We all love rags-to-riches tales. People who bid their time on crypto investments have many to tell. However, there is an ugly side to it. The highly volatile nature of the market can sometimes wipe savings clean.

Gro aims to strike a balance between the two — crypto risk and returns.

Let’s see how.

What is Gro protocol

Gro protocol is a stablecoin yield aggregator. It promises to deliver the best DeFi yields while mitigating the risks associated with it. This is made possible through dynamic yield optimization strategies which include lending, liquidity providing, and protocol incentive farming.

What makes Gro different

Gro is set apart by its novel risk tranching module, Gro Risk Balancer. As the name implies, the module mitigates the chances of loss or failure users are prone to by distributing smart contract and stablecoin risks in a targeted way.

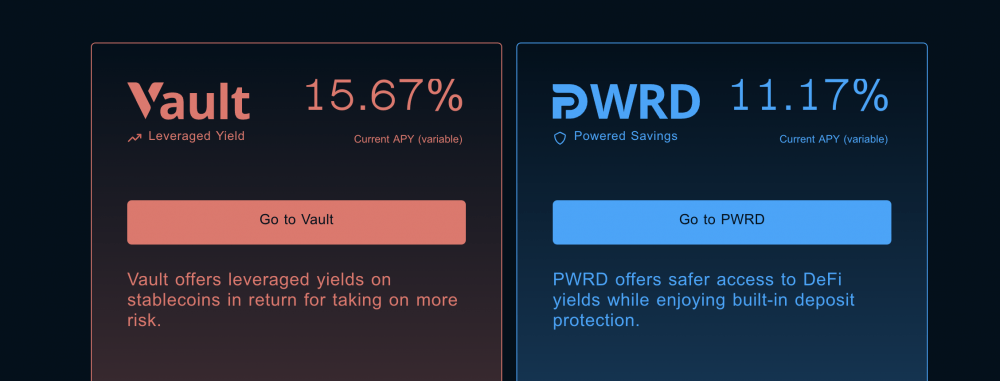

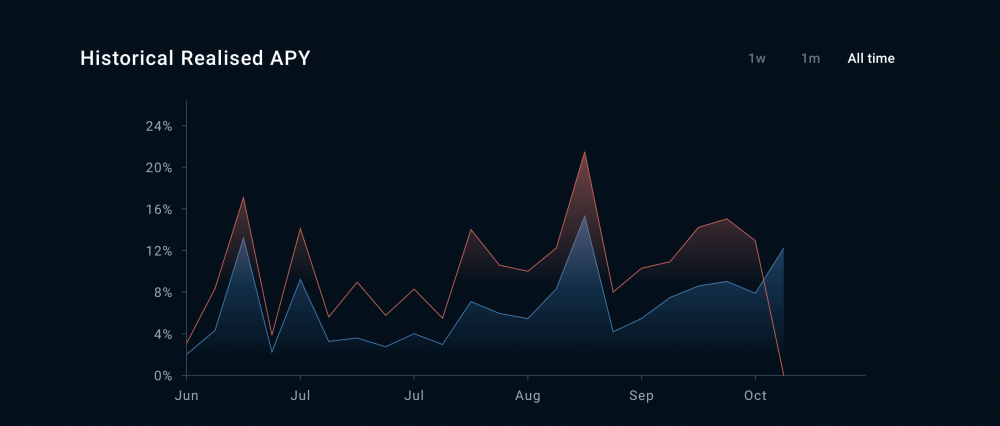

The protocol has two risk and yield-tranched products: Vault — a leveraged stablecoin yield optimiser. And, PWRD — a low-risk savings product.

While Vault depositors are eligible for a higher proportion of the system yields, they also have to bear extra smart contract and stablecoin risk. On the other hand, PWRD has claim to a smaller portion of the system yield. But it is more secure against the risks. This is what the APY looks like for Vault and PWRD respectively at the time of writing.

Gro wants to make new-age financial services accessible to everyone by tapping the best of decentralized and traditional finance. Don’t be confused, the products will only deliver DeFi value propositions. However, Gro claims to make DeFi as simple as its centralized counterpart. Deposits made on the protocol are algorithmically and non-custodially allocated to a set of strategies.

What is the relevance of Gro protocol

There is little to no means to earn passive income in the traditional financial system. The inflation rates set new records year after year that people are looking for alternative means of generating returns on their savings. In many cases, all that effort and time you put in are not worth it. Factoring in the service fees and inflation, you get back very little.

Crypto offers amazing deals, people are buying coins and tokens in hoards. Mostly, to speculate on price increases. However, here the risks are as high as the rewards. The erratic fluctuations in the market are the primary cause of concern. Highly sensitive to the events in the external as well as internal environments, for an amateur investor, crypto investing is not a lot different from gambling. DeFi changed this to a great extent by integrating traditional financial services like lending, trading, and insurance into transparent, trustless protocols. Here too, market volatility and technical complexity stand in the way.

Gro deploys advanced products designed around stablecoins to address these user challenges.

PWRD – For low risks

Backed by DAI, USDC, or USDT, PWRD is tokenized as a stablecoin (PWRD). It features more protection and less yield. The latter of which is accrued as more stablecoins through a rebasing mechanism.

PWRD is fortified against the changes in the stablecoin prices by spreading the risk. So, even if one of the stablecoin fails, the risk for PWRD is mitigated. It is designed to be more stable than the stablecoins that constitute it. Moreover, losses incurred from the stablecoin price fluctuations or smart contract failures are absorbed by the Vault first. This makes PWRD a safer option for generating passive income.

PWRD doesn’t charge any performance fees. It is subject to changes in the future by governance. The assets can be withdrawn in a preferred stablecoin by paying 0.5% fees.

Vault – For high returns

Vault generates DeFi yields by employing an optimized portfolio of strategies that keep changing for the best results. Since they are leveraged using assets from PWRD, Vault returns are higher. Vault accepts deposits in USDT, USDC or DAI, which are tokenized as GVT. It accrues yield without manual intervention. The performance fees and withdrawal fees are similar to PWRD.

Vault derives its power from PWRD. As the PWRD increases, so does the leverage and yield from Vault. However, when it comes to losses, they are first covered by Vault. So, the element of risk is higher for Vault. Since Gro is a stablecoin protocol, it is not much prone to market volatility. The risks are primarily smart contract-based.

Rebasing mechanism

The platform employs a rebasing mechanism that generates value for PWRD depositors over time. The token supply increases algorithmically keeping in line with the yields generated. Since the platform wants to avoid risks caused by large PWRD stakers, positive rebases accrue in small increments gradually.

When it comes to losses from the protocols, they are absorbed by Vault first. This essentially means that the PWRD rebase is less likely to go negative. For that to happen, multiple protocols and stablecoins will have to fail.

Since Vault holders are more prone to market failures, they claim higher yields. Or, we can say that, PWRD holders purchase security on their investments from Vault holders. Win-win.

How does Gro generate income from deposits

Gro leverages three strategies for profit generation.

- Interest from lending protocols

Platforms like Compound offer DeFi lending and borrowing services. Since over collateralized, the risks for the lender are not as huge as one would assume.

- Trading fees from AMMs

Gro will use the locked-in funds to contribute liquidity to AMM pools. The interest earned as trading fees will be another source of passive income the platform distributes among its users.

- Protocol incentives

Here, LP tokens from DEXs are added to yield farming protocols for more revenue.

Apart from these, protocol users who withdraw funds make ‘HODL contribution’ as withdrawal fees charged at 0.5%. It is distributed back to users. This stabilises the protocol during large withdrawals.

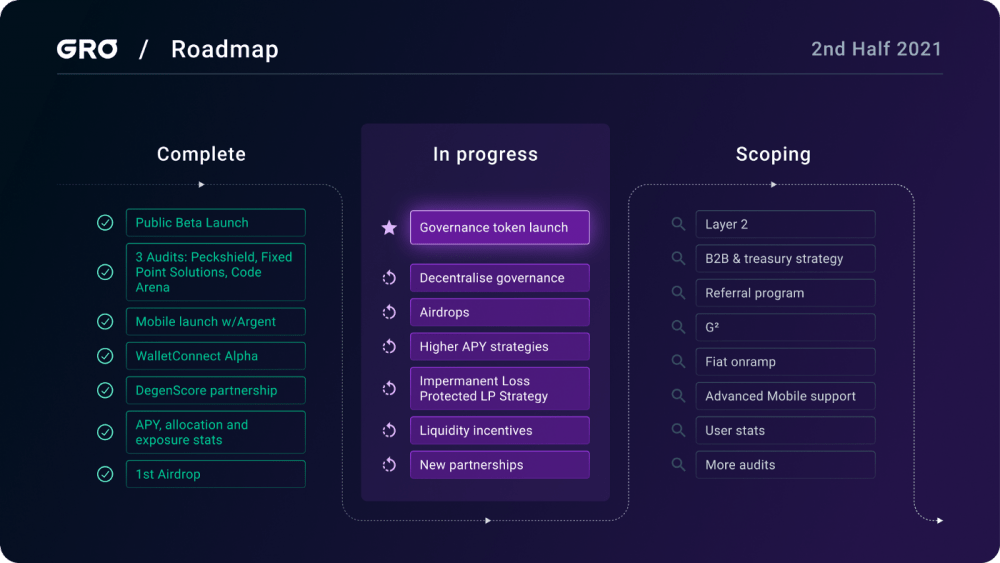

Here is a quick peek into how far the project has come and what lies ahead.

Is the protocol as risk-free as it claims to be

CREAM Finance, the decentralized chain-agnostic lending protocol, was hacked on Oct 27. The total loss was calculated to be around $130 million. Gro protocol had allocated 2 of its 7 strategies on CREAM, amounting to $9.24 million. Having a diversified portfolio, 14.9% of the TVL was impacted. Vault holders took the brunt, of course, and PWRD holders were left unscathed.

Evidently, Gro is vulnerable. It doesn’t just have to watch out for in-protocol risks, but also the risks faced by the listed protocols.

However, the team is taking action to mitigate the loss.

1/ Gro has successfully recovered ~$720k from the CREAM exploit. This is already accrued into Vault (GVT) and reduces the impact to ~19%. Efforts to compensate CREAM victims continue, so stay tuned! 💜

— Gro (@groprotocol) October 30, 2021

What is Gro DAO token

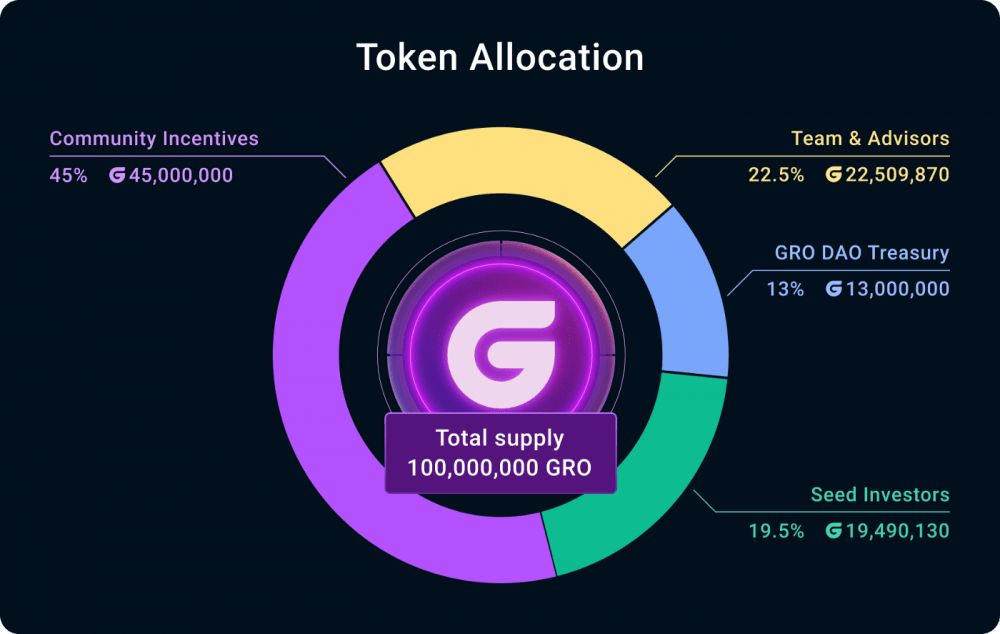

GRO is the governance token for the Gro ecosystem.

The platform is slowly moving towards a decentralized governance model, and the ecosystem needs to stimulate engagement through incentivization and stabilize the protocol. GRO will fuel this mission. GRO holders will have access to exclusive privileges, including voting rights on matters that concern the facilitation of the protocol. Some of the key decisions they will have a say include protocol roadmap (priorities and future projects), protocol parameters (fees or funding rates), and yield strategies.

At the time of writing, each GRO is worth $14.40. The highest price recorded is around $36.19.

The final verdict

There is none! We don’t give financial advice. We introduce you to promising projects within the emerging DeFi & NFT space. You make the final verdict.

PWRD and Vault are sister products that try to strike a balance between risk and return with aligned actions. Since it is based around stablecoins, the protocol is less prone to market threats. If you are looking for a passive investment, this is something you may find attractive.

Gro smart contracts have completed several audits and reviews with Peckshield, Fixed Point solutions, and Code Arena. It also offers a bug bounty program in collaboration with Immunefi. Despite that, protocol threats like the one that happened with CREAM are a stain on the value propositions from Gro.