Note: Many want to find best reviews or opinions about the up and coming ICOs. So this is a full disclosure, my articles are NOT any form of advice or recommendation. This post will be as neutral as possible with stating key points and facts about this ICO: Covesting.

Project Brief

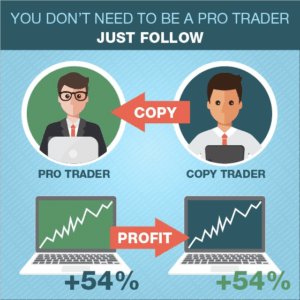

“Bringing a copy-trading platform to the cryptocurrency markets”

The main idea behind Covesting is to provide a social platform for investors, whether experts or fresh, to copy professional traders who are very successful in their trade and earn the same capacity as them. Of course, there are handling fees and commissions that will be calculated into the investment.

The ICO

ICO Coin Name: COV

Covesting is currently on the Pre-ICO phase during the publishing of this article. The pre-ICO end date is 19th of November 2017 with a cap of 1,500,000 coins (7.5% of total coins). COV is priced at 1 ETH to 300 COV

They will not be waiting long before they start their public ICO on the 24th of November and will run for 30 days. The hard cap is 100,000 ETH.

Team

Covesting has a total of eight in the main team. Two co-founders, three software engineers, a marketing & PR person, Business Development and Digital marketing.

All in all the team does seem strong enough. Covesting is a trading platform and the co-founders are experienced traders, so might help their investment conversion.

Personal note, this will certainly come up in the global perspective, there are no women what so ever on the team. Something to be aware of.

MVP

My favourite part of the analysis. To someone in the Startup ecosystem an MVP is one of the most crucial requirements for a Startup. In the website, they say that they already have a prototype in development. There is no evidence of it on their Github website, which only has a forked EIP repository and a smart contract project.

If their claim on current work is development it would be extremely useful to showcase it, even on a blog with some snapshots.

“Their (covesting) GitHub repository is empty only the ICO contract so in other words …empty” Julien Bouteloup, Blockchain Technical Expert

Intellectual Property

At the moment, none. There might be something there in the near future with a certain automatic matching algorithm to match investors profile with the professional traders.

Whitepaper

NO content or summary of the paper!

There are some good details in the whitepaper. You might not notice it but some parts of the Business model have been covered.

They talk about the Problem: When it comes to successful traders most are overlooked by potential investors looking for a reliant Digital Assets Managers. From the Investors point of view, there isn’t a good central venue that aggregates such successful Traders.

They also talk about the Solution, which is simply a centralised platform with social reputation building for traders that investor can trust coping their trade portfolio.

They obviously elaborate in detail about the product specifications and it will work.

What is missing is market entry strategy How are they going to attract the investors and traders to use their product. The competitive advantage, what differentiates them to other similar platforms. The competitors themselves! It is essential to know your competition, which I’m sure the team knows who they are. Potential investors would like to know as well.

They also mentioned that they passed the SEC (USA’s State Examination Commission) Howey test. Showing the results of test score can be very helpful.

Milestone

The roadmap on the website was standard like most other roadmaps you see on other ICOs. Basic and to the point.

The roadmap in the whitepaper is more detailed with a timeline that reaches beyond May 2018 where they are launching a mobile app among other points. Now, it does mention that a prototype version, which I’m guessing/hoping is a public beta of the platform on the same day of their public ICO. Not sure how strategic that is since no work has been publicly seen yet.

Value Proposition

“The Tender of copy trading?”

From they are saying Investing wants to establish itself as the eToro of match trading Asset managers with investors utilising blockchain smart contract technology. The main difference I see between Covesting and other major players already in the market is a price war, basically, an attractive commission structure for all parties involved.

Legal Entity

Nothing is mentioned on any of their media channels or whitepaper where Covesting as a company will be based. Are they already a registered company to begin with?

Website Quality

The website is protected through Cloudflare firewall servers, which is a good thing. This will be essential for the digital handling for the ICO transactions. The SSL certificate is issued by COMODO through Cloudflare. The domain registrar seems to be GoDaddy. I personally use them and they are one of the top hosting sites out there.

This does indicate well managed website and the security level is high, which can be safe enough to token sales.

Social presence

Here are some statistics on their social media during the post of this article:

Medium is their main blogging channel with 38 followers, Twitter (2204), Facebook (1051), Reddit registered as a user with no subscribers, LinkedIn (12) and Telegram (815).

Most of the social activity seems to be healthy and active. LinkedIn is low and it is key to grow the professional traders’ portfolio.

Bottom line

There was no mention of lost trades, or at least I didn’t read anything on that point. Does the trader or investor still get charged if there was a trading loss? Are there repercussions to the trader if there was a bad investment?

They do seem legitimate enough with a genuine desire to kickstart a digital trading company, but with no legal entity (at least not publicly visible) or a clearer and more robust business model. They might fall short on delivery, especially there is no recorded validation from potential customers. Plus from the looks of it they are entering a very competitive market.