Important Dates: Dec 29 – Public sale ends

Number of Tokens: Max 1.285 Billion

Hard Cap: $15 Million

Token Type: ERC-20 token built on the Ethereum blockchain. Mainnet token in January.

What is Nau?

Nau is a platform that links customers and retailers together via digital coupons. A retailer that wants to attract more customers can put an offer on the platform that a customer can redeem for a discount. Nau will charge a 5% fee of the value of each redeemed voucher.

What is the problem Nau wants to solve?

There are a series of issues with the current coupon market listed in the whitepaper. While I would disagree that some of them are actually issues (e.g. huge discounts are the only option), there are some valid issues with the current coupon industry.

- Payments to middlemen: Coupon services charge a huge fee for coupons to be listed. The whitepaper quotes up to 50%.

- Users are spammed by offers they do not want: Nau claims that it can offer more targeted offers based on past user behaviour.

- Users are not motivated to share: In traditional coupon campaigns, users receive the coupon and spend. They may share it with a friend, but there is no incentive to do so. In Nau’s platform users that share coupons will be given a portion of the fees paid by the retailer.

What is Nau’s Business Plan?

I was pleased to find a marketing plan in the Nau whitepaper, something that most other ICOs have not even considered. Nau has clearly defined its market and explained that it wants to start operations in five different countries to begin.

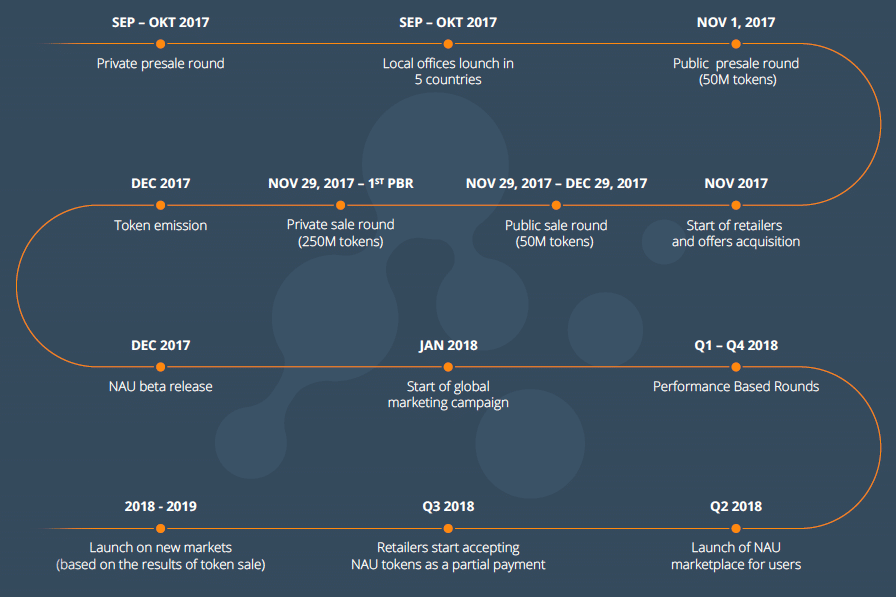

They also have a detailed map map which is below and describes milestones up to 2019.

ICO

The ICO is currently ongoing and is scheduled to finish on Dec 29th.

After the main net goes live, ERC20 Nau tokens can be redeemed for main net tokens.

Token Utility

The Nau token is the form of payment for using the platform. There is no other use case based on the token section of the whitepaper

The Team

Nau is incorporated in the Cayman Islands but appears to be based in Berlin. Despite being based in Berlin, the team is mostly Ukrainian.

The CEO of Nau is Yaroslav Shakula who has quite of bit of start-up experience. I am slightly concerned about how dedicated he is to this project, given that he has two other positions on his linked in profile that are still active.

Hype

Nau received some good press from Inc where it was named one of the top 10 ICOs of 2018 (despite having their ICO now).

However, there are only 426 members in Telegram, which is dire. This is a very poor number for a project in the midst of a token sale, and means that Nau has virtually no visibility amid the glut of ICOs that are currently taking place.

The progress of the token sale clearly shows the lack of hype. The sale has only raised about $650,000 thus far – significantly off the $5 million hard cap.

Competition

I feel that there are two main types of competition in this space: Coupon Services and In-house services.

Coupon services include companies such as Groupon, which have not been doing well lately. In house services would be retailers offering their own coupons via print or online media advertising.

Both of these markets will be difficult to crack given that there are large entrenched players. Nau will need network effects in order to be successful – otherwise there will be no token liquidity.

Risks

Lack of Focus: According to its roadmap, Nau has already opened offices in five countries (Germany, Russia, Colombia, The Phillippines and Ukraine). It is not clear to me why Nau can’t just focus on one country to refine its product and then move into others at a later date. It feels like Nau is trying to expand too quickly and spending too much money for the country offices.

Tokenisation: It is unclear to me how customers will be able to change Nau tokens into real money. I can’t imagine that an old lady (a prime user of coupons) would have the technical skills to open an account on an exchange in order to change tokens into a few dollars and then get them sent to her bank account. It doesn’t make sense.

Scores

Fundamental Indicators

Concept: 3

The concept for Nau makes sense. There are a lot of current issues with the coupon industry that need disrupting. However, whether that disruption is most appropriate using Nau’s solution is an open question

Token Utility: 0

If the Nau token were replaced by fiat currency it would work just as well. Nau is the kind of project that is building on a token in order to raise money more easily.

Status: 2

It is unclear to me how advanced the project is. Nau was launched in in July 2017, and the roadmap indicates that a beta is supposed to be release around now. However, at the moment this remains a whitepaper project, as there is little evidence much has been accomplished.

Team: 3

The team is reasonably good, with strong experience in start ups.

Competition: 2

There is significant completion in this sector that will be difficult to dislodge.

Technical Indicators

Market Cap: 4

The project has a low market cap of 15 million. This is a reasonable number for an ICO.

Hype: 1

There is virtually no hype for this project and there is a serious risk the project won’t reach its funding targets.

Investment Horizon

Short Term: I don’t have strong short term expectations for this project. There is little information about the project’s technical progress. The scope for expansion is too fast, and there is little hype. All of these factors point to poor short term potential.

Long Term: The long-term view is similar. The muddled business strategy and entrenched completion make this project a major risk. While the idea s good in principal, bolting on the blockchain aspect and tokens in fact increase the risk (as there will need to be token liquidity for it to work).

Conclusion:

With the current state of the crypto currency market, investors are spoiled for choice when making investment decisions. Nau does not rank highly compare to some of these project, so I would give it a miss.

Overall Score: 2.3/5