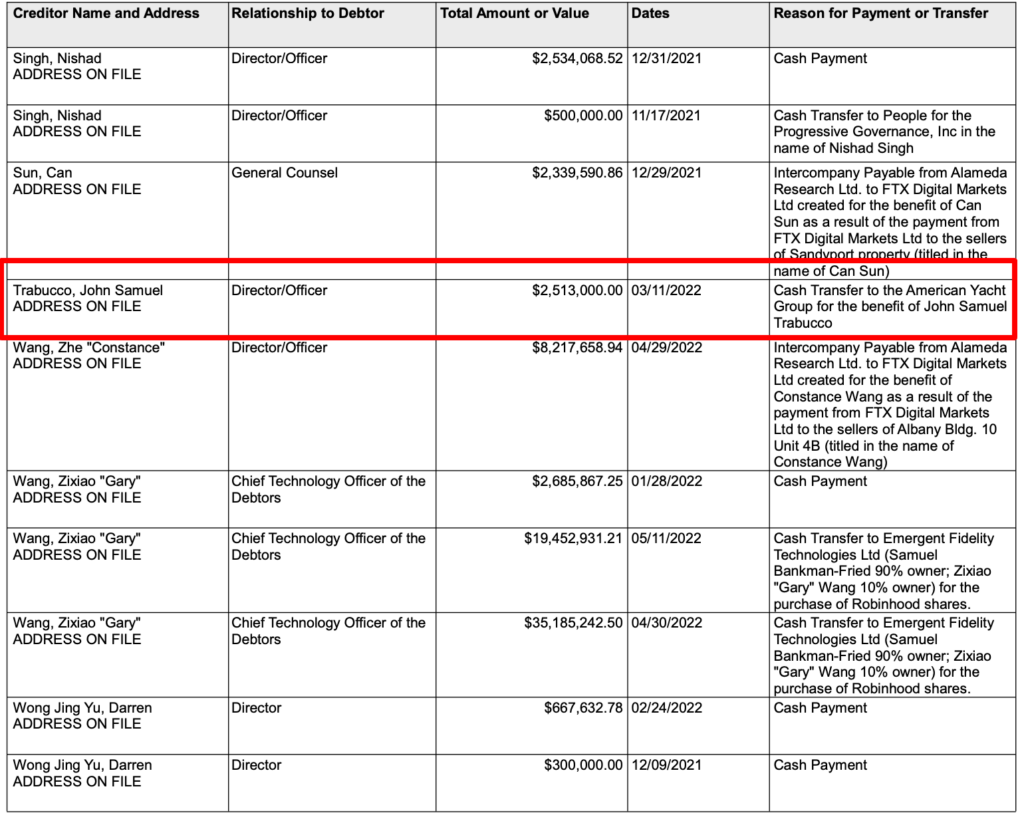

In a recent financial filing, FTX debtors disclosed a series of transactions that shed light on the misuse of company funds by top executives. One notable transaction highlighted in the filing is a payment of $2.51 million made from FTX to the American Yacht Group in March 2022. This payment directly benefited former Alameda Research co-CEO Sam Trabucco. Several months later, Trabucco confirmed his ownership of a boat in an August 2022 tweet, which coincided with his resignation from the company.

FTX Debtors Disclose Financial Statements Showing Misuse of Company Funds

The financial statements provided in the filing also revealed cash payments made to FTX executives within the twelve months leading up to the collapse. Executives such as Sam Bankman-Fried, Gary Wang, Nishad Singh, Darren Wong, and Constance Wang received cash payments during this period. It’s important to note that these disclosures only pertain to fiat currency, and limited information is available regarding crypto transactions. The filing clarifies that not all transfers of cryptocurrency or other digital assets have been included in the disclosures.

Payment of $2.51 Million to American Yacht Group

One significant transaction revealed in the financial filing is a payment of $2.51 million made by FTX to the American Yacht Group in March 2022. This payment directly benefited former Alameda Research co-CEO Sam Trabucco. The purpose of this payment and the details surrounding the yacht purchase are still unknown.

Trabucco’s Confirmation of Boat Ownership in August 2022

In August 2022, Sam Trabucco confirmed his boat ownership in a tweet announcing his resignation from the company. This confirmation came several months after the payment of $2.51 million to the American Yacht Group. Trabucco’s former co-CEO, Caroline Ellison, responded to the tweet, expressing her well wishes and hopes that he would enjoy more time on his new boat. The confirmation of ownership raises questions about the timing and use of company funds for personal acquisitions.

Cash Payments Made to FTX Executives

The financial statements provided in the filing revealed cash payments made to FTX executives in the twelve months leading up to the collapse. Executives such as Sam Bankman-Fried, Gary Wang, Nishad Singh, Darren Wong, and Constance Wang received cash payments during this period. The purpose and justification for these cash payments are unclear at this time. The disclosure of these payments raises concerns about the potential misuse of company funds.

Limited Information Available on Crypto Transactions

The financial filing acknowledges that the disclosures provided do not include all transfers of cryptocurrency or other digital assets. While the filing sheds some light on the use of company funds for personal acquisitions and cash payments, it is important to note that the information available regarding crypto transactions is limited. The lack of transparency in this area raises questions about the overall financial practices and management of FTX.

Purchase of Robinhood Shares by FTX Co-Founder Gary Wang and CEO Sam Bankman-Fried

Another significant disclosure in the financial filing is the purchase of Robinhood shares by FTX co-founder Gary Wang and CEO Sam Bankman-Fried. In April 2022, they acquired Robinhood shares worth $35,185,242, followed by an additional $19.45 million in May 2022. Bankman-Fried held a 90% share ownership, with Wang holding the remaining 10% through their company, Emergent Fidelity Technologies. However, in January, the US Department of Justice seized the shares belonging to Bankman-Fried and Wang.

US Department of Justice Seizes Robinhood Shares

In January, the US Department of Justice seized the Robinhood shares owned by FTX co-founder Gary Wang and CEO Sam Bankman-Fried. The seizure of these shares raises questions about the legality of the acquisition and ownership. The Department of Justice’s action indicates potential legal issues surrounding the purchase and serves as a significant development in the ongoing investigation into FTX and its executives.

Bankman-Fried Faces New Allegations After Being Jailed

Bankman-Fried, CEO of FTX, is facing new allegations from the Department of Justice (DOJ) following his release from jail earlier this year. According to an indictment filed last month, Bankman-Fried is accused of embezzlement of customer funds, including misappropriation and embezzlement of FTX customer deposits. The indictment alleges that Bankman-Fried used the stolen funds to make over $100 million in political campaign contributions ahead of the 2022 US midterm elections. These new allegations add to the existing legal troubles faced by Bankman-Fried and raise additional concerns about the management of customer funds at FTX.

Accusations of Embezzlement of Customer Funds

Bankman-Fried, the CEO of FTX, is facing accusations of embezzlement of customer funds. The Department of Justice (DOJ) has alleged that Bankman-Fried misappropriated and embezzled customer deposits from FTX, using the stolen funds for personal enrichment, political donations, and to cover Alameda’s operating costs. These allegations highlight serious concerns about the mismanagement and misuse of customer funds within the company.

Misappropriation and Embezzlement of FTX Customer Deposits

The DOJ’s indictment filed against Bankman-Fried includes allegations of misappropriation and embezzlement of FTX customer deposits. The potential mismanagement and misuse of customer funds are significant violations of trust and raise questions about the overall financial practices at FTX. The allegations further underscore the need for transparency and accountability in the management of customer funds within cryptocurrency exchanges.

Bankman-Fried’s Request for Temporary Release from Jail Denied

Bankman-Fried’s legal troubles continue as his request for a temporary release from jail was denied by Judge Lewis Kaplan of the Southern District of New York. Bankman-Fried’s lawyers had requested his release to work on his defense with his legal team. However, the judge declined to grant the release during a hearing last week. The denial of temporary release further complicates Bankman-Fried’s legal situation and underscores the severity of the allegations against him.

In conclusion, the recent financial filing by FTX debtors has revealed significant transactions and financial mismanagement by top executives. The purchase of a yacht by former co-CEO Sam Trabucco raises questions about the use of company funds for personal acquisitions. The cash payments made to FTX executives and limited information available on crypto transactions highlight concerns about financial practices and transparency. Additionally, the purchase of Robinhood shares and subsequent seizure by the US Department of Justice further complicates the legal situation surrounding FTX. Bankman-Fried’s new allegations and denial of temporary release from jail add to the existing legal troubles faced by him. These developments raise serious concerns about the management of customer funds and the overall financial stability of FTX.