Tether (USDT) has announced that it will conduct an official and independent audit of its stablecoin reserves.

Thanks for the chat on #Tether @dee_bosa! I thought it was a tough but fair interview. Thanks for allowing @paoloardoino & me to spend some time with your viewers. @CNBC @CNBCTechCheck @Tether_to

— Stuart Hoegner (@bitcoinlawyer) July 21, 2021

Let’s just get our Balances straight

As a centralized stablecoin, Tether must hold sufficient cash or cash equivalent reserves to ensure that every USDT token is backed one to one with a US-Dollar. For years, the crypto community speculated that the leading stablecoin provider was not completely honest though, until Tether’s lawyer confirmed in 2019 that USDT was undercollateralized by as much as 26%.

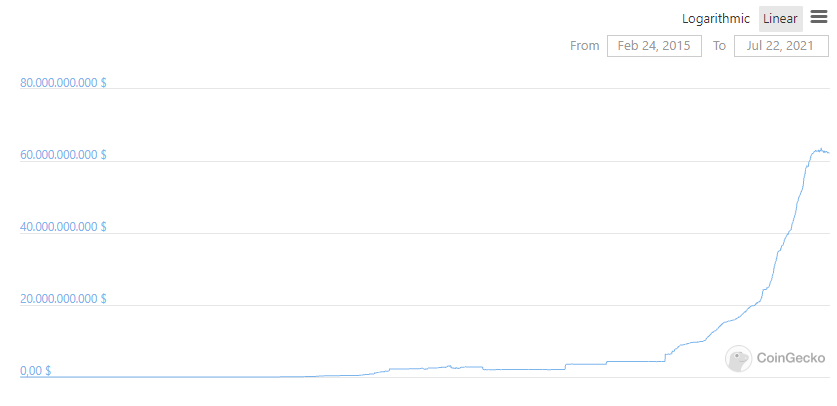

Despite all the controversy, Tether kept growing exponentially, with a two-fold market cap increase in 2019, an almost five-fold increase in 2020, and a three-fold increase since the beginning of this year. Since the end of May, the market cap has stabilized and is now hovering around the 62 billion USD mark.

Bit

Bit

Furthermore, Tether’s has become a lot more transparent in the last months, even revealing a complete breakdown of it’s reserves in May 2021. Their transparency efforts began after reaching a settlement with the New York Attorney General in February 2021 for a fine of 18.5 million USD. The settlement also demanded Tether to submit reserve reports on a regular basis.

In an interview with CNBC, Tether general counsel Stu Hoegner announced that the leading stablecoin will also conduct an official audit. However, as a time frame, Hoegner mentioned “months”, so there will be enough time for Tether to even up any imbalances in their reserves.

Alternatives to Centralized Stablecoins are growing

Paxos, one of Tether’s largest competitors, took a side blow, at the leading stablecoin, as well as Circle, who also recently released a full reserves report. In a recent blog post, Paxos criticised that both Circle (61%) and Tether (76%) only partially back their stablecoins by cash or cash equivalent, while the rest of their collateral is invested in yield-bearing financial instruments. Hence, Paxos advocates for a stronger regulation of stablecoins.

Meanwhile, decentralized stablecoins are gaining traction after the DeFi boom in Summer 2020. Under their token model, stablecoins are not collateralized centrally through USD equivalents, but through crypto assets. Examples for this are Maker, which backs its stablecoin Dai with collateralized debt positions, or Terra, which uses holders of their LUNA tokens as lenders of last reserve.

Finally, some projects that are widely seen as stablecoins, such as Ampleforth, use a dynamic that compensates spikes and troughs in demand. This however ties the token only loosely to a target price. During a demand surge in July 2020, AMPL traded for as much as 4 USD, right before crashing down to 0.60 USD during the months afterwards.