Crypto miners and stakers will not be subject to the IRS reporting rules, affirms the US treasury.

Earlier, the rules mandated crypto brokers to share data regarding their clients’ digital asset transactions with the IRS. Whether this applies to other market participants as well has been in a gray area.

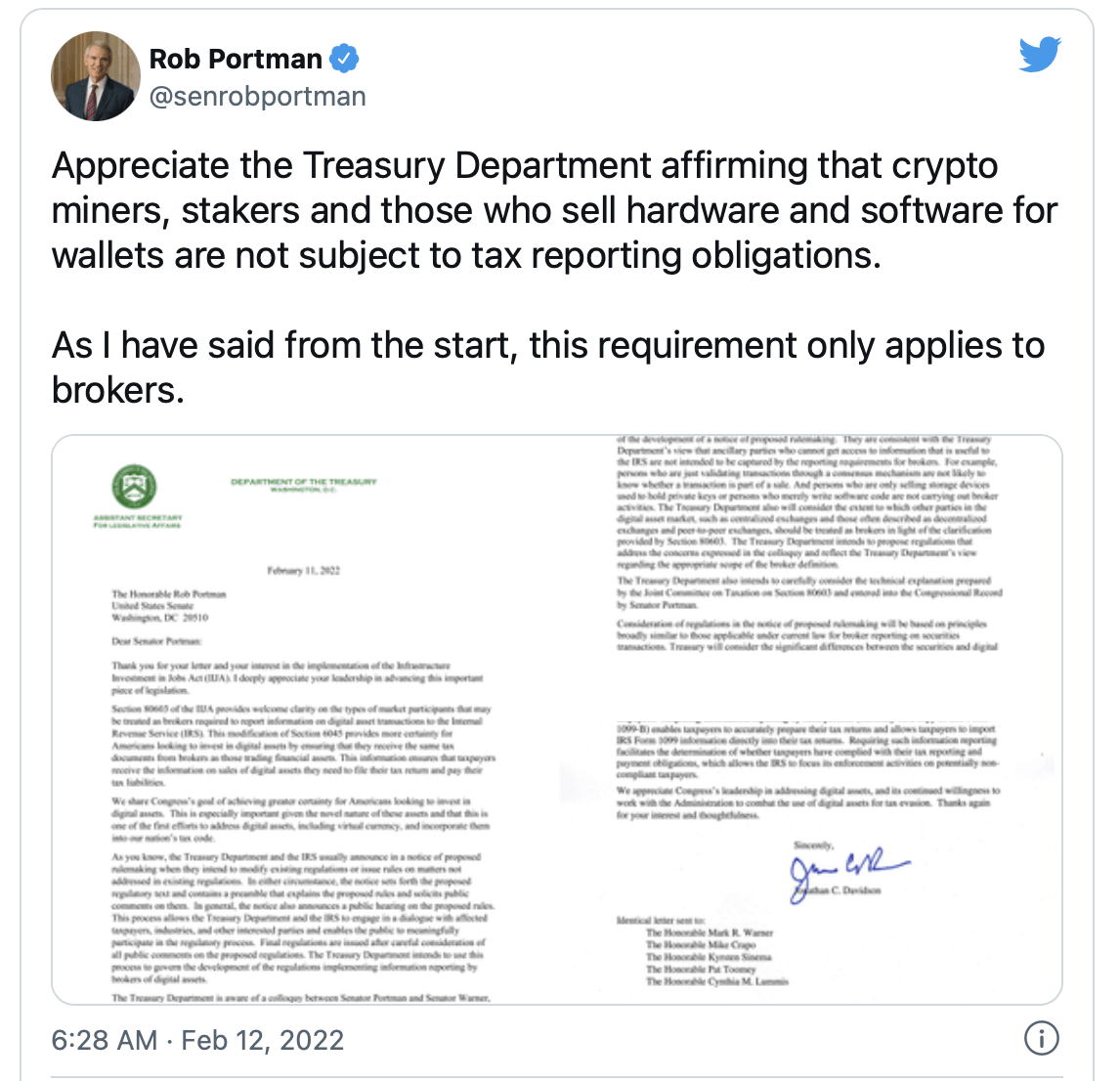

The latest news comes as a relief to crypto users. It was revealed in a letter from the Department of Treasury addressed to a group of senators on Friday. Senator Rob Portman shared the letter in a Twitter post.

Decluttering regulations and compliance

The IRS reporting rules under section 6045 would not apply to “people solely involved with validating distributed ledger transactions through proof of work”. Aka, miners. Or, “people solely staking digital assets for the purpose of validating distributed ledger transactions”. Or, “people solely engaging in validating distributed ledger transactions through other validation methods associated with other consensus mechanisms”. The clarification also exempts people who sell hardware and software for wallets.

The letter stresses that taxes accumulated on digital asset transactions should be paid. As of now, capital gains tax and income tax are levied from crypto users. This covers almost all transactions including sales, purchases, gifts, trading, swapping, NFT purchases, airdrops, interests, block rewards, bug bounties, and payments accepted in cryptocurrency.

Meanwhile, the letter also acknowledges how the lack of reporting increases the chances of abuse and the creation of a shadow financial system that will be challenging for the authorities to keep track of. The new initiatives are aimed at bringing more clarity to the cryptocurrency industry and more certainty for users.

“We share Congress’s goal of achieving greater certainty for Americans looking to invest in digital assets. This is especially important given the novel nature of these assets and that this is one of the first efforts to address digital assets, including virtual currency, and incorporate them into our nation’s tax code,” reads the letter.