Nexo: What’s the Latest Regarding its Price?

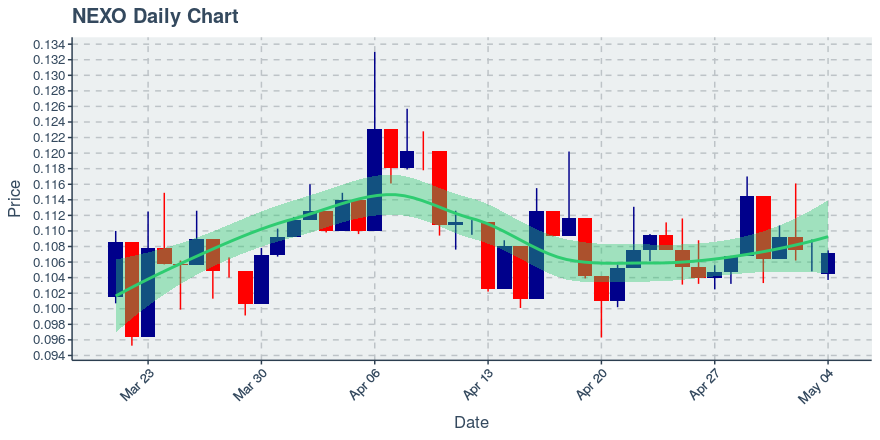

Nexo is down by approximately 0.37% from the previous day, with its price currently hovering around $0.1072 USD. Yesterday’s down day is a reversal of the day before it; in terms of trend, though, note that the current price is now 0.05% above its 20 day moving average, and is currently in a unclear trend over the past 14 days. From another vantage point, note that price has gone up 5 of the past 10 days. Another data point we may find worthy of observation is that price for Nexo has increased 5 of the previous 10 days.

In terms of an expected trading range, the Bollinger bands on Nexo suggest price may bounce between $0.101956 and $0.112334 based on its momentum and volatility over the past 14 days. Price’s current proximity to the top of the range may make shorting an attractive opportunity to traders interested in trading the range.

The currency’s market cap currently stands at $60 million US dollars.

Straight Off the Chain

Yesterday saw 237 transfers amongst holders of Nexo. Regarding a tally of holders, Yesterday saw Nexo’s wallet count rise by 35. To further our understanding of engagement we can observe the ratio of daily active users to monthly active users; that ratio now stands at 0.07, with 92 wallets making a transfer this past day and 1,361 wallets having made a transfer in the past month.

How are the Strong Holders of Nexo Faring?

And in regards to wealth distribution, note that the top 1,000 Nexo wallets hold over 109.37% of the token’s total money supply. Incidentally, this value exceeds 100% because many owners are not yet able to sell (due to contractual provisions), and our supply metric only observes liquid supply. Drilling down to just exchanges, the top 1,000 wallets that are exchanges control 4.36% of the currency’s money supply. The week over week growth rate in the share of the total supply of the top 1,000 wallets has changed by -0.09%; as for the share of the total supply owned by exchange wallets within the top 1,000 wallets, that has changed by 0.25%. The underlying smart contract itself for Nexo owns 0.02% of the total money supply; over the past week, this amount has not changed.

Nexo’s Social Media Presence

Traders interested in following Nexo has the biggest presence on Facebook, where it has NA users engaged.

Article by SixJupiter