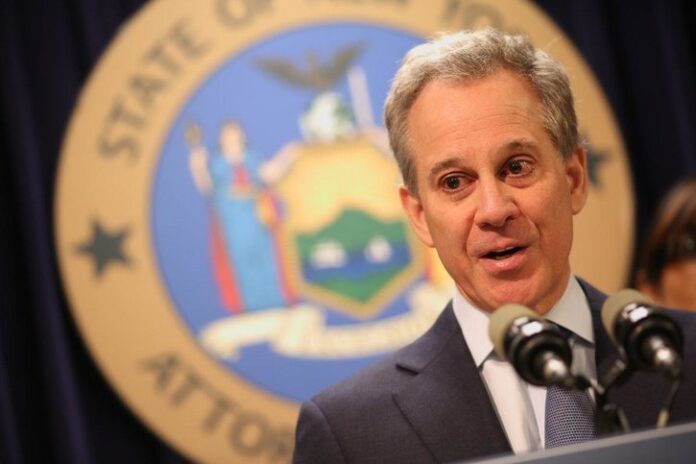

A recent declaration from the New York Attorney General, Eric T. Schneiderman, calls for crypto exchanges to be labeled as “Exchanges”. In the case of cryptos, the possibility for fraud is potentially increased due to the lack of regulation, which is why the office of the Attorney General of New York is seeking to clarify some of the most outstanding exchange platforms for virtual coins.

The office sent several inquiry letters to a group of exchange platforms, among which were Coinbase, Inc. (GDAX), Gemini Trust Company, bitFlyer USA, Inc., iFinex Inc. (Bitfinex), Bitstamp USA Inc., Payward, Inc. (Kraken), Bittrex, Inc., Circle Internet Financial Limited (Poloniex LLC), Binance Limited, Elite Way Developments LLP (Tidex.com), Gate Technology Incorporated (Gate.io), itBit Trust Company, and Huobi Global Limited (Huobi.Pro).

Clarity and liability on the table

To protect cryptocurrency investors in New York and nationally, the office of the AG has developed an initiative, Virtual Markets Initiative, on which Schneiderman stated:

“With cryptocurrency on the rise, consumers in New York and across the country have a right to transparency and accountability when they invest their money. Yet too often, consumers don’t have the basic facts they need to assess the fairness, integrity, and security of these trading platforms… Our Virtual Markets Integrity Initiative sets out to change that, promoting the accountability and transparency in the virtual currency marketplace that investors and consumers deserve.”

It is thought that the crypto community will welcome this attempt at transparency to reduce risk from fraud and allow genuine companies and traders to thrive. However, the “intervention” notice caused a drop in the prices of the market, leading Bitcoin and other cryptocurrencies back to previous levels. This does not necessarily signal an approaching bear market, it could represent a bullish opportunity counting on the fact that Mr. Schneiderman himself is the one behind the interventional initiative. Indeed, crypto prices have already started to recover now.

The actions taken by the AG office may not be what we were expecting, but they may solve various issues the market has been facing lately.

Schneiderman has shown his willingness to protect potential victims from lousy market practices. In fact, he recently announced a settlement with the company Harbert Management valued at 40 million dollars.

After all, this might be proof that the government of the United States will start to consider cryptocurrencies as regular assets.