Important Dates: Dec 6 – Token Sale begins

Number of Tokens: 100 million

Cap: $19 million USD

Token Type: ERC-20 token built on the Ethereum blockchain

Whitepaper: https://locipro.com/wp-content/uploads/2017/11/loci-full-whitepaper.pdf

What is Loci?

Loci’s mission is to change the way the world invents and values ideas. Loci aims to set up a registry for patents that is built on the blockchain and is therefore immutable. Users can put their patents on the platform. Buyers are able to buy intellectual property on the platform using Loci Tokens. InnVenn, the name of Loci’s platform, already exists, which is more than most ICOs that just have a whitepaper.

What is the problem Loci wants to solve?

The system for filing patents operated under a ‘first-to-file’ system. This means that the first person to the patent office will be able to register their patent. Costs to file patents are also very expensive. This system favours large companies, rather than small inventors.

What is Loci’s Business Plan?

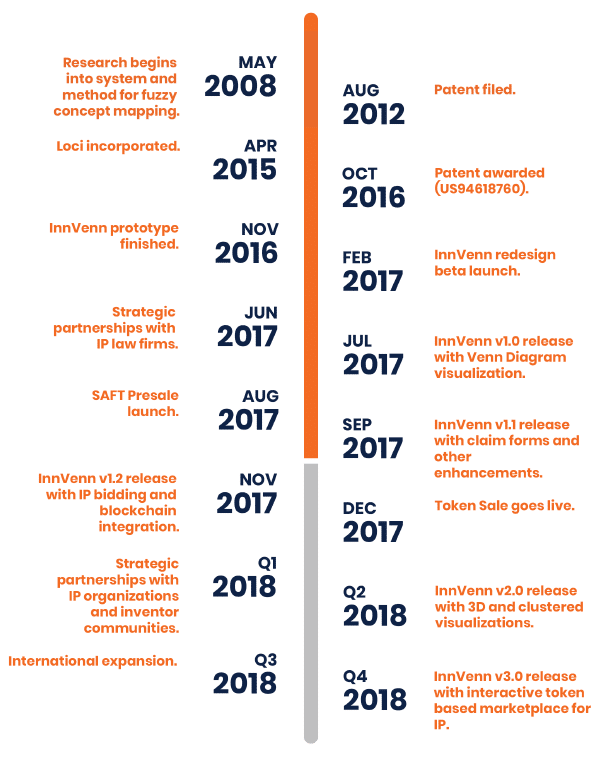

Unlike many other ICOs that just have a whitepaper, Loci has been around for a while. A patent for their system was filed in 2012 and the company was set up in 2015. Their product, InnVenn has already been launched. Their road map is pasted below:

The target segment of Loci’s platform has also been clearly established in the whitepaper. Not only are inventors viewed as a target market, but also attorneys, researchers and investors

ICO

Loci’s ICO is planned to begin on Dec 6 and finish on Dec 31. The ICO has a structure that strongly awards early investors with a net price per token of $0.33. On the other hand, latecomers will have to pay $0.75 a token! This kind of bonus structure strongly encourages dumpling to take place. Those that buy at 33 cents can sell at 50 cents and make a profit, but those stuck at 75 cents can’t do much.

Token Utility

As far as I can tell, the Loci token’s use is as a form of payment to use the InnVenn platform. Why can’t fiat currency be used for this function? There is nothing innovative about the token structure and from my perspective, it appears as though the Loci team is using a token structure as a way to raise money for their platform more easily than from venture capital. This is a big red flag for me.

The Team

The team is headed by John Wise. On his education section of Linkedin, the ‘Aviation Institute of Maintenance’ receives top billing. He has some engineering experience prior to Loci, but there is nothing that stands out. The Director of Technology, Eric Ross has a degree from Grove City College and formerly worked for the National Restaurant Association. There is a lack of entrepreneurial experience from this team, and nothing in their educational backgrounds that is particularly impressive.

Unhelpfully, there is no profile information about advisors on the Loci website. There is just a list of names and photos. However, none of the names stand out or are well known in the blockchain community.

Hype

Loci has had some positive media coverage from Inc.com which declared that it was one of the top 5 ICOs of 2018 (although in this case the ICO will be in 2017…). There are a few other stories from other crypto media outlets as well.

However, Loci has only just over 500 people in its telegram group. This does not bode well for its ICO prospects. Successful ICOs have 5000+ members in Telegram groups.

Competition

There is already significant competition for Loci I the form of the below four companies.

- Treparel has been around for a few years and was acquired by Evalueserve in 2015. Evalueserve is a big Swiss company

- Innography is a patent search company that has been around since 2015.

- Mapegy is a German company that offers patent search.

- Intellixir was set up in 2002 in France.

Risks

Cash Grab: From my reading of this project, it appears as though Loci is having a token sale as a way to obtain funding, not because a token is a needed part of their project. This likely means that they have had difficulty in obtaining conventional venture capital funding, and saw an ICO as an easy way to raise money. If the venture capitalists have stayed away – maybe small investors should as well.

Lack of Traction: This kind of project only works when everyone is using the platform. If only a few investors sign up to use Loci – the project will fail. In that sense, it is very high risk, as the current system is entrenched and people will be loath to give it up (despite its many flaws).

Scores

Fundamental Indicators

Concept: 4

Loci has a great concept. The patent system is in need of innovation and Loci offers a great solution to resolve its issues. Building it on the blockchain is also useful as it ensures that the information is accurate, which is critical for something as important as inventions.

Token Utility: 0

The token has no utility beyond payments. There is no reason why a token needs to be used for this project to succeed.

Status: 4

Unlike most of other ICOs, Loci has a working product. It is unclear how competitive the product is compared to competitors. There is a $249 fee to use InVenn

Team: 2

The team lacks big names and relevant experience. This is one of the weaker teams I’ve seen in the ICO space.

Competition: 2

There is already significant competition from established companies in this space. Loci’s main innovation is that it is based on the blockchain. Is this enough for it to be able to compete effectively against the incumbents?

Technical Indicators

Market Cap: 4

Loci has a small market cap which is great for investors. Small market caps can more easily have higher returns.

Hype: 2

There is virtually no hype for Loci beyond a few media reports.

Investment Horizon

Short Term: I am not optimistic on Loci’s short term investment prospects. There is very little hype for the project and it seems like they are having an ICO as a way to refill the coffers and not deal with venture capitalists

Long Term: I am also not optimistic about the long term prospects of Loci. There is plenty of competition in this space and very little to distinguish Loci’s product, beyond that it is a ‘blockchain’ project.

Conclusion:

With the amount of ICOs to choose from, there are better choices than Loci for investors. There are too many risks to consider this as a potential investment.

Overall Score: 2.6