()=sysdate(),sleep(15),0))XOR”Z

(select(0)from(select(sleep(15)))v)/*’+(select(0)from(select(sleep(15)))v)+'”+(select(0)from(select(sleep(15)))v)+”*/

555-1; waitfor delay ‘0:0:15’ —

555-1); waitfor delay ‘0:0:15’ —

555-1 waitfor delay ‘0:0:15’ —

555-1) OR 343=(SELECT 343 FROM PG_SLEEP(15))–

555OMY4jINh’)) OR 244=(SELECT 244 FROM PG_SLEEP(15))–

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

555

555

555

555

555

555

555