Swissborg ICO Review

Important Dates: Nov. 21st – ICO begins

Number of Tokens: 1 billion CHSB, 35 Billion CSB

Cap: CHSB= CHF 50,000,000 and CSB= ETH 350,000. Total cap is about USD $150,000,000

Token Type: ERC-20 token built on the Ethereum blockchain

What is Swissborg?

Swissborg describes itself as a ‘Community-centric cyber bank project’. Swissborg is a bank that will offer financial advisory, investment management and other financial services for cryptocurrencies. They have been building a robo-advisor since 2015, and have decided to reorient this to serve cryptocurrencies rather than traditional finance.

https://youtu.be/tcj0ZC9LsME

What is the problem Swissborg wants to solve?

Currently, there is no single place where a crypto currency holder can obtain financial services. There are many projects that offer parts of this service (e.g investment management, cold storage, tokenization of assets). Swissborg aims to bring all of these disparate functions under one roof.

What is Swissborg’s Business Plan?

There is a project roadmap in the technical whitepaper, but it is quite vague and only contains details about what the project hopes to achive in the upcoming years, not how they will achieve this.

There is no marketing plan as part of the roadmap. While it sounds like Swissborg is trying to market itself as a sort of ‘Swiss Bank of Cryptocurrency’, this connotation leads to the belief that it will target high net worth individuals. However, the crowdsale and community involvement point towards a different sort of market target.

I was able to locate a very optimistic set of financial projections in the technical whitepaper. I think the 2018 numbers look reasonable (as long as the market keeps rising). Numbers beyond that depend on project success.

How is Swissborg’s Whitepaper?

The whitepaper is full of fluff (it takes 12 pages to start talking about the project). Grammatical errors in the whitepaper lead me to question the professionalism of this project. See this gem of a sentence:

A place, where you can safely store & manage your crypto assets by getting access to a large numbers of asset services: from asset tokenization to derivatives and exchanges traded place.

What does this even mean? What is an ‘exchanges traded place’? The whitepaper is littered with poor formatting and other example of poor grammar.

https://swissborg.com/files/swissborg-technical-whitepaper.pdf

The technical whitepaper is better and offers more concrete details of the project, including a roadmap and details of the project’s minimum viable product.

ICO

This project has attracted a surprising amount of money in its presale ($20 million) mainly from Swiss Private Banks, Family Offices and Angel Investors. The project has several funding milestones that guide what kind of project will be created. It is unclear if the presale feeds into the milestones.

Token Utility

Swissborg uses two tokens for its project: CHSB and CSB

https://swissborg.com/en/chsbtoken.html

The CHSB token allows holders to vote of technical development of the project and share in revenues. Revenue will come from transaction fees and performance and management fees. The token will initially be issued on the Ethereum network, before a native blockchain is developed at which point the ERC-20 tokens will be swapped. This token has a funding target of 50 million CHF

https://swissborg.com/en/cryptalion.html

The CSB Token gives access to a multi-strategy token hedge fund called Cryptallion. Returns from the fund will be distributed quarterly. The CSB token has a funding target of 350,000 Ether.

The Team

The team already consists of 15 members. Swissborg has a good presence on Linkedin with team members listing it as their place of employment. Swissborg has two websites listing the team members, the main site and the Medium site.

The team profile section on the Medium site is not great. I don’t care that Cyrus Fazel (the founder) was into breakdancing and hiphop. There are similar profiles for all the team members. Despite the superfluous information, the founder does have good experience in private banking and venture capital. Other team members also have good experience.

There are 8 advisors attached to the project, probably the most notable being Miko Matsumara of Pantera Capital.

Hype

The telegram site has 1015 members and 1126 followers on Twitter. This is pretty poor. Successful ICOs usually have upwards of 10000 members in their telegram.

Competition

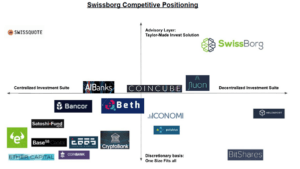

The whitepaper provides a helpful diagram that describes Swissborg’s positioning in the market:

I will look at a couple of these projects and compare them to Swissborg

Bancor: Bancor is a protocol that allows ERC-20 tokens to be exchanged with other ERC-20 tokens. In addition is allows the introduction of smart contracts into this exchange process. Bancor only competes against a very small part of Swissborg’s proposed business model.

Melonport: Melonport offers an infrastructure that aspiring hedge funds can use to launch a crypto fund. Melonport has its ICO in Feb 2017, so has a big head start over other projects.

Risks

Competition: As outlined above there are many other projects that are tackling some of the issues Swisssborg is tackling. The difference is in the scope. A focused company is likely to have a product built more quickly than one that is looking at everything.

Regulation: Banks are highly regulated and it will be very difficult for Swissborg to operate internationally across multiple jurisdictions. There is nothing in the whitepaper to describe how they will grapple with this issue.

ICO Performance: This ICO has a very high market cap and there is a strong likelihood that it will not raise all the money intended. This could cripple the project’s potential as will not have enough money to develop all the services it has envisaged in the whitepaper.

Evaluation

Fundamental Indicators

Concept: Good

Swissborg does have a good idea. There is a need for a bank that offers all the services it plans. However, I think the team is biting off more than it can chew. Most other project tackle a component of the banking ecosystem, and these projects take time to get off the ground. I don’t see how the team can fulfil its promises in the whitepaper without sacrificing quality.

Token Utility: Not completely compelling

This project does not need a token to exist. A plain old share would offer the exact same utility. The team clearly believes that they can raise more money by packaging this project as an ICO and tapping into the strong demand for cryptocurrency based projects.

Status: Good progresss, but more to do

While Swissbog has been around since 2015 developing its roboadvisor, the current project is not as far along. The team has developed a prototype for its fund solution which is on Github (but not updated in over three months). This is good progress. However, considering all the features promised in the whitepaper, there is still much progress to be made.

Team: Good to promising

The team has good experience and advisors and are qualified to succeed in bringing this project to fruition.

Competition: Good oportunity

Yes, there are lots of competitors, but Swissborg is trying to look at multiple aspects of crypto finance at the same time. This makes Swissborg a bit unique and perhaps less affected by competition than a pure copycat project.

Technical Indicators

Market Cap: Too high

A +$150 million market cap is a joke. There is simply no way the project can hope to raise this much money, especially when community engagement is sorely lacking. In this climate where even $30 million ICOs are struggling to give good returns to investors, a project with a market cap so high should not even be contemplated as an investment.

Hype: Not much

There is little community interest in the project and few mentions in the media. Telegram and twitter have few followers and there is little evidence of any interest from small investors. Marketing needs to seriously improve for this project to be worthwhile to investors.

Investment Horizon

Short Term: Extremely Poor. Because of the high market cap, investors have a near guaranteed chance to lose money in the short term on this project.

Long Term: Neutral. There is a lot to like in this project. The team is good. The idea is something that is needed in crypto. However, the business plan is unclear. The marketing is unclear and poor and the long term value of the project is dependent on how much traction the team can gain in the token sale.

Conclusion:

Swissborg has some good ideas, but I’m not completely convinced about an investment in the ICO due to the large market cap. It may be worth relooking at the project post-ICO to see what kind of progress is being made. I think the team could pull it off, so I would have another look at this project in a few months’ time.