Price Action

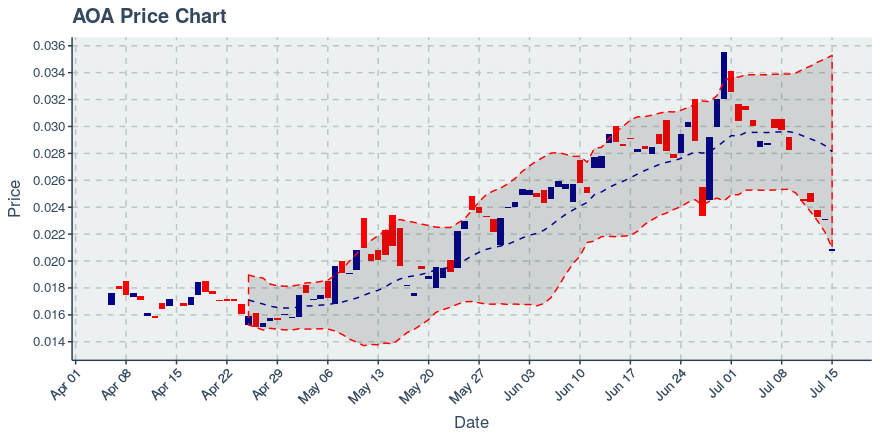

Over the past week, Aurora saw its price go down by -29.79%. It is below its 20 day moving average by 25.61%, so it’s a bit of a ways off. Aurora ‘s bullish momentum, based on its distance from its 20 day moving average, is pretty far negative compared to the other coins we’re covering, and thus may be due for a correction upwards or some kind of a period of low volatility. In terms of volatility, Aurora exhibits greater price volatility than approximately 76% of coins in our index, so traders can expect a bit more volatility than usual. Looking ahead, if the upcoming week mirrors the volatility of three past three weeks, the price range for Aurora in US dollars is expected to be between $0.02050142 and $0.03563358.

Where to trade Aurora (symbol: AOA): Yobit, DDEX

Volume Update

In the week prior, the daily volume for Aurora has ranged between 294,512.6 and 3,924,600 currency units. Looking back over past 21 days, both price and volume have been declining. Over the past week, Aurora saw its trading turnover — which we define as average daily trading volume divided by circulating supply — register at 0.02%. Its turnover rate is more than approximately 3.92% of the cryptocurrencies in our index, so it’s well below average; this coin may be hard to get into and out of, and thus is suitable only for those interested in holding and exiting slowly and patiently.

Engagement Update

The number of wallets holding Aurora went from 100,788 to 101,000 in the past week, marking a change of 0.21%. In terms of blockchain-recorded transactions made by these wallets since their inception, that number changed from 121,660 to 122,244, which translates to growth of 0.48% for the week. The combined engagement growth rate (growth rate in holders plus growth rate in transfers) of Aurora is thus at 0.69% which, relatively speaking, is ahead of 68.77% of the cryptocurrencies we’re tracking. One interpretation of this may be that the coin’s engagement is growing at an above average rate.

Technology Development Status

At the moment, Aurora has 13 repositories open to the public on GitHub, with the oldest one now being 1.16 years young. The last recorded update to its public repositories was within the past week which is not bad, as the coin is still being updated routinely. Aurora’s public repositories collectively have a total of 99 watchers, which is below average relative to its peers; that’s more than only 31 % of the 100 similar coins in our index. The coin has 0 issues reported across its public repositories. Relative to the number of watchers it has, though, its open issues count doesn’t seem like something to worry about. To put the situation in context, Aurora has a better issue/watcher ratio on its GitHub than 88% of similar coins we’re tracking.

Aurora News and Commentary

We found one link over the past week about Aurora that we thought was especially worth sharing. If possible we included a brief excerpt from the article — be sure to click through for the entire piece.

Dogecoin is going to launch IDAX ‘s Aurora Platform. Get your doge coin for 50

Snippet:

The coin has produced 100 billion units by the end of 2014 and is now producing roughly 5 billion units per year.

Where to Buy

You can trade Aurora, listed under the symbol AOA, through the following exchanges: Yobit, DDEX.

Article by SixJupiter