Institutional interest sparks a Bitcoin rally

Bitcoin price has experienced a significant increase today, rising 5% and reaching a two-week high over $28,000. This surge can be attributed to the recent victory of Grayscale Bitcoin Trust (GBTC) in its case against the U.S. Securities and Exchange Commission (SEC). The decision by U.S. Court of Appeals Circuit Judge Neomi Rao has amplified the growing institutional interest in Bitcoin. Companies like BlackRock and Fidelity Investments, both of which are set to hear answers about their BTC spot ETFs on September 2nd, are contributing to this rally.

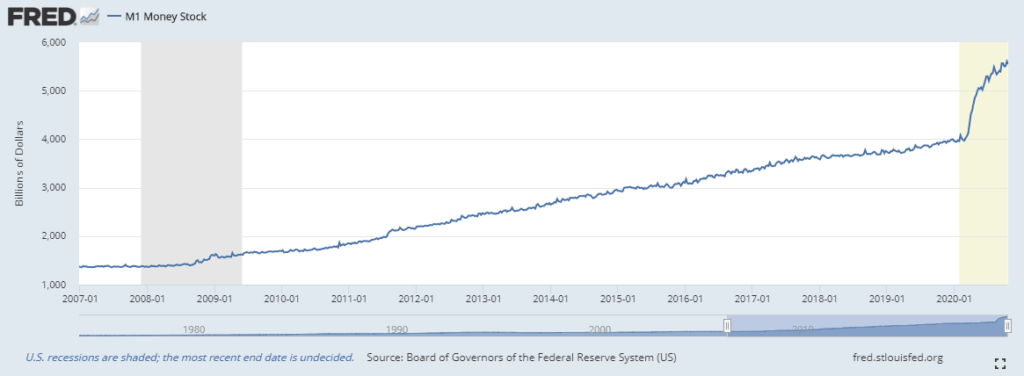

Lower exchange BTC supply

Another reason behind the Bitcoin price increase is the decreasing BTC supply on exchanges. The BTC supply on exchanges is currently at its lowest level since January 2018. This decline is seen as a bullish signal by the market, as it indicates that traders are withdrawing their BTC to hold it in self-custody for the long term. On-chain data also reveals that exchanges have been shedding Bitcoin since May 2023, suggesting that a significant number of Bitcoin investors are positioning themselves for a price rally.

Liquidations could be sending Bitcoin price higher

The departure of Bitcoin from exchanges has resulted in increased volatility. In the past 24 hours alone, over $46.5 million worth of BTC shorts have been liquidated, with over $100 million in shorts being liquidated across the entire crypto market. Despite this losing streak for short-sellers, 48% of the futures market remains short on Bitcoin price. This high ratio creates the potential for a short-squeeze, which could lead to even greater upside for Bitcoin price.

Bitcoin Fear & Greed Index shows market is still fearful

Although Bitcoin price has been on the rise, the market sentiment is still leaning towards fear. The Bitcoin Fear & Greed Index, which measures the overall sentiment of the market, is down over 13 points compared to the previous month. This indicates that despite the recent price increase, there is still a significant degree of caution among investors.

Grayscale victory over the SEC

The recent ruling by Judge Rao in favor of Grayscale in its case against the SEC has had a positive impact on the Grayscale ETF. The discount of the ETF is approaching 2023 highs, reaching under 25%. This victory is a boost for the Grayscale ETF and further contributes to the overall increase in Bitcoin price.

Growing institutional interest in Bitcoin

The growing institutional interest in Bitcoin is another factor driving the current price rally. Companies like BlackRock and Fidelity Investments, two of the largest asset managers in the world, have shown interest in Bitcoin and are scheduled to hear about their BTC spot ETFs in the coming days. Additionally, there are numerous applicants for spot Bitcoin ETFs, including BlackRock, Fidelity, Cathie Wood’s ARK, and 21Shares. BlackRock’s status as the largest asset manager globally, with over $8.5 trillion in assets under management, further solidifies the significance of this institutional interest. These companies also plan to utilize Coinbase for BTC custody, indicating a growing acceptance and integration of Bitcoin within traditional financial systems.

SEC’s refusal to approve a spot Bitcoin ETF

Despite the increasing institutional interest, the SEC has repeatedly refused to approve a spot Bitcoin ETF. The regulatory body has voiced concerns over fraud and the overall soundness of Bitcoin. This lack of approval has been a significant barrier for many applicants, including BlackRock, Fidelity, Cathie Wood’s ARK, and 21Shares. However, there is hope that the upcoming hearings in September could bring about a change in the SEC’s stance.

Coins leaving crypto exchanges

The decrease in BTC supply on exchanges is seen as a bullish signal by the market. The balance of BTC on exchanges is dropping, reaching its lowest level since January 2018. This indicates that traders are withdrawing their BTC for long-term self-custody, further supporting the notion of a price rally.

Short-seller losing streak in the futures market

Despite the ongoing price increase, a significant portion of the futures market remains short on Bitcoin price. This creates an opportunity for a short-squeeze, as the high number of shorts could potentially lead to greater upside for Bitcoin price.

Bitcoin price showing bullish momentum in the short-term

The recent Grayscale ruling and the liquidations of shorts have had a positive impact on Bitcoin price. As a result, Bitcoin price has reached a two-week high. However, despite this bullish momentum, the Bitcoin Fear & Greed Index indicates that the market is still fearful, suggesting that caution is warranted.

In conclusion, there are several reasons behind the current increase in Bitcoin price. Institutional interest, indicated by companies like BlackRock and Fidelity Investments, has sparked a rally. The lower supply of BTC on exchanges, liquidations of shorts, and growing institutional interest have all contributed to the price increase. However, the market sentiment remains fearful, and the SEC’s refusal to approve a spot Bitcoin ETF continues to be a point of concern. Nonetheless, Bitcoin price is currently showing bullish momentum in the short-term, indicating potential for further growth.