How Did Nexo’s Price Fare Yesterday?

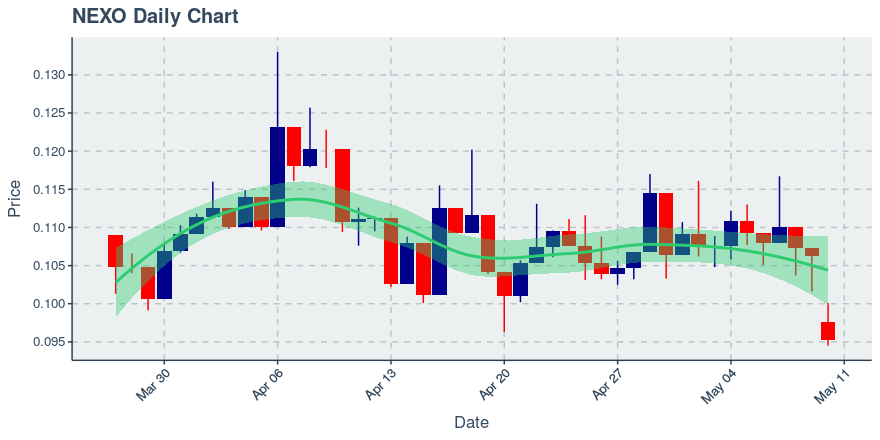

Nexo’s current price, at the time of this writing, is $0.09521 USD, down by approximately 10.43% from the day prior. This marked the the 3rd straight day Nexo has been down; it is still in a unclear trend, and is currently 11.14% below its 20 day moving average; staying above this level may be critical to sustain short-term momentum. From another vantage point, note that price has gone up 4 of the past 10 days. As for the volume underlying yesterday’s move, note that the price change occurred on volume that was approximately 41.27% less than its 7 day average volume.

Traders looking for a range to trade within may wish to note that the Bollinger bands (a price indicator based on recent momentum and volatility) for Nexo imply the currency may oscillate between $0.098632 and $0.115659, based on how price has behaved in the two weeks prior. Price’s current proximity to the bottom of the range may make buying an attractive opportunity to traders interested in trading the range.

The market capitalization of Nexo, or the amount of US dollars it would take to buy up all the circulating coins, is currently estimated to be $55 million.

Update on Transactions and Holders

Over the past 24 hours, 317 transfers have been added to the blockchain recording transactions amongst holders of Nexo. Regarding a tally of holders, Yesterday saw Nexo’s wallet count rise by 36. To understand loyalty or repeat usage amongst holders of Nexo, we can note that there were 120 wallets making a transaction yesterday, while 1,745 wallets have sent or received tokens in the past month; this imputes a daily active wallet to monthly active wallet ratio of about 0.07.

Just How Rich are Nexo’s Richest Holders?

As for wealth distribution, the richest 1,000 wallets currently own 109.28% of the money supply. This number is greater than 100% because many of the token holders are not able to sell them yet, and thus their numbers are not included in the supply yet, though they can be regarded as future sellers when they are able to sell. If we focus on exchanges, which may be an correlated with liquidity and greater confidence in the currency, the exchange wallets that are in the top 1,000 wallets own 4.45% of the currency’s total money supply. Exchange ownership grew by 0.1% over the past week, while the overall ownership percentage of the top 1,000 richest wallets grew by -0.09% over that time period. Nexo’s smart contract owns approximately 0.02% of its own total money supply. This amount hasn’t changed over the past week.

What’s Going on Social Media?

Facebook appears to be the most popular place to follow the company, and thus may be worth monitoring.

Article by SixJupiter