Price Action

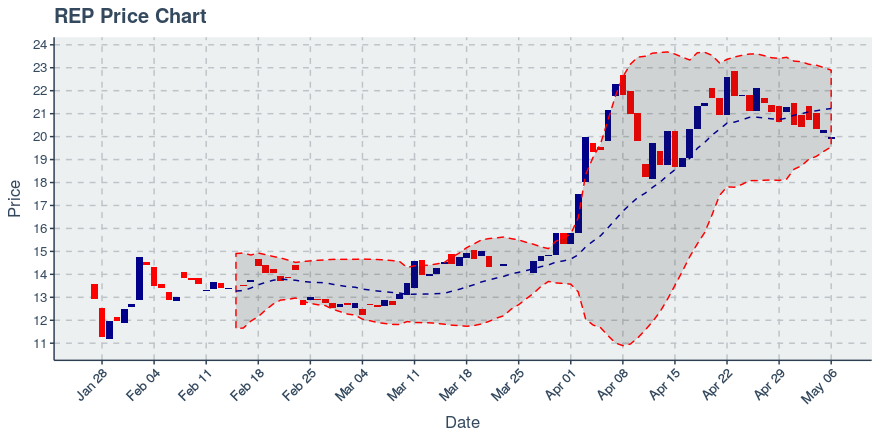

In the week prior, the price for Augur went down by -3.25%. It is below its 20 day moving average by 5.32%, so it’s slightly away. Augur’s bullish momentum, determined by its distance from its 20 day moving average, is roughly middle-of-the-pack relative to the cryptos we’re tracking. Now when considering volatility, Augur is more prone to sizable price moves than 6% of coins in our index, so this coin might not move much — something traders and investors will certainly want to keep in mind. If volatility over the past three weeks is any indication of what’s to come, we can expect Augur to bounce between 19.6939 and $22.4921 US dollars per coin.

Where to trade Augur (symbol: REP): Gate, Yobit, Binance, DDEX, Ethfinex

Volume Update

In the week prior, the daily volume for Augur has ranged between 264,215.5 and 2,202,346 currency units. In the three weeks prior, the trend in volume,like the trend in price, is choppy and does not reveal a clear direction. Augur experienced a turnover rate of about 12.09% over the past week, which means that is the percent of its available money supply that is traded daily. Its turnover rate is more than approximately 88.54% of the cryptocurrencies in our index, so it’s far above average and thus a good coin for those interested in active trading or being able to get out of the market if they need to.

Engagement Update

Augur saw the number of wallets holding its coin go from 8,782 to 9,277 over the past week — a change of 5.64%. In terms of blockchain-recorded transactions made by these wallets since their inception, that number changed from 124,839 to 129,732, which translates to growth of 3.92% for the week. The combined engagement growth rate (growth rate in holders plus growth rate in transfers) of Augur is thus at 9.56% which, relatively speaking, is ahead of 75.00% of the cryptocurrencies we’re tracking. One interpretation of this may be that the coin’s engagement is growing at an above average rate.

Technology Development Status

Augur currently has 30 public repos on GitHub, with the oldest one clocking in at 4.42 years young. Its last public update to any of its repositories was within the past day, which is pretty good, as it suggests the coin is still under active and rapid technical development. Augur’s repos that are visible to the public collectively have 1544 watchers — that’s more than 80 % of the top 100 coins we compare it to. The coin has 556 outstanding issues in the backlog awaiting to be addressed by the core development team. Its number of watchers, when viewed against its open issues count, is quite poor, and may potentially indicate some concern that the software is at risk of not being updated fast enough. Our hypothesis that the open issue/watcher ratio may be of some value in assessing the healthiness of a coin’s software development process, and for Augur, this ratio was better than a mere 11 % of the similar coins we track in our index.

Augur News and Commentary

Over the past week, we found one link about Augur that we thought was particularly interesting. Where available, we included a snippet of the article that we thought might be interesting.

Augur Weekly Report — May 1st – Augur

Excerpt:

The Forecast Foundation has no role in the operation of markets, trades or actions created or performed on the Augur protocol, nor does it have the ability to censor, restrict, control, modify, change, revoke, terminate or make any changes to markets created on the Augur protocol….The Forecast Foundation has no more control over the Augur protocol than anyone else using Ethereum.

Where to Buy

You can trade Augur, listed under the symbol REP, through the following exchanges: Gate, Yobit, Binance, DDEX, Ethfinex.

Article by SixJupiter