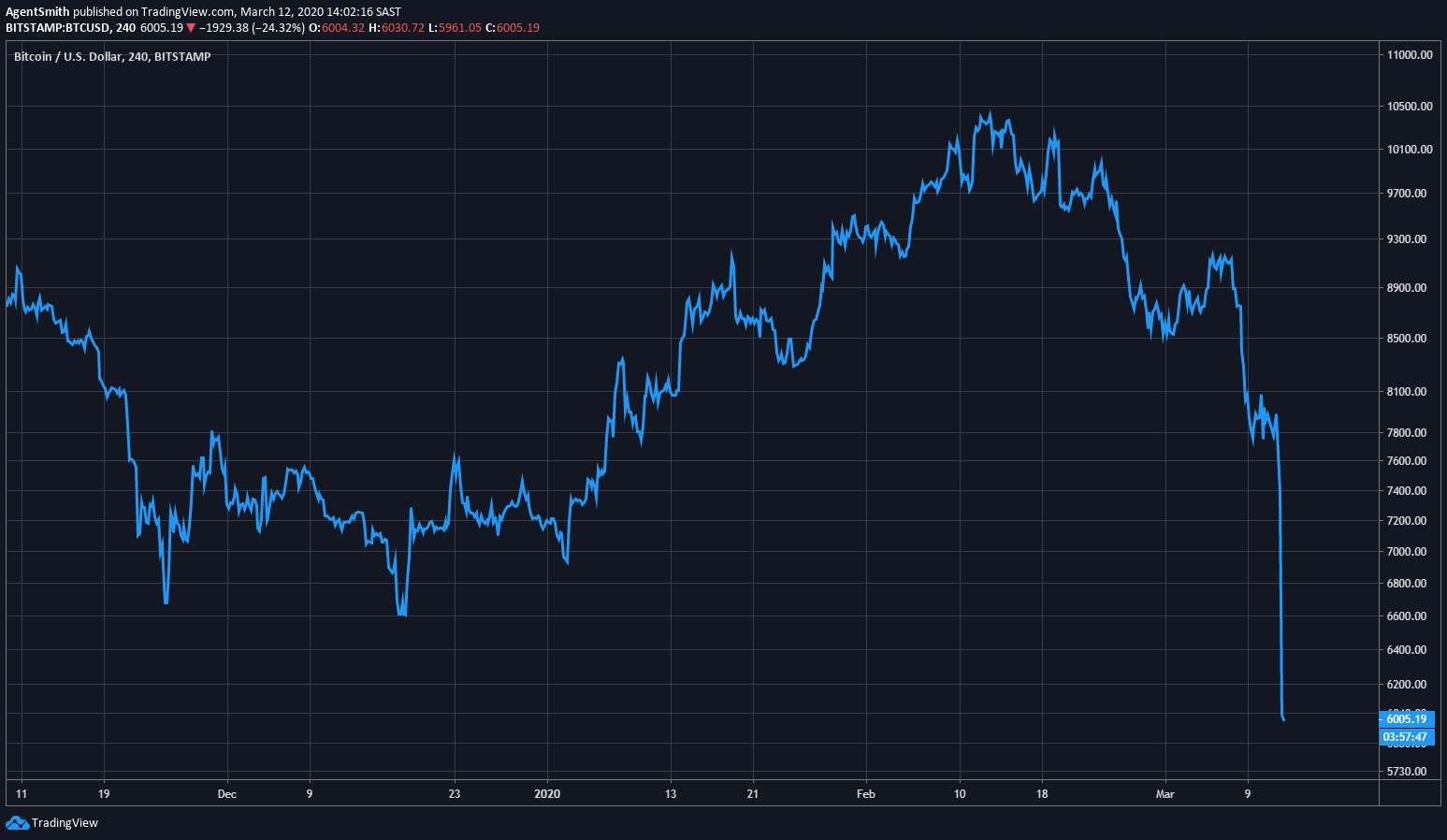

- Bitcoin fell through the floor on Thursday as sellers pushed the price of the flagship cryptocurrency to a new year low of $5,720 a coin.

- Risk markets remain in turmoil even after U.S. President Donald Trump tried to calm investors and consumers with a national address.

- Peter Schiff predicted the 2008 crash, but will his predictions turn out to be accurate for crypto too?

Despite a stellar start to the year, bitcoin is now officially in the red after massive selling pressure caused the price of the leading cryptocurrency to plunge almost 30% on Thursday.

CryptoCoin.News recently reported that bitcoin’s safe-haven narrative was under threat, and that theory now appears to have been debunked as the price per coin touched a ten-month low of $5,720.

The drop follows the ongoing rout in equity markets in which the Dow Jones officially confirmed a bear market on Wednesday now down more than 20% for the year.

Thursday’s action looks equally ominous as stock futures hit limit down, halting trading overnight for the second time in less than a week.

Trump Travel Ban & National Address Does Little to Calm Markets

Several black swan events, including the weekend oil shock and the Coronavirus (Covid-19) crisis, have converged, creating what appears to be a perfect storm for financial markets.

U.S. President Donald Trump tried to calm investor’s nerves on Wednesday with a national address claiming the recent selloff was “not a financial crisis”:

Our vast economic prosperity gives us flexibility, reserves, and resources to handle any threat.

"This is not a financial crisis. This is just a temporary moment of time that we will overcome together as a nation and as a world." pic.twitter.com/6gIfhrFguz

— The White House 45 Archived (@WhiteHouse45) March 12, 2020

The President also took the wide-sweeping measure of banning all travel from Europe, excluding the U.K, for the next 30 days in an effort to prevent further contamination from Covid-19.

Outside of China, where the novel flu originated, Italy has the most infections. Crypto market commentators are blaming the extreme travel measures for the massive drop in prices; however, there is little evidence to suggest the two are in any way correlated.

Will Stock Market Crash Expert Peter Schiff Be Correct on Bitcoin?

Perhaps the only investor smiling on the day was fabled 2008 stock market crash predictor and bitcoin-basher Peter Schiff, who has been calling for crypto’s downfall for several years.

Even gold, which Schiff religiously punts, was down on the day, however, its losses (1.8%) paled in comparison with the general crypto market:

As #Bitcoin crashes below $6K, down almost 20% this year, hodlers can take comfort in Bitcoin not being the worst performing asset of the decade. For now, that distinction belongs to oil, which is down by 50%. But at the rate Bitcoin is falling this comfort may not last long.

— Peter Schiff (@PeterSchiff) March 12, 2020

Elsewhere among the top ten coins, Ethereum was down almost 44% at one point while XRP fell sharply by 32%.

Bitcoin Cash and Litecoin also suffered heavy losses, down 37% and 33%, respectively, before paring back some losses.