After a two-month pause, Tether is once again issuing fresh batches of USDT to the Bitfinex wallet, this time to the tune of 250,000,000. This is a far cry from the breakneck pace that Tether issued USDT throughout 2017. Setting aside the fact that the executives of Tether and Bitfinex are one and the same, it’s worth considering the impact on Bitcoin of large injections of stable coins into the market.

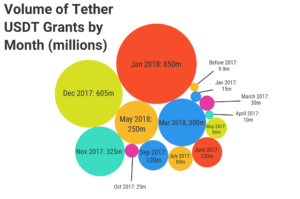

According to Tether, every unit of USDT is backed by a US dollar in a bank somewhere. When hundreds of millions of these hit the market, it can be similar to the effects of introducing a comparatively large amount of fiat. In 2017, billions of Tether were created. As the chart below shows, the majority of all Tether in existence were created between April 2017 and January 2018.

Did Tether cause most BTC gains in 2017?

An anonymous author (who is admittedly much better at math than I am) penned The Tether Report, a thorough comparison of Bitcoin’s price and USDT grants throughout 2017. Specifically, a period between April 2017 and January 2018, when billions of Tethers were granted, and Bitcoin rose from around $900 to almost $12,000. Perhaps more demand for Bitcoin caused more demand for Tether, and thus these results are only a correlation. However, the author found that 48.8% of all of Bitcoin’s gains in the observed period occurred within two hours following a new Tether grant. Remember, this is the same period that saw Bitcoin go on its epic run to nearly $20,000.

Impact of one USDT on price of BTC

Using this author’s figures, we can drill down to see the effect that each unit of USDT had on Bitcoin. In the period studied, Bitcoin’s market cap swelled from $14.6 to $188.2 billion. If Tether grants are indeed responsible for nearly half of that amount, we can estimate that Tether created $84,713,432,800 worth of Bitcoin’s value.

In the same period, Tether granted a total of 1,935,048,400 USDT. That’s approximately 77% of its total market cap to date. If we compare that with the Bitcoin value estimate above, we can estimate that one unit of USDT created $43.77 of Bitcoin. Not a bad return on investment considering we’re still waiting for an audit of Tether.

Impact of Tether post-January 2018

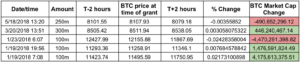

The Tether Report analyzes data up to January 18th, 2018. Let’s examine the price of Bitcoin before and after the few (but large) Tether grants following the report. All data comes from Omni Explorer, Coindesk’s BPI, and Coinmarketcap.com.

As you can see, the results are mixed but generally fall in line with the Tether Report hypothesis. It could be that the effect on Bitcoin’s price is greater with more frequent grants, rather than larger ones spread further apart. Tether’s run of printing USDT by the billions seems to have slowed, but it’s worth keeping an eye out for new grants hitting the market. Cryptocurrency markets are ripe for manipulation, and you don’t want to get caught on the wrong side of a bull trap.