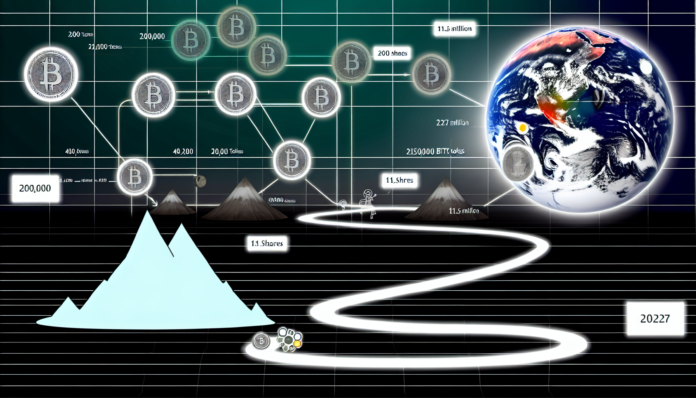

Metaplanet has reached a significant milestone by growing its Bitcoin treasury to 20,000 BTC, following a recent acquisition of 1,009 BTC. This impressive accumulation underscores the company’s aggressive and strategic commitment to becoming a dominant player in the Bitcoin treasury space, particularly within Japan. To support this growth, Metaplanet concurrently issued 11.5 million new shares, a move designed to raise fresh capital that will further fuel its Bitcoin purchasing strategy. As the largest public Bitcoin treasury firm in Japan, Metaplanet is clearly signaling a strong bullish stance on the long-term prospects of Bitcoin while aiming to deliver sustained value to its shareholders.

From a Pivot to a Bitcoin Powerhouse

Metaplanet’s journey is a compelling narrative of transformation and ambition. Initially engaged in the hotel and Web3 sectors, the company pivoted in early 2024 to prioritize Bitcoin treasury management as a core business focus. This shift has proven fruitful, transforming Metaplanet into a prominent corporate entity with a rapidly growing digital-asset balance. Within just 16 months, the firm dramatically expanded its Bitcoin holdings from zero to 20,000 BTC, surpassing its initial target of 10,000 BTC and positioning itself as the sixth-largest Bitcoin holder worldwide.

Such rapid growth is not only a testament to Metaplanet’s strategic agility but also to its confidence in Bitcoin as a durable store of value amid shifting economic landscapes. By accumulating a meaningful portion of the Bitcoin supply—roughly 0.1% of the total—the company aligns itself with global market leaders while carving out a distinct position in Asia’s cryptocurrency ecosystem.

Capitalizing on Share Issuance to Power Bitcoin Acquisitions

To sustain its acquisition momentum, Metaplanet undertook the simultaneous issuance of 11.5 million new shares. This capital raise is designed to provide the liquidity necessary to continue the steady accumulation of BTC, adhering to the company’s long-term growth plan. By leveraging the public markets, Metaplanet efficiently marshals resources from a broad investor base, effectively turning shareholder capital into expanding Bitcoin reserves.

This dual approach—combining equity financing with asset acquisition—reflects a sophisticated corporate finance strategy that enhances the company’s ability to scale its Bitcoin treasury while managing dilution and capital costs strategically. It also means that investors are directly participating in Metaplanet’s Bitcoin exposure, making the company not just a holder of cryptocurrencies but a publicly accessible vehicle for BTC investment in Japan and beyond.

Leadership Vision and Ambitious Targets

Metaplanet’s president, Simon Gerovich, has been vocal about the company’s ambitious roadmap. He has set an extraordinary goal of accumulating 210,000 Bitcoin by 2027, which would represent approximately 1% of the entire available Bitcoin supply. This target places Metaplanet on course to potentially become the second-largest Bitcoin treasury in the world, trailing only behind the current market leader, Strategy.

Gerovich highlights the company’s remarkable growth in Bitcoin holdings per share, noting that Metaplanet’s ratio now far surpasses that of its global peers. This enhanced Bitcoin per share metric suggests a greater value proposition for investors as the company continues to build out its balance sheet and capitalize on Bitcoin’s expected appreciation.

Moreover, Metaplanet’s shares actively trade across global exchanges and brokerages for more than 100 hours weekly, reflecting growing international investor interest and reinforcing the company’s status as a global player, not just a Japanese phenomenon.

Metaplanet’s Role in Japan’s Cryptocurrency Landscape

Japan has historically been a cautious yet progressive market toward cryptocurrency, with regulatory clarity fostering a favorable environment for institutional involvement. Metaplanet’s emergence as Japan’s largest Bitcoin treasury firm represents a pivotal development in the country’s crypto narrative.

The company’s success helps demonstrate a model where traditional businesses can embrace and integrate Bitcoin as part of their financial strategy, moving beyond speculation to structured treasury management. Its transparency in reporting Bitcoin acquisitions, average purchase cost, and holding metrics also sets an example for public companies globally in responsible digital asset stewardship.

Strategic Implications and Market Impact

Metaplanet’s continued accumulation of Bitcoin via fresh share issuance has several strategic implications:

- Market Influence: With 20,000 BTC in its treasury, Metaplanet holds one of the largest corporate Bitcoin positions worldwide, capable of influencing market sentiment and liquidity.

- Investor Accessibility: By issuing shares, the company offers retail and institutional investors an accessible channel to gain exposure to Bitcoin indirectly without direct ownership challenges.

- Long-Term Hedge: Bitcoin serves as a strategic reserve asset against traditional fiat currency volatility and inflationary pressures, supporting Metaplanet’s broader financial durability.

- Competitive Positioning: Metaplanet’s growth positions it to challenge established Bitcoin treasury companies, elevating Japan’s prominence and fostering competition that could spur innovation in public Bitcoin investment vehicles.

Financial Transparency and Accountability

Metaplanet maintains robust financial reporting standards, regularly disclosing its Bitcoin acquisitions, total holdings, and purchase prices. This transparency helps build investor confidence and aligns with best practices for companies operating in the volatile cryptocurrency space.

The latest addition of 1,009 BTC was acquired at an average price of approximately $108,698 per coin (JPY equivalent considered), contributing to a total Bitcoin cost basis exceeding $2 billion. Such disclosures underscore Metaplanet’s commitment to keeping its shareholders informed and engaged in its strategic trajectory.

Looking Ahead: The Road to 210,000 BTC

Metaplanet’s aggressive strategy over the next two years will focus on expanding its Bitcoin holdings from 20,000 to 210,000 BTC, a tenfold increase that would decisively cement its position in the global cryptocurrency treasury ecosystem.

This ambitious goal involves scaling financial operations, continued capital raising via innovative share offerings, and leveraging growing investor interest in Bitcoin as an institutional asset class. Achieving this target would represent a landmark for corporate Bitcoin adoption and set new standards for treasury management in public companies worldwide.

In summary, Metaplanet’s recent milestone of acquiring 20,000 BTC combined with the issuance of 11.5 million new shares highlights a carefully balanced and well-executed growth strategy. It reflects a bullish long-term view of Bitcoin and a commitment to delivering value to shareholders through innovative financial structures and transparent stewardship. As Japan’s largest Bitcoin treasury firm, Metaplanet serves as a powerful example of how companies can integrate digital assets into their corporate frameworks while navigating capital markets effectively and responsibly.