Key highlights:

- The public testnet launch of the highly anticipated Ethereum Shanghai Upgrade will take place in February.

- With the Shanghai Upgrade, ETH tokens with a market cap of $20 billion will become withdrawable.

- Many Ethereum Improvement Proposals are being postponed to the next upgrade so that the upgrade date is not delayed.

Ethereum developers announced that the public testnet launch of the Shanghai upgrade could be made in February. The Shanghai upgrade, which was expected to go live on the mainnet in March, was decided to begin testing on the testnet in February, by Ethereum developers at the All-Core Developers Call (ACD) for 2023.

The developers’ primary goal in this upgrade is to allow stakers to withdraw the ETHs they have staked on the ETH 2.0 contract. Other code changes that won’t be completed until next month will be rolled out in the next upgrade. Ethereum Improvement Proposals (EIPs), specifically regarding EVM’s EOF, will not be the subject of this upgrade. Testing of the codes continues and EVM 2.0 will be ready with the next upgrade.

Ethereum co-founder Vitalik Buterin said, “It is much harder to change things in the EVM than to change other properties. You have applications written in EVM code and if the EVM changes, those applications cannot continue to run.”

Ethereum Improvement Proposals Delayed

Developers, who made it a priority for investors to withdraw their staked ETH, delayed further improvement proposals. In addition to EIP 5988 proposed by StarkWare developer Abdelhamid Bakhta and EIP 5843 proposed by Jared Wasinger, Etan Kissling’s proposal to use the updated and modern serialization format SSZ has also been delayed.

Developer Testnet in Progress

The Shanghai Developer Testnet, which Ethereum launched before Christmas, has surpassed the 4,000th block. Currently all combinations of Consensus Layer (CL) and Execution Layer (EL) clients are currently running on this testnet.

Staked ETHs to Be Unlocked

ETH tokens staked on the PoS Beacon chain launched in 2020 will become available with the upgrade. This will pave the way for ETH stakers to withdraw their tokens with rewards and sell them on the open market. Currently, the amount of ETH staked on the ETH 2.0 contract is about 15 million ETH, which means almost 20 billion dollars. 13.8% of circulating ETH tokens are staked on the Beacon Chain.

This can cause investors to sell their ETH as the whispers about the upgrade increase, and the ETH price can be dumped as the day of the upgrade approaches. The Shanghai Upgrade, on the other hand, will be the first major upgrade since The Merge upgrade in September 2022. This shows that the upgrade could also affect the ETH price positively, contrary to what was expected.

ETH Staking Pools Are in Trend

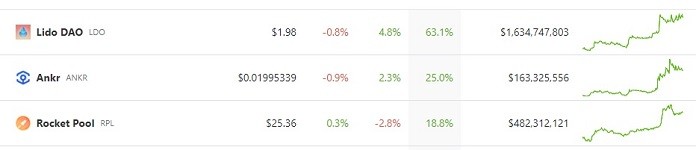

Liquid staking protocols, which offer less entry barriers than the minimum requirements offered by Ethereum, gained traction with the news of the Shanghai upgrade. Lido’s native token LDO has seen a price increase of 90% in the last 14 days, while ANKR has increased by 25% and Rocket Pool (RPL) by 29%. A price correction is expected from the ETH liquid staking protocols.